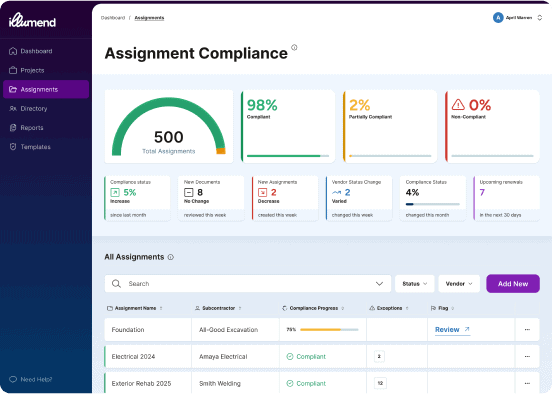

AI-Powered COI Tracking for Bulletproof Insurance Compliance

Say hello to illumend– the insurance compliance and COI tracking software powered by AI simplicity and efficiency. illumend is built on 15 years of insurance expertise for fast, confident vendor insurance compliance.

Insurance Compliance Made Easy for You and Your Third Parties.

Try illumend risk-free—love it or your money back, no questions asked. Limit-based on the number of contracts.

15 Years of Insurance Expertise

80% Less Admin Time on COIs

50% Fewer Delays from Missing Docs

A Smarter Approach to COI Compliance

With 15 years of compliance experience built into its foundation, illumend is not only an AI-powered tool that works for you, it does so with legacy expertise you can depend upon. Why outsource to another company or bury yourself in admin tasks? Let illumend shed light and give you confidence that even if you’re not an insurance professional, you’ve got it handled.

COI TRACKING SOFTWARE

Introducing illumend: Compliance with Confidence

Created by experts. Powered by AI. Built for all.

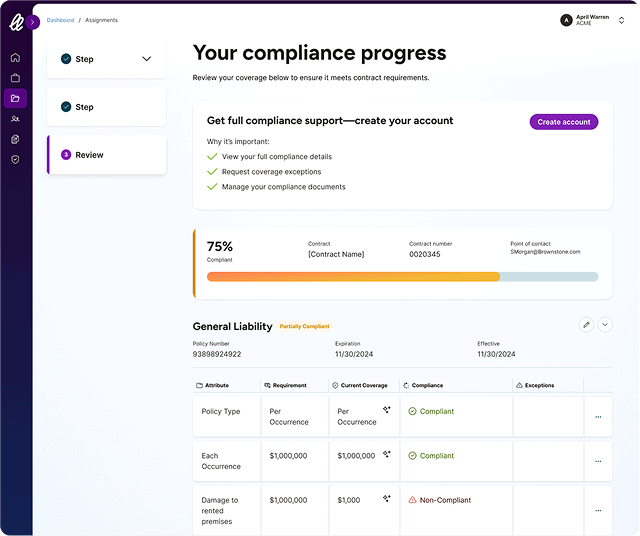

ONBOARDING WITH ILLUMEND

Getting Started is Easy – We Make Sure of It.

While illumend is AI-powered, our personalized onboarding is quite

human. We ensure a smooth and efficient start-up process so you’ll

be ahead in no time.

Upload Your Requirements

Drop in your contracts or insurance requirements—we’ll take it from there.

Invite Your Third Parties

One-click invites. No portals or logins required for them.

See Instant Compliance Status

Get real-time decisions and guidance, right out of the gate.

Stay Ahead, Automatically

From renewals to reminders, illumend keeps everything on track—no chasing needed.

Built-In Expertise. Real Results.

80%

Less Admin Time on COIs

50%

Fewer Delays from Missing Docs

75%

Time Saved Across Teams

The Old Way vs. The illumend Way

AI-powered insurance expertise for smarter compliance

The Old Way

Neverending third-party emails

Decoding dense policy documents

Wasting time in compliance reviews

Confusing communications

Not knowing what you don’t know

Trying your best

The  Way

Way

AI-powered organization and efficiency

Instant answers and simple next steps

Faster compliance, better results

Guidance with clarity and confidence

Proactive alerts and always-on visibility

Trusting the best

Compliance That Works for Everyone

Smarter, faster compliance without the hassle

- Personalized Onboarding, Faster Compliance

We ensure vendor compliance in hours, not weeks. - Hate admin? Do what you love instead

Get time back with 80% less time spent managing COls. - No stress, no doubt – just get you want with what you need

Confidence with 15+ years of insurance compliance expertise at your side. - Happier partners make for better relationships.

Imagine how third parties will feel about your business when it’s this easy.*

Experience Smarter Insurance Compliance

Get started today with a worry-free guarantee

Helpful Resources

Explore helpful guides, case studies, and best practices to make your compliance process even smoother.

Let’s Make Compliance Easier

Discover how fast, simple, and powerful compliance can be.

Way

Way