Certificate of Insurance Requirements By State

Proving that someone has business insurance (like, say, a third party or independent contractor before they begin working with you) is most simply done through a certificate of insurance. Also known as a COI, these are documents that come straight from an insurer that verifies someone’s coverage. COIs are hugely important for several reasons that we’ll get into, and it’s imperative to review them carefully before finalizing them.

Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

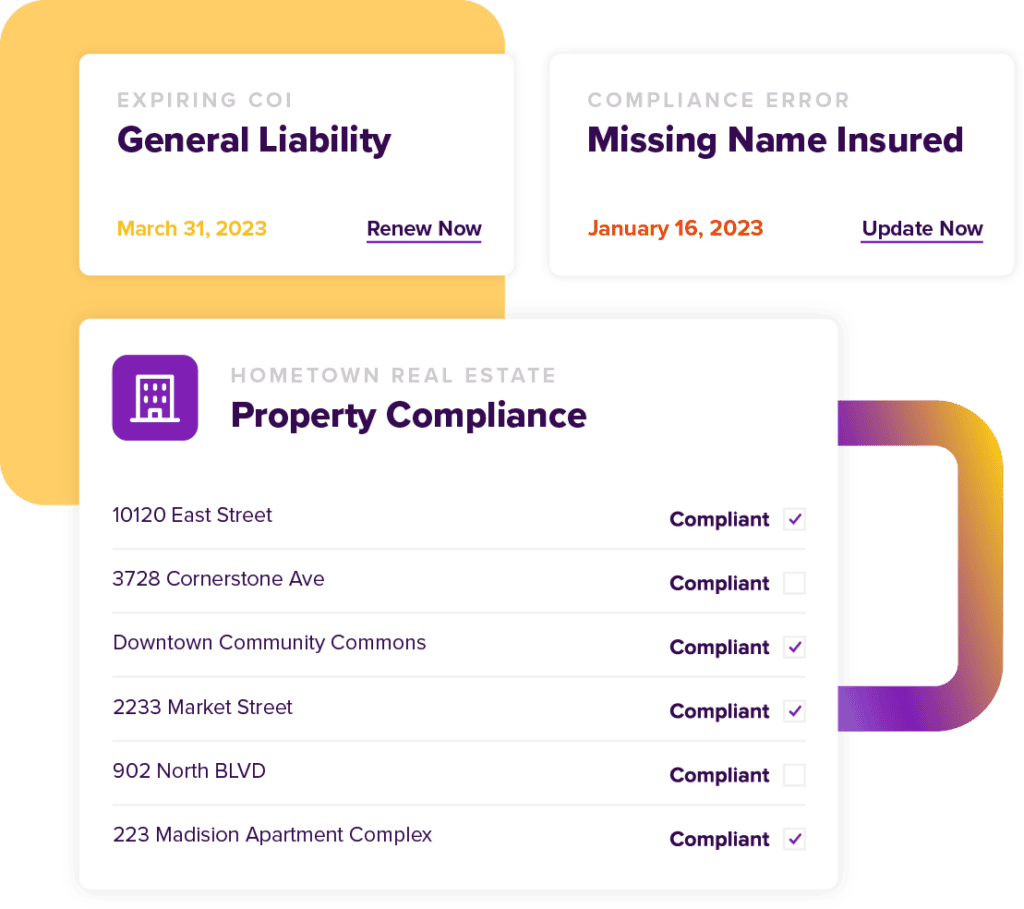

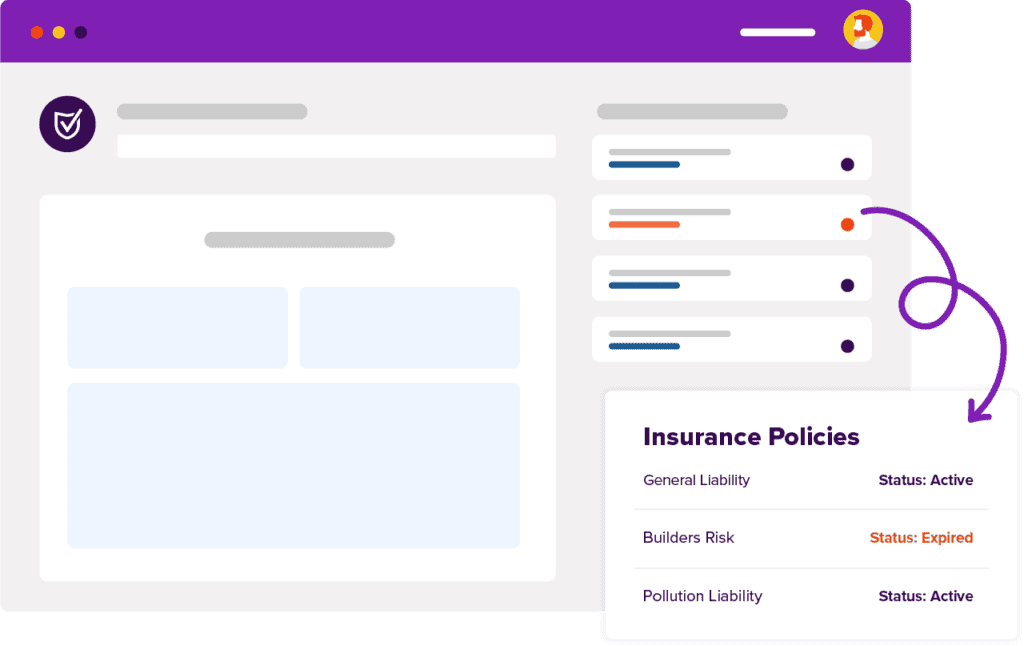

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesCertificate Of Insurance Requirements By State

Proving that someone has business insurance (like, say, a third party or independent contractor before they begin working with you) is most simply done through a certificate of insurance. Also known as a COI, these are documents that come straight from an insurer that verifies someone’s coverage. COIs are hugely important for several reasons that we’ll get into, and it’s imperative to review them carefully before finalizing them.

However, as you may have already figured, the minimum insurance requirements and regulations that govern certificates of insurance differ from state to state. Because insurance is regulated at the state level in the U.S., each state has the authority to establish its own rules for insurance companies and policyholders.

As a result, businesses and insurance companies alike must keep up and comply with the laws and regulations of each state where they do business, which includes the specific requirements governing certificates of insurance. Failure to comply with these requirements can result in penalties, fines, or other legal consequences, so it’s important to know the rules wherever you’re operating.

Follow along in our official statewide guide where we break down what COIs are used for and how different states regulate them.

What Is a COI Used for?

Before we get into state-by-state comparisons, let’s get back to the basics. A COI, or certificate of insurance, is used for several purposes, the main one being that it serves as a certification of insurance coverage for a specific policy period. It provides quick and easily digestible evidence that a policyholder does indeed have the insurance coverage that they claim.

Here are a few other things that COIs are used for:

- Risk management. Businesses protect themselves and their clients from potential damages or losses through business insurance. To prove that everyone working with them has the proper coverage, businesses obtain COIs from the necessary third parties that they can use to mitigate their own risk in the case of a claim.

- Compliance and contractual obligations. As we’ve discussed before, some industries, professions, and jurisdictions require insurance coverage in order to comply with regulatory requirements. Additionally, many contracts like service agreements require proof of insurance coverage to show professional liability. Again, a certificate of insurance will demonstrate that a policyholder has the required coverage in place.

- Additional insureds. Hiring subcontractors and vendors means needing upstream coverage. To do this, they (subs and vendors) must name you as an additional insured on their insurance policy; this additional ensured endorsement will be noted on the COI.

How to Get a Certificate of Insurance

To obtain a certificate of insurance, you’ll need to request it from the third party that you’re working with. For them, it’ll go something like this:

They’ll start by contacting their insurance company or broker and letting them know that they need one. They’ll then provide their insurer with some information, including the name and contact information of the entity requesting the certificate (you), the type of certificate needed, the policy number, the agreed-upon coverage limits, the effective dates and expiration date of the policy, the names and addresses of any additional insureds, etc.

Once they’ve provided all of the necessary information, they can officially request the certificate from their insurance company or broker. The insurer will deliver the certificate as a printed hard copy or in an electronic format and the whole process typically takes up to a few business days. Finally, after reviewing and approving the COI, they’ll provide it to you to prove their coverage.

What Are The Types of COIs

There are numerous types of COIs, and the requirements for each type can differ by state. It essential for businesses to be able to keep track of all types of COIs. A few common types companies should be aware of are certificates of liability insurance, certificates of workers’ compensation insurance, and certificates automobile liability insurance.

What Are the Requirements of Certificates of Insurance By State

As is the case with many other legal issues, each state has its own requirements when it comes to governing certificates of insurance. The requirements can vary depending on both the type of insurance and, of course, the state where the policy is issued.

It’s important to note that laws and regulations can be changed at any time, so it is essential for you to stay on top of the different relevant state laws and regulations that may affect your COI management. In other words, conduct research on the different COI requirements for all of the states in which your company conducts business.

Since it would be a very lengthy and potentially ever-changing ordeal to list all of the slightly differing rules for each state, here are the current requirements of COIs by state for the top ten most populated states in the United States:

- California: In California, COIs must include the name and address of the certificate holder, the name of the insurance company, the policy number, and the effective dates of the policy.

- Texas: In Texas, COIs must include the name and address of the insured, the policy number, the effective dates of the policy, and a description of the coverage provided.

- Florida: In Florida, COIs must include the name and address of the insured, the policy number, the effective dates of the policy, and the limits of liability.

- New York: In New York, COIs must include the name and address of the insured, the name and address of the certificate holder, a description of the coverage provided, and the effective dates of the policy.

- Pennsylvania: In Pennsylvania, COIs must include the name and address of the certificate holder, the name of the insurance company, the policy number, and the effective dates of the policy.

- Illinois: In Illinois, COIs must include the name and address of the insured, the name and address of the certificate holder, the policy number, the effective dates of the policy, and a description of the coverage provided.

- Ohio. In Ohio, COIs must include the name and address of the certificate holder, the name and address of the insurance company, the policy number, and the effective dates of the policy. Ohio also requires that COIs must be issued by the insurance company or its authorized representative, and they must be provided to the certificate holder within a reasonable time after the request.

- Georgia: In Georgia, COIs must include the name and address of the certificate holder, the policy number, the limits of liability, and the effective dates of the policy. Similar to Ohio, Georgia also requires that COIs be issued by the insurance company or its authorized representative and must be provided to the certificate holder within a reasonable time after the request.

- North Carolina: In North Carolina, COIs must include the name and address of the certificate holder, the name and address of the insurance company, the policy number, and the effective dates of the policy.

- Michigan: In Michigan, COIs must include the name and address of the insured, the name and address of the certificate holder, the policy number, and the effective dates of the policy.

Again, requirements can vary depending on the state and the type of insurance policy you’re working with. While we have listed some of the individual state laws and regulatory directives, these are just a few examples of COI regulations as of the moment this blog was written. To ensure that a COI meets the necessary requirements in your state, be sure to consult with an attorney or insurance professional.

How To Add Certificate Holder To Insurance

Adding a certificate holder to an insurance policy is not the same thing as adding someone to the policy (like an additional insured, for example). Instead, a certificate holder is the third party who requests and receives the COI and can use it to verify and provide proof of coverage. So, you become a certificate holder once you request a COI from a third party, and your name and contact information is put on the document.

To go about adding an entity to a COI as the certificate holder, the contractor or third party you need coverage verification from will first need to ask their insurance company or agent for a certificate of insurance in order to add a certificate holder to the policy. The policyholder will then specify which party requested the certificate. As the business hiring them, you will be the certificate holder in this case, and you should be sure that they know about all of your required terms and conditions.

From there, they’ll give their insurance company all the needed information about the certificate holder, including your name, address, and relationship to them. They’ll also need to provide information about the policy itself, such as the start and end dates of the coverage. Finally, their insurance provider will deliver the certificate to you with your information officially listed on the policy!

Manage Multiple COIs With Ease With myCOI

Ready to take the hard part out of COI collection, management, and more? myCOI’s certificate of insurance tracking software makes dealing with piles of certificates easier than ever. Book a demo today to learn how you can save time and increase efficiency in your practice. Reach out to us today.