Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

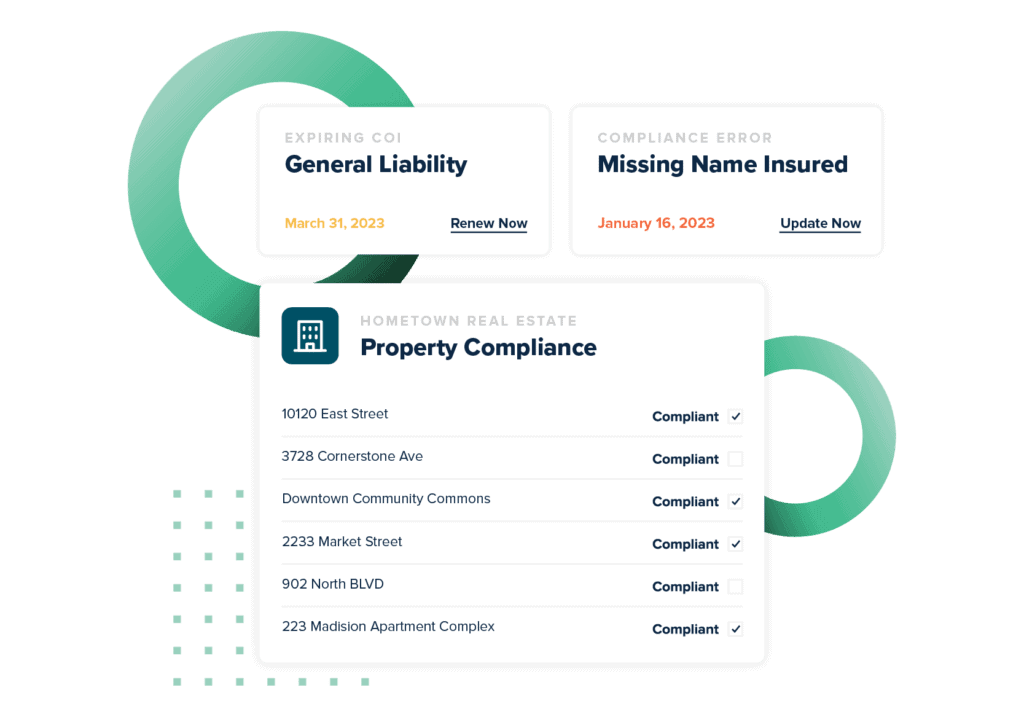

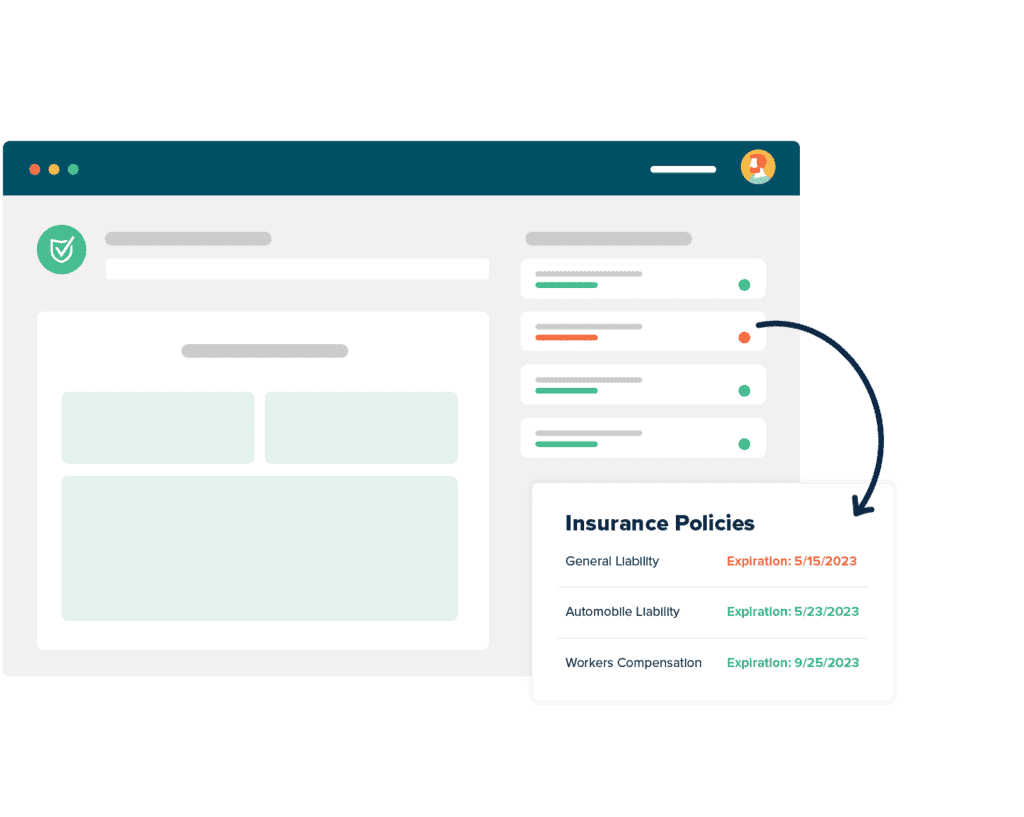

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesCertificate Of Insurance Additional Insured Sample

IRMI—the International Risk Management Institute—defines an additional insured as “a person or organization not automatically included as an insured under an insurance policy who is included or added as an insured under the policy at the request of the named insured.” That translates quite often as “I need to extend the coverage I purchase from my insurer to the third-party hiring me to do some work.”

A sample of additional insured endorsements is relatively easy to find online. A quick search will turn up a plethora of certificate of insurance additional insured samples. What you’re going to see is a standard certificate of insurance, but with the addition of the additional insured. Be careful that you don’t mistake a sample certificate of insurance with additional insured for an example of the kind of coverage you need to secure for your business; that’s a conversation you need to have with your insurer, not something you get from a PDF.

If you’re on the other side of this conversation, as a business requesting additional insured status on the certificates of insurance you collect from your third parties, you already know the necessity of such endorsements. Transferring additional risk incurred by your third parties back to those third parties is a critical part of risk management, and few companies can afford to carry the risk of damaging claims on their own books.

Many companies that use a sample letter requesting certificate of insurance from vendors often have special versions of that letter that lay out the requirement for additional insured endorsements. It would include the specific endorsements sought, provide a list of limitations that your company will not accept, or other insurance-related notes like that. Risk management teams often have custom letters for different industries or verticals.

Certificate Of Insurance Additional Insured Wording

There is a great deal of importance in the certificate of insurance additional insured wording, so much so that it is often the deciding factor between whether a company is held liable for a specific claim or not.

Let’s look at this example IRMI provides:

A project owner may enter into a contract with a general contractor that obligates the general contractor and all subcontractors to name the owner as an additional insured on their general liability policies. Even if the general contractor, in turn, requires the subcontractors to name the owner as an additional insured and the subcontractors procure policies containing blanket additional insured endorsements, it is not always clear that the subcontractor’s insurer will be obligated to provide additional insured coverage to the owner due to the absence of a direct contract between those parties.

There is a growing distance between being listed as additional insured and being endorsed as an additional insured, and states and courts have been ruling on this difference in different ways. You need to make sure your counsel or your risk management team clearly understands the precedents in your state, if you receive additional insured wording on certificate of insurance.

And if you’re a company that often receives requests for additional insured endorsement wording, make sure your requestors are making what they require very clear, because again: there is a difference between being listed as an additional insured and being endorsed as one. You’ll want to work with your insurer to make sure you understand the costs and impacts of each of those scenarios, so you know what your business can accept during the negotiation process.

Most companies that routinely request it have sample additional insured wording on file, or even a sample COI with additional insured requirements clearly illustrated. The additional insured endorsement wording can vary slightly between states, so it’s a good idea, no matter which side of the table you’re on, to make sure you fully understand the requirements.

Additional Insured Endorsement Example

A simple search online will show you plenty of additional insured examples, with enough variety that you can find an example for all types of additional insured endorsements.. Additional insured endorsement forms take a common shape: most include a warning right at the top that says “this endorsement changes the policy; please read it carefully.” This is an important distinction because, as we’ve already discussed, you’re amending your prior coverage to additional coverage for the entity named.

Next on an additional insured endorsement example, you may see “Additional Insured – Names Person or Organization.” This may seem like just a field label, but it carries the weight of precedent. It’s not unheard of for a claim to be adjudicated against a putative additional insured because they didn’t take the time to check their additional insured endorsement forms to make sure their name was spelled correctly.

Most additional insured endorsements form will also have a short section noting that this endorsement modifies the “who is an insured” definition from the original certificate of insurance.

If this doesn’t make sense, take the time to look up an additional insured endorsement PDF that is applicable for your industry and your state. Quote often, just seeing what an example looks like is enough to help it begin to make sense.

Blanket Additional Insured Wording On Certificate Of Insurance

Investopedia defines blanket additional insured wording on certificate of insurance as “an insurance policy endorsement that automatically provides coverage to any party to which the named insured is contractually required to provide coverage. A blanket additional insured endorsement is most commonly found in liability insurance policies, though it is typically not a feature of the policy language.” Quite often, people choose blanket endorsements because they work with so many companies that securing individual endorsements is too time and effort-consuming to be practical.

Like a named additional insured endorsement, a blanket additional insured endorsement extends the insured’s policy protection to another party. However, many insurers stipulate additional requirements for entities to qualify for blanket endorsement, the most common of which is that the two parties have a business contract in place.

If you want to see what these endorsements look like, search online for blanket additional insured endorsement PDF or blanket additional insured endorsement form sample. You should be able to find quite a few PDFs for your state or industry to give you a good general direction of what to look for.

Deciding whether your business can accept a blanket endorsement vs specific endorsements is a question for your counsel or your risk management group. There are pros and cons to each, and in many cases certificate holders often stipulate that a specific endorsement is required, so that there’s no danger of claim denial.

Also, remember that additional insured endorsements are different from things like a blanket waiver of subrogation; subrogation refers to the practice of recovering losses incurred from claims from other related parties.

Insurance Certificate Holder Vs Additional Insured

This distinction is perhaps one of the most important in the insurance industry when it comes to certificates of insurance and additional insureds: the relationship between the insurance certificate holder vs additional insured. And that most often happens because people don’t understand what it means to be a certificate holder.

A certificate holder, put baldly, is the person or organization that holds the certificate. If you receive a certificate of insurance from a hired third party, you’re the certificate holder. That doesn’t automatically mean that you receive additional insured protections; that can only happen if the certificate carries blanket additional insured endorsement, and your company meets the requirements of the insurer to receive this blanket coverage.

One of the most common mistakes we correct at myCOI is certificates that lack the additional insured information that the certificate holder requires. Simply holding the certificate may not offer you the protection you require, and verifying that status is a key component of our service and technology.

Remember, claims often come down to determining who has the final assumption of the liability for the action that caused the claim. When it comes down to certificate holder vs additional insured, or even policyholder vs certificate holder, the decision will come down to what’s in the policy, and what assertions were made at the beginning of the relationship.

Certificate Holder Insurance Sample

We saved this for the end because there’s a lot of interest in questions like “what is a certificate holder for insurance?” and it’s sometimes difficult to know exactly what’s being asked. On a certificate of insurance form, it’s the party named in the box at the bottom of the page, who requested the certificate of insurance.

In an office, it’s often a file cabinet.

Let’s assume you’re curious about the first: look online for a certificate holder insurance sample or certificate holder insurance form. You’re going to find lots of highlighted PDFs, quite often the ubiquitous ACORD 25 form, with a yellow highlight in the bottom left, where the form says “certificate holder.”

Now, as to who should be listed as certificate holder on a certificate of insurance, the answer is the legal entity requesting the certificate, or more specifically, the entity requesting the legal protections the certificate conveys from the issuing insurer. This is important because this is the entity that will get named in any possible future claim.