In the past, as businesses began to purchase insurance policies to protect themselves against potential losses, there was no good way of providing proof of coverage besides through the policy itself. As you may well know, insurance policies are complex and lengthy documents, and verifying coverage by scouring through them is a cumbersome and time-consuming process.

That’s why, for years now, certificates of insurance (COIs) have been used to track and provide proof of insurance coverage. These simple documents outline the basic information necessary about the policyholder, coverage, and policy and make it much easier for everyone involved to quickly get the information they need.

Read on to learn a few certificates of insurance management best practices, as well as whether or not a vendor or subcontractor can issue their own COI.

What Are Certificate Of Insurance Best Practices?

There are many considerations to keep in mind when it comes to managing certificates of insurance across multiple vendors and other third parties. Here are a few best practices:

- Obtain a COI from each vendor you work with. A certificate of insurance management system starts with requesting and collecting COIs from each of the vendors, contractors, tenants, or third parties that you work with. We recommend that you request certificates from relevant parties as soon as possible and before they begin working with you if you can.

- Double-check all of the details. Before you file the document, be sure to review it thoroughly and ensure that it accurately reflects coverage limits, expiration dates, and any terms agreed upon in a contract. If any information is incorrect or missing, send it back to the insured party and ask them to make corrections.

- Ask to be named as an additional insured. While this isn’t always necessary, being added to a contractor’s policy through an additional insured endorsement, for example, is a good idea. This would extend their policy to provide another layer of protection for your organization if any claims come your way as a result of their actions.

- Stay up-to-date with certificates. Reach out to the third parties you’re working with before their coverage expires to ensure that there are no lapses in coverage. Any time your vendors or contractors renew their policies, you’ll want to request new certificates to keep for your records.

- Consult insurance professionals for more help. Still not sure where to start? Have specific questions the internet isn’t helping with? Consider leaning on the myCOI team. We’re qualified industry professionals and always here to help.

Can I Issue My Own Certificate Of Insurance?

It is not legal or possible for anyone to issue their own certificate of insurance. Since the purpose of a certificate of insurance is to provide proof of insurance coverage, the insurance company that issued the policy that the COI is providing evidence of is the only entity with authority to verify and provide this confirmation.

So again, while an insured cannot issue their own certificate of insurance, obtaining a COI from their insurer is typically quick, simple, and free. Soon, we’ll cover the steps you can take to request a certificate of insurance from your vendors and subcontractors and how they can request one from their insurance provider.

Why Do Companies Require A Certificate Of Insurance?

Companies often need proof of insurance for parties that work with them, for legal reasons, compliance reasons, or just to attain the most protection possible. And while they could go get and read through the entire insurance policies for each party they need to verify insurance for, certificates of insurance provide a quicker and easier alternative.

How To Get A Certificate Of Insurance

To get a COI from your subcontractor or vendor, all you have to do is request one. As a vendor, to get a COI for yourself, contact your insurance company or agent, give them the details of coverage you’re looking to have verified, and they’ll generate it for you. To get a COI for another party, simply request one from them. They’ll go through the same process laid out above with their insurance agency, and then they’ll deliver the COI to you as requested!

Can I Get An Insurance Certificate Online?

As a subcontractor, depending on the insurance company that you’re working with, in many cases, you’ll be able to obtain a certificate of insurance online. Many insurance companies have online portals where policyholders can go to access policy information, request a COI, and more. It’s important to note, though, that not all insurance companies will offer online access to COIs, so you’ll have to reach out to your provider to be sure.

Additionally, as a requesting party, you can require COIs in hard copy form rather than digitally.

What Is The Most Common Certificate Of Insurance Document

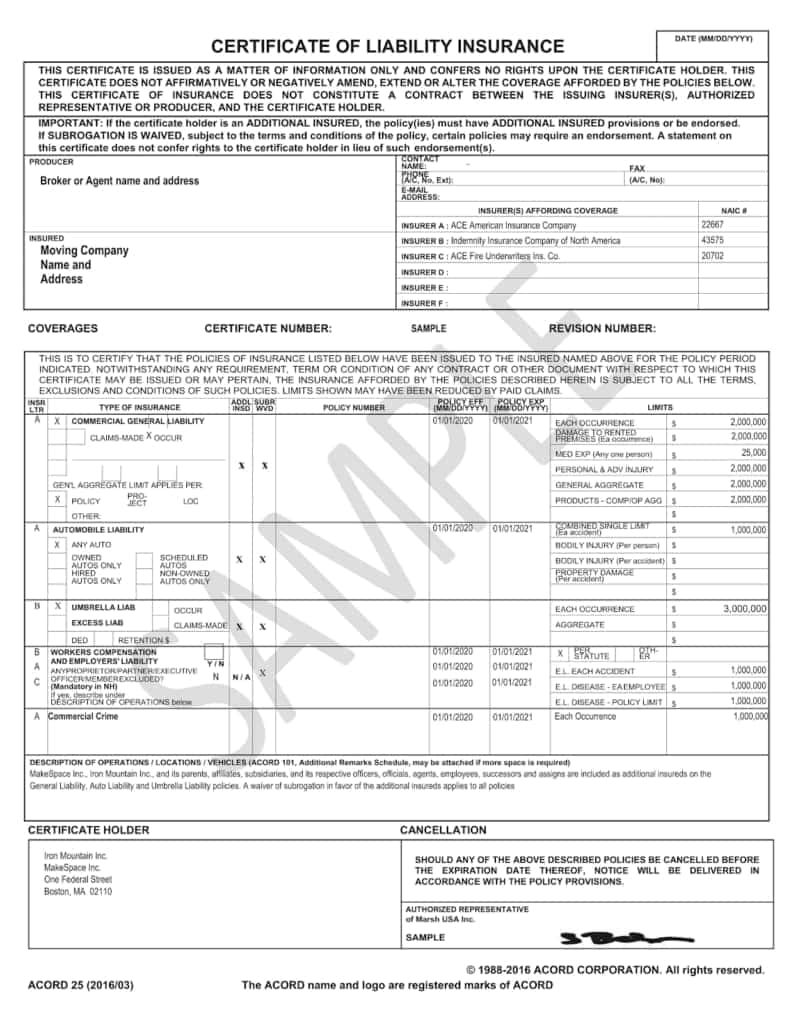

The most common certificate of insurance document is the certificate of liability insurance, which provides proof of liability insurance coverage or protection against claims for things such as property damage and bodily injury. It is very common for businesses or individuals to require a certificate of liability insurance from the contractors and vendors they work with as a condition of working with them. Here is a certificate of insurance example for liability insurance coverage:

(Pictured: Sample Certificate of Liability Insurance. Source: MakeSpace)

Insurance Tracking Simplified

Make COI management easy. Our solution automates your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance. Reach out to us today.