Best Certificate of Insurance Tracking Software

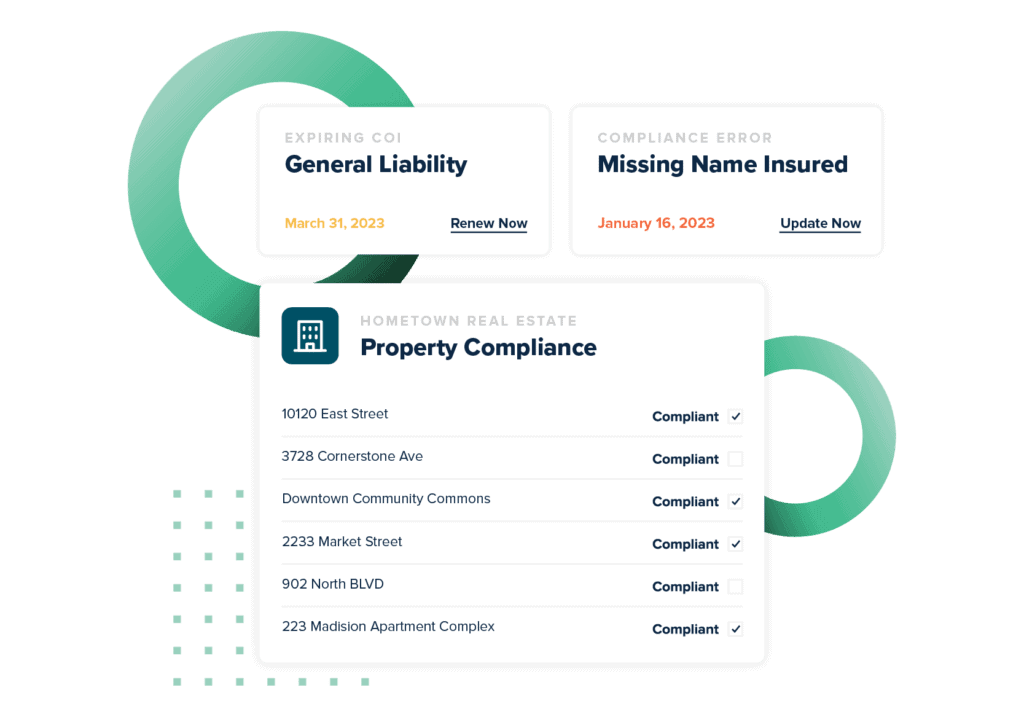

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

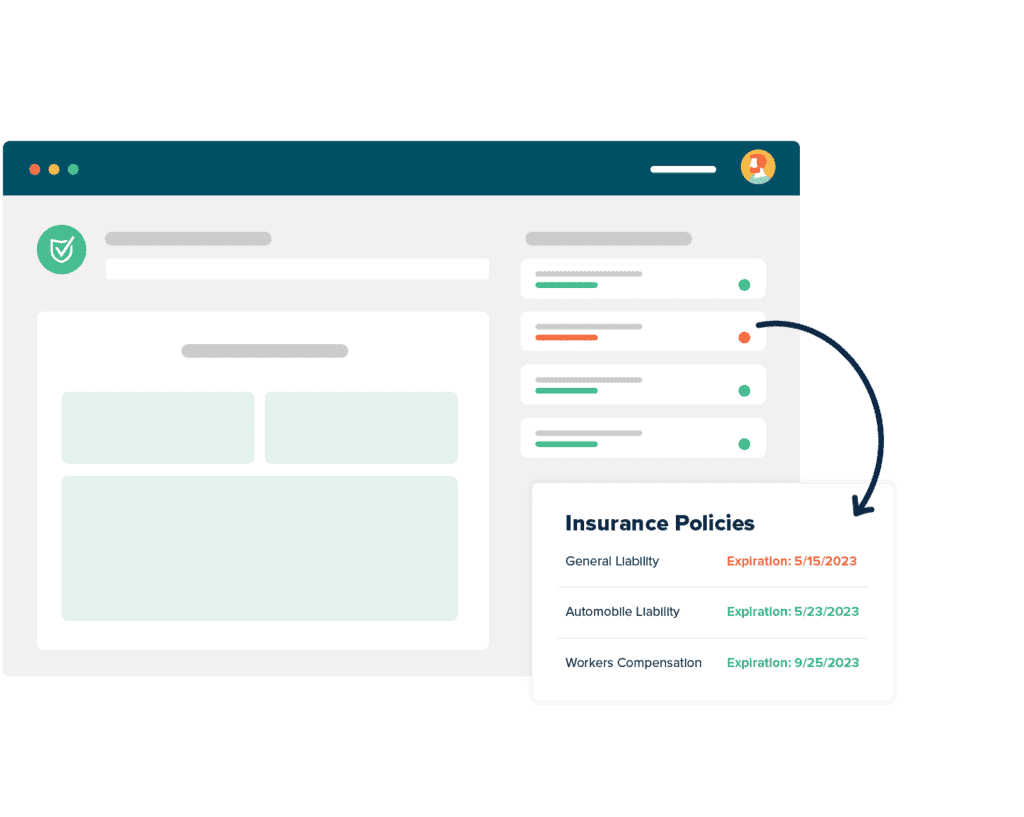

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesCertificate Of Insurance Tracking Platform

Certificate of insurance tracking is what myCOI does. Period. We use our custom-built tools, technology, and expert insurance team to erase the worry companies feel about insurance certificate tracking. For more than a decade we’ve led the certificate-tracking industry, and we’re not sacrificing any of that lead. We’re the best certificate of insurance tracking platform you can find. There are other insurance tracking platforms. We’re better.

Certificate of insurance (COI) tracking is a key component of corporate insurance risk management. The more third parties your company hires, the more you need a tool stronger than some insurance policy management software free download.

Let’s take a look at what makes COI tracking such a critical part of your company’s success.

Certificate Of Insurance Tracking Template Excel

If you’re looking for a simple and manual way to track the certificates of insurance in your business, then using a COI tracking spreadsheet is an option worth considering. Many companies begin by having their staff track insurance policies on Excel spreadsheets. And for smaller companies just starting out, that system works. For basic certificate of insurance tracking spreadsheets are not a bad solution.

Many companies find spreadsheets a good training tool; for a certificate of insurance tracking template Excel has several basic templates that can be customized to what you need, but most companies scale past this very quickly.

The drawbacks of using an Excel insurance tracker are that they can be time-consuming to maintain and often require constant updating. What began as a simple project one person could track and easily snowball into a time-intensive process that’s impossible to scale as a company grows. Instead, companies might add more people and more spreadsheets, which leads to paperwork being lost or misplaced, which leads to increased chances for errors in the data.

That is exactly the worry that myCOI erases. Our systems are industry-leading. Our insurance professionals are top-notch. If you’re tracking hundreds of certificates of insurance, we’d love the chance to show you just how much time and effort we can save you.

What Does A Certificate Of Insurance Look Like

If you’re a contractor, you need to have a certificate of insurance for business for the insurance policies your business has. There are probably lots of insurance policies you carry at your company. These include:

- General liability insurance, which covers the potential liability you take on with each project, such as construction projects

- Commercial auto insurance, which covers your vehicles and drivers during the job

- Commercial property insurance, which protects any real estate you might have or lease for your business

- Workers compensation and Employers Liability

When it comes to certificates of insurance 101, you need to make sure you have accurate certificates to represent all of your policies. Don’t just trust a certificate of insurance PDF. Know what you’re looking for. A few critical elements include:

- The limits of your protection

- The effective and expiration dates, which define when that policy is active

- Your insurers or carriers, which are your insurance companies

You should not be creating your own COIs. Even though you should review your certificates, it is essential to rely on a specialized third party like your insurance agent to produce them. This is one of the services that your policy premiums pay for. That way, you know you have the proper protection for your company the next time you start a project.

And remember that certificate of insurance requirements by state can be very different. Let’s imagine you’re headquartered in Cincinnati, which puts you within working distance of both Indiana and Kentucky. All three of those states could have differing regulatory requirements around insurance and compliance, and its your responsibility to be compliant.

Subcontractor Insurance Tracking

If you’re a contractor or business asking which vendors need a certificate of insurance, the answer is pretty simple: any vendor that enters your business premises or project site to perform work and takes any actions that may generate any risk at all needs to give you a certificate of insurance. You want each vendor to have a certificate of insurance for delivery to you, in hand, before the work begins.

That sounds pretty vague, we know, but it’s a simple reality. Risk exists all around us, whether we generate it or not, and the last thing you want to do is assume the burden of risk your vendor opened you to because you failed to secure a certificate of insurance.

Now you may ask “what is a certificate of insurance for vendors?” and the answer is, the same thing you provide to other entities that you do work on behalf of. It should show the vendor’s coverage, any limitations or exclusions, and all the usual information.

Knowing how to request a certificate of insurance from a vendor likely comes down to how your business works with vendors. In many cases, COIs with the required coverages are required as part of the vendor application process or were specified in the RFP, or in an agreement or contract. If not, it’s often a requirement before the vendor can begin working.

If you deal with a lot of vendors, you can often save a lot of time by having a sample letter requesting certificate of insurance from vendors on hand.

COI Tracking Software

Running a business is expensive, and sometimes the last thing you want to add is another expense, even when you have a need. We can’t tell you how many times we’ve heard companies tell us that they were doing their best: they knew about insurance tracking services, but the budget was just too tight, so they did it with Excel or a free COI tracking software. There are expiration date tracker apps. For a while, they did okay. Sometimes they tried to make do with free renewal tracking software or apps.

But their compliance percentage slipped down a little every month, as their business grew and more and more certificates were received. Each of those certificates had to be tracked and verified. Each month, more certificates than the last.

At a certain point, the amount of unnecessary risk they were assuming got to be too much, and they had to look for a more professional solution. Sometimes it’s because their risk management team or general counsel audits and realizes the exposure. Sometimes a new hire discovers a distressing reality that had gone unnoticed.

Unfortunately, sometimes it’s because the company just had to pay a damaging claim that they should have been covered for.

Free COI tracking software is not inherently bad, and almost no one sets out to make bad software. But it takes a dedication to customer service, a mission to erase worry, and a team of insurance professionals like the one we’ve assembled at myCOI to make sure your company is doing all it needs to with its certificates of insurance. At myCOI integrations we’ve built with other software make us a powerful option, and a key component people ask about in myCOI demos. Certificate of insurance tracking software isn’t often free, but it’s often much less than the cost of not using it.

Certificate Of Insurance Management

Knowing how to organize certificates of insurance for tracking is a necessity for any company that hires third parties such as contractors or vendors. A certificate of insurance tracking solution allows businesses to track certificate of insurance compliance. It’s more than a free expiration date tracking software. And it’s a complicated practice that requires more nuance than “I have a stack of certificates now what?”

One of the most common mistakes that businesses make is not keeping accurate records of certificates of insurance. This puts them at risk for fines and penalties if they do not have up-to-date documentation on hand when requested by a third party, such as an attorney, sometimes even when they think they’re in compliance because they don’t check certificate of insurance requirements by state, which vary. In addition to having legal consequences, failing to keep track of your company’s certificates could lead to financial losses. It also increases the likelihood of liability lawsuits filed against your business. Knowing who needs to provide a certificate of insurance is one of the core components of risk management.

It’s not just those who hire contractors and vendors that need to track certificates of insurance. Property managers who host commercial tenants also need to ensure those tenants are carrying the proper insurance. We often see the duty of securing and verifying these COIs fall on property managers, instead of dedicated risk teams, so we strongly suggest having on hand a sample letter requesting certificate of insurance from commercial tenants, so you can quickly request the COIs you need to manage your property’s risk.

Remember. If you find yourself asking which vendors need a certificate of insurance, the answer is usually “all of them.” That’s just certificate of insurance 101. The next step, knowing how to request a certificate of insurance from a vendor, is something your risk management team probably already has a process for.

Certificates Of Insurance Best Practices

If your business hires a lot of outside help, in the form of subcontractors, vendors, specialists, commercial tenants, really anyone who interacts with your business in a way that generates risk, then certificate of insurance compliance is a key part of your business. Certificates of insurance, or COIs, are the promise your vendors are making to you that they carry the insurance coverage you require for employment. If you’re not getting them, or worse not tracking them, you could be opening your business to incredible insurance risk. Certificate tracking helps mitigate that risk.

Certificates of insurance best practices require you to do more than receive a COI. You must verify the coverage. You must verify the details. You must ask for clarification on places where it’s unclear, and you must ensure your business is protected. That’s just certificate of insurance management good practice. You’re probably already starting to see that this is more complicated than a software to track expiration dates.

Certificate of insurance compliance software, like the expert tools and service that myCOI provides, can save your compliance team literally hours of work every day. It can save you from delayed job starts. It can keep your other employees from standing around, waiting for that critical vendor, while you’re confirming their insurance compliance. Knowing how to organize certificates of insurance, and track and verify them, can literally help your company make its quarterly or annual goals.

And it can save you from having to pay costly insurance claims when, inevitably, there are accidents.