Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

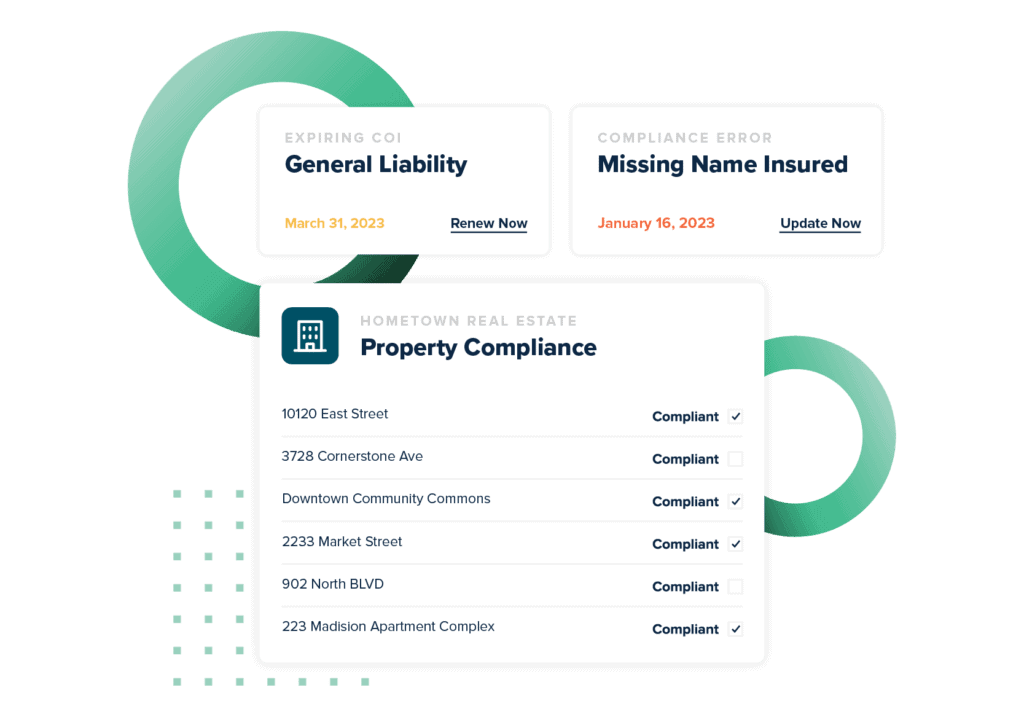

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesBlank Certificate Of Insurance

If you run a business today, then you already know how important it is to make sure you have the right type of protection. In addition to having the right Insurance, you also have to make sure you have an insurance form that serves as proof of the type of insurance you carry. That is why it is important to have a certificate of general liability insurance for government officials, employers, and potential business partners. If you are looking at a blank certificate of insurance, you may be wondering how to fill it out. One of the most common certificates of insurance you may have is the ACORD 25 form.

The ACORD 25 form is a certificate that shows you have general liability insurance. It is important for you to follow ACORD 25 instructions when r reviewing an ACORD 25 form template. You might also want to refer to an ACORD 25 example to make sure your agent or broker filled this form out properly. If you have an ACORD 25 certificate, then you possess proof of your general liability insurance policy. If you are wondering, “what is the most current ACORD 25 form,” check the ACORD website. The forms are not updated every year, so there’s no such thing, for instance, as an ACORD 25 2021 form.

There are a few common mistakes people make when they request an ACORD form, or are reviewing, an ACORD 25 form. One of the most common mistakes people make is confusing the effective date of their insurance policy with the date on which they paid their bill. These are not necessarily the same dates.

ACORD Certificate of Insurance Sample

It may be helpful to take a look at an ACORD certificate of insurance sample. This might also include a sample certificate of insurance with additional insured information.

There are a lot of boxes out on this form. Whether you’re reviewing a certificate issued by your agent or other insurer, these include:

- You need to make sure your general liability insurance is listed. This typically includes l the per occurrence limit and the aggregate limits of the policy.

- You also need to confirm the policy number. This includes the policy effective date and the policy expiration date.

- If you have automobile liability insurance, you need to include this as well. Again, make sure you confirmed the policy number, effective date, and expiration date.

- If you have workers’ compensation and employers t liability insurance, you should include all of this information as well. This includes the policy number, effective date, and expiration date.

- You may also have an umbrella or excess insurance policy. An umbrella or excess policy is a policy that kicks in if you exceed the maximum liability on some or all of the underlying insurance policies.

If you have questions about how an ACORD form should be filled out properly, you may want to take a look at an ACORD form sample for help.

Certificate of Insurance Form Sample

As you are looking at your certificate of insurance form sample, it is important to make sure there are no mistakes. If you’re providing this certificate to a hiring entity, they’re going to verify your coverage. If there are discrepancies, that could slow down when you begin work or even delay the project.

Think of it this way: in many states, you’re required to carry a certificate of car insurance sample—well, not a sample, the little card your car insurance agent gives you is the actual certificate—in case you get pulled over, to prove you’re covered in case of an accident. Companies have to do the same check, except the insurance requirements for businesses when dealing with other businesses are far more complex.

On the ACORD form 25 sample, there are a few common mistakes people make. One of the most common mistakes is getting policy numbers confused. Your auto, workers’ compensation, and general liability insurance policies may have different policy numbers. Make sure you pair the right policy number with the right type of insurance.

Furthermore, these policies may have different expiration dates. Do not assume they all have the same effective date and expiration date. If you do, you may end up assigning the wrong dates to the wrong policies. This will render your ACORD 25 form inaccurate. Double-check the policy effective dates and expiration dates before you provide the certificate to anyone. If you have questions about your insurance policies, reach out to your insurance provider for more information.

ACORD 25 Fillable 2021

If you’re looking for the ACORD 25 fillable 2021 is the year it got more common than ever for people to try and create their own COIs. This is not a good thing.

There is almost no good reason for you to try and fill out your own certificate of insurance. It makes you look like you’re trying to fool somebody. Just request it from your insurance broker or agent. Think about it: it’s a certificate. It certifies something. You can’t certify what your insurance agent is covering. Only they can do that.

Also, be sure you get the correct form. ACORD 27 fillable PDF, which is for property insurance when you actually need a general liability form.

ACORD Certificate of Property Insurance

One of the most important certificates of insurance you have is your ACORD certificate of property insurance. If you own or lease commercial property, you need to protect it with the right property insurance policy. As you are reviewing this property insurance certificate, refer to a certificate of property insurance sample to make sure the information representing the policy is filled out properly. evidence of property insurance samples can also assist with making sure your ACORD certificate of property or evidence of property insurance is accurate.

There are several important items to r confirm on this form. First, you need to make sure your policy number is correct. Refer to your insurance policy for this number. Then, you have to list the policy effective date and the expiration date. The effective date is when the policy becomes active. The expiration date is when the policy expires. You may also want to verify the appropriate property coverage, such as Building Contents or Business Interruption coverage of this insurance policy as well.

Remember that the date on which you pay your property insurance premium is not necessarily the date the policy becomes active. Double-check the dates to make sure the certificate is filled out properly.

ACORD Certificate Of Insurance Verification

The right form makes ensuring your vendors and contractors are in compliance much easier. With an ACORD certificate of insurance verification becomes a matter of confirming each of the listed values matches what your requirements are.

Easy, right? Not exactly. The easy and unquestioned access of anyone to free ACORD 25 fillable forms means that you may need to also verify the coverage with the issuing agent or broker. Knowing how to verify a certificate of insurance with the issuing agent is a handy skill for risk team members or compliance admins to have.

Sometimes it’s not just coverage you have to verify. If you’ve held this certificate for a while, you may want to verify that the certificate is still valid. Coverage expires, or gets modified, and sometimes new certificates with accurate coverage are not provided to you.

Regardless, knowing how to verify a certificate of insurance is a skill every compliance admin or risk manager needs to know.

ACORD Certificate of Insurance 2021

As your business continues to grow, you will also accumulate a wide variety of insurance policies. Therefore, you need to make sure that you stay prepared to meet the insurance certificate needs of multiple clients. One means of staying organized is to take a look at a blank ACORD form from the ACORD insurance forms list, which will include a sample ACORD 25 as well as the ACORD 25 instructions.

The ACORD 25 is the standard liability insurance certificate, but it can serve a lot of needs.

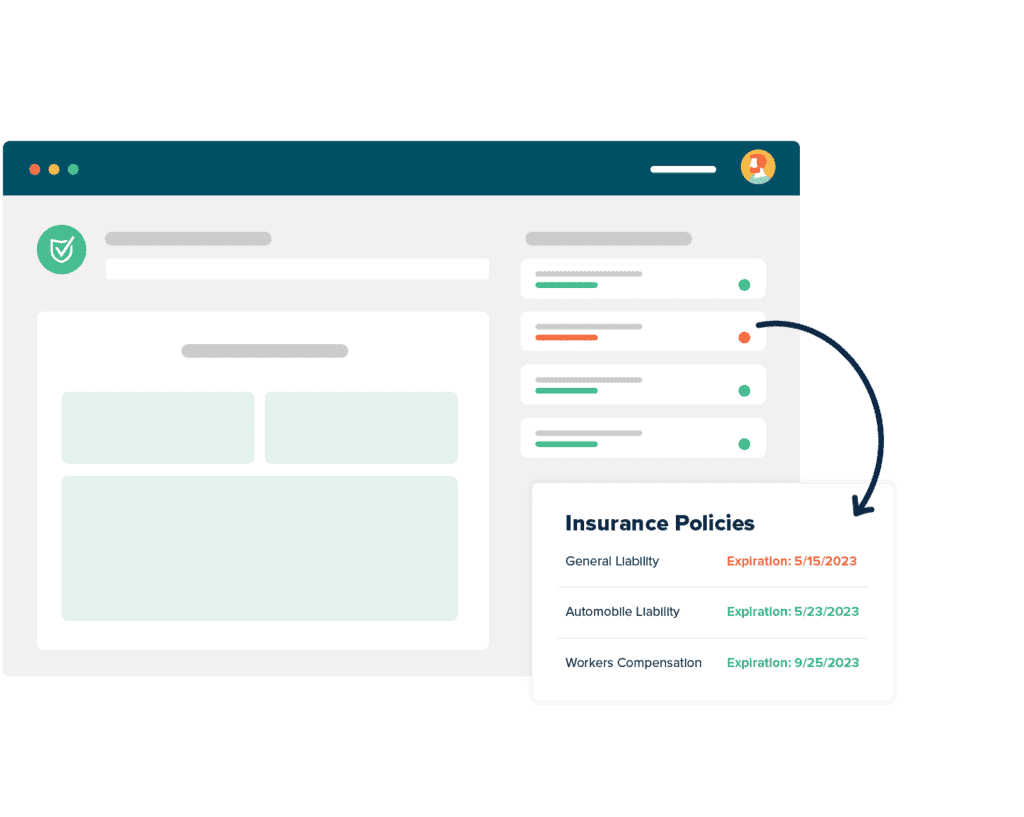

There are advanced software programs that are designed specifically to help you keep these forms in the correct order, as well as up to date, secure, and accessible. This way, you can be alerted automatically whenever a policy is about to expire, and choose to renew it if that is the right decision for your company.

Also, make sure you’re securing certificates from your agent or agency. Because of the simplicity and universality of an ACORD form insurance agents are always familiar with it, and will work with you to ensure you’re meeting—and proving, with your certificates—that you have the coverage you need.

ACORD Form Insurance

Because of the widespread availability of the forms, and because of ACORD’s standing in the industry, the ACORD form insurance companies use is always a good choice. Always refer to the ACORD forms instruction guide to make sure your agent is filling out the certificates appropriately. In addition, you may also want to refer to a list of ACORD forms to make sure you the right form for the coverage represented is appropriate. These ACORD forms vary depending on the type of insurance you have. That is why you should always double-check the ACORD Form before you decide to send off your certificates to a requester

Finally, make sure you proofread all of these forms as well. They are official documents. Therefore, you should proofread the forms carefully to make sure they have been filled out correctly. If you have questions about the forms, you should reach out to your insurance provider for help. If you receive certificates of insurance from third parties, make sure you take advantage of advanced software and technology, such as myCOI, to keep track of these certificates. That way, you can address third-party compliance concerns before they become critical.