Best Certificate of Insurance Tracking Software

Automate Your COI Tracking

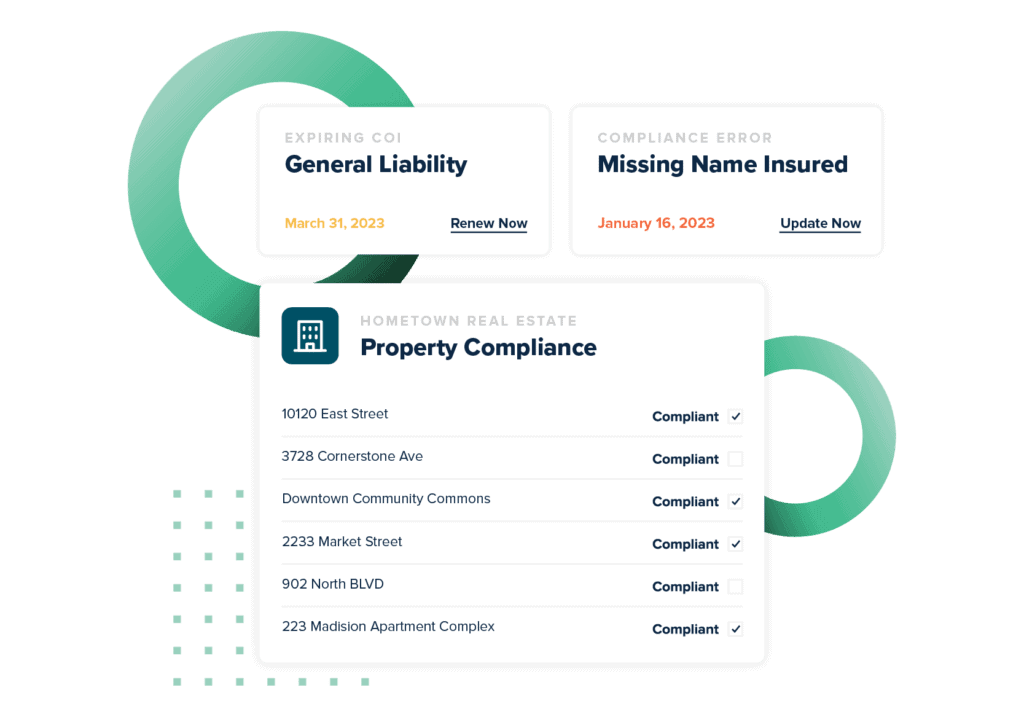

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesCertificate Of Insurance For Contractors

Anyone working with contractors will want to make sure that job-related accidents or injuries that happen will not cause them to break the bank.

The way individuals and businesses typically go about this is by verifying that any contractor they’re working with has appropriate insurance coverage and endorsements, which protects the hired and hiring parties alike. The most standard method of insurance verification is through the use of COIs.

In this blog, we’ll explain everything contractors need to know about certificates of insurance, including when and why they are necessary.

What Is a Certificate of Insurance Document?

A COI, which stands for a certificate of insurance, is an official document that validates, summarizes, and verifies a policyholder’s insurance coverage. It’s essentially a shortened representation of an insurance policy, only reflecting its most important details.

Certificates of insurance are used for cases where multiple parties are working together, and one wants to ensure that the other has insurance protections in the unfortunate case that anything goes wrong. Certificates of insurance can be used for small businesses, large businesses, or even for individuals, such as tenants.

What Information Do Certificates of Insurance Include?

Certificates of insurance are documents that contractors, vendors, and other individuals can use to verify insurance coverage. Standard-form COIs typically include the following details:

- Policyholder information. This is important as it denotes who the policy actually insures.

- Insurer information. COIs also provide contact information for the insurance agent or broker who is providing the policy.

- Type of coverage and coverage limits. This refers to the type of coverage (e.g., liability coverage) and the maximum amount of coverage available under the policy. It’s crucial for contractors to ensure that they have adequate coverage limits in place in order to protect themselves against potential liability issues.

- Policy number. This refers to the exact policy that the policyholder is covered under.

- Effective dates of coverage. These are the dates that an insurance policy goes into effect and when it expires.

- COI requester information. COIs will also include the name and contact information of the party requesting the certificate, also known as the certificate holder.

It’s important to review each certificate of insurance thoroughly in order to ensure that all of the information listed above is accurately represented within the certificate and will not cause any problems down the line.

Now that you understand the basics of COIs, let’s discuss why they’re so important in the world of contracting and what you need to know about obtaining them.

What Is A Certificate of Insurance For Contractors?

A lot can go wrong in the world of construction. Workers can fall from roofs and scaffolding, be involved in vehicle-related accidents, or be hit by falling plywood or tools, to name a few. Typically, the partners hiring contractors won’t be found responsible for these accidents – the subcontractors will.

That’s why construction contracts will often require that each contractor or subcontractor they hire maintain a certain level of insurance coverage. It’s important for contractors to set up protections through an insurance policy, and a construction COI is a perfect way to quickly reflect their coverage status. It serves as evidence that a contractor has the correct coverage in place to protect against potential liability issues related to the work they are performing, providing peace of mind to them and the people hiring them.

Contractors technically only need COIs when working for clients who require proof of insurance coverage; however, most clients will. Often, clients will mandate proof of insurance coverage as a condition of doing business with a contractor to ensure that they have the right protections in place. This is particularly true for contractors who work in industries that involve a high degree of risk, such as construction, landscaping, and transportation. Government entities may also want to see proof of insurance and require COIs from any contractors they begin work with.

What Types of Insurance Coverage Should Contractors & Subcontractors Have?

It’s vital for contractors to understand the different types of insurance coverage that may be required for their work. Here are a few to keep in mind.

General Liability Insurance

One example of a commonly required type of coverage for contractors is commercial general liability insurance. General liability insurance is designed to protect businesses from suffering from financial losses due to claims of property damage or bodily injury caused by the business or any of its employees. These policies cover things like legal fees, medical expenses, and damages that a business is found liable for. General liability insurance can be important for contractors, who are often working on someone else’s property and may accidentally damage it or injure someone as a result of their work.

Workers’ Compensation Insurance

Another common type of coverage required for contractors is workers’ compensation coverage. Workers’ compensation insurance provides benefits to employees who are injured or fall ill as a result of their work. It covers things like medical expenses, lost wages, and rehabilitation costs. Again, this can be important for contractors, for example, if they have employees who are injured on the job. In some cases, contractors will need to provide proof of both their general liability insurance and their workers’ compensation insurance.

Commercial Automobile Insurance

A final example (though not an exhaustive list) of insurance a contractor might need is commercial auto insurance (as opposed to personal automobile insurance), in the case that they use vehicles for business purposes. Commercial automobile insurance protects contractors if they are involved in an accident while driving to or from a job site, towing their trailer or equipment, or providing other transportation services.

As well as understanding the types of coverage that may be required of you as a contractor, you should also review that your policy details, such as coverage limits, are up to par with your needs. Additionally, contractors must ensure that their insurance policies are up to date and that they have any necessary endorsements (modifications to an insurance policy that alter its coverage or terms) in place. For example, a contractor may be required to add an endorsement to their policy if they add a new location or need coverage for a different, specific type of work.

What Does A COI Cost For Contractors & Subcontractors?

Many people wonder if there’s a cost associated with getting a COI. Certificates of insurance are generally not charged for by insurance companies because they are not actually insurance policies themselves. Rather, they are documents that provide evidence of insurance coverage that has already been purchased.

When a business or individual requests a COI, they are essentially asking for proof that the policyholder has an insurance policy in place that meets certain coverage requirements. The insurance company providing the policy is already receiving the premiums from the policyholder for the coverage provided, so there is typically no additional charge for providing a COI.

It’s also important to note that while COIs themselves do not always have a cost associated with them, the insurance policies they provide evidence of do. Policyholders must pay premiums for insurance coverage, and the cost of the policy will vary depending on the type and amount of coverage needed, as well as other factors such as the size and location of the business.

To obtain a COI, contractors simply need to contact their insurance provider, request the document, and provide them with any necessary details. The insurance provider will then generate the certificate and send it back to the contractor or directly to the requesting client or partner.

Should Contractors Keep Records of Their COIs?

It’s critical that contractors keep track of their COIs – especially when they’re providing evidence of current coverage, but even after they expire, too. Because insurance claims can be filed years after an incident may have occurred (depending on the contract language), it is key to keep past COIs as they will provide proof of your coverage at a given point in time.

As long as your contracting business is still around, a best practice for managing your certificates of insurance is to maintain good records in case you need to exhibit proof of insurance as an extra layer of protection.

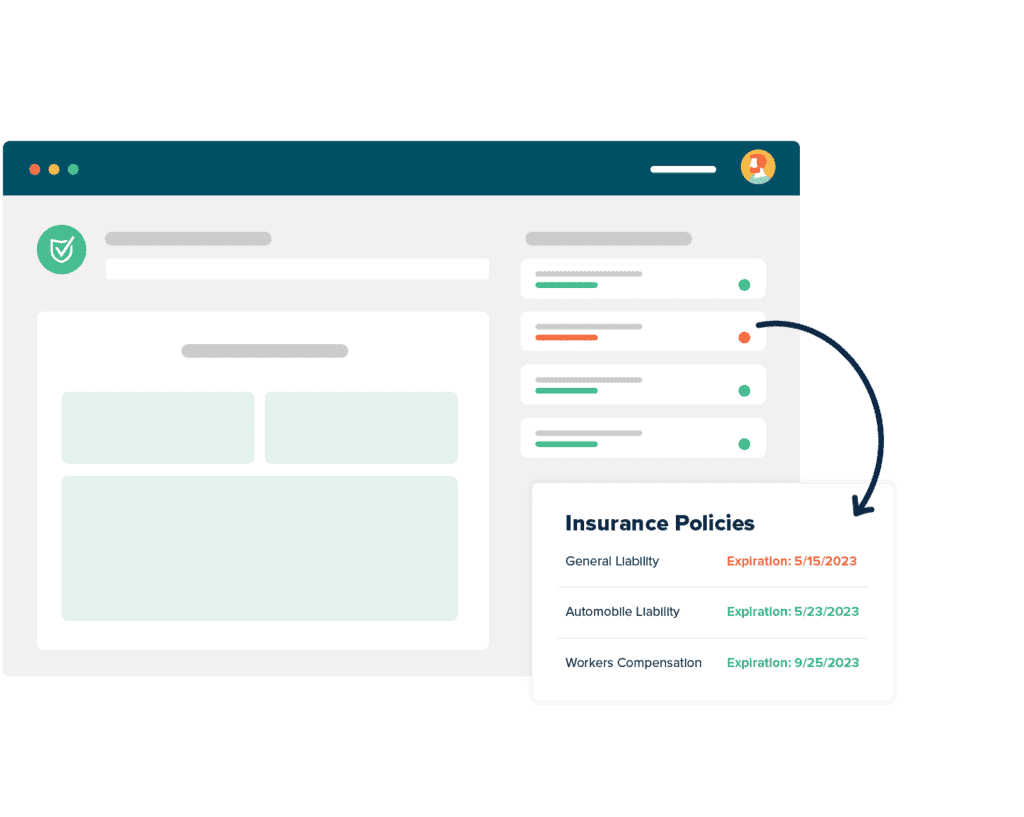

Many contractors utilize COI tracking software to help them keep track of their certificates, more easily communicate with their partners and clients, and ensure that their coverage always stays up to date. COI tracking services aim to automate lots of the manual tasks associated with COI management and can help you ensure that you always have the protection you need to keep contracting safely for years to come.

Of course it’s important not only for contractors to keep track of their COIs but also for hiring parties. As a hiring company or individual, the more subcontractors and vendors you hire, the more COIs you will have to keep track of and manage. Naturally, that can become an overwhelming task when done manually, not to mention prone to human error. With COI tracking software like myCOI, you can reduce the hassle and costs associated with COI tracking.

Easily Manage Business Insurance COIs for Contractors With myCOI

It’s easy to get lost in the world of insurance and COI management, especially on top of all of your other day-to-day duties. If you’re ready to reduce your time spent on administrative work, avoid coverage gaps, and stay compliant, myCOI is the tool for you.