Best Certificate of Insurance Tracking Software

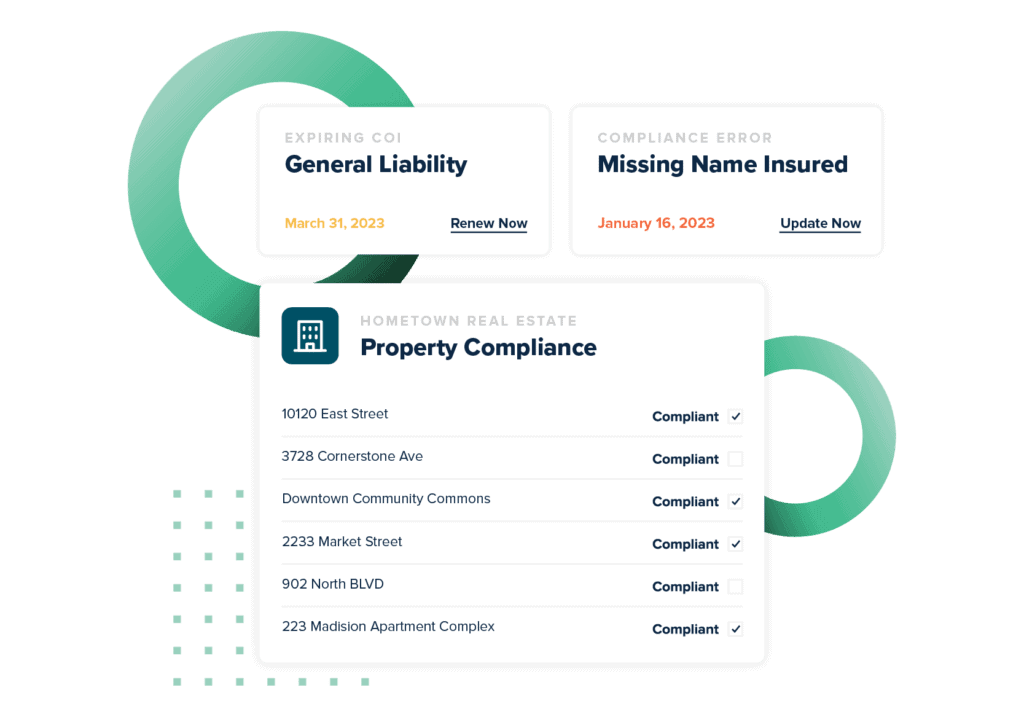

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

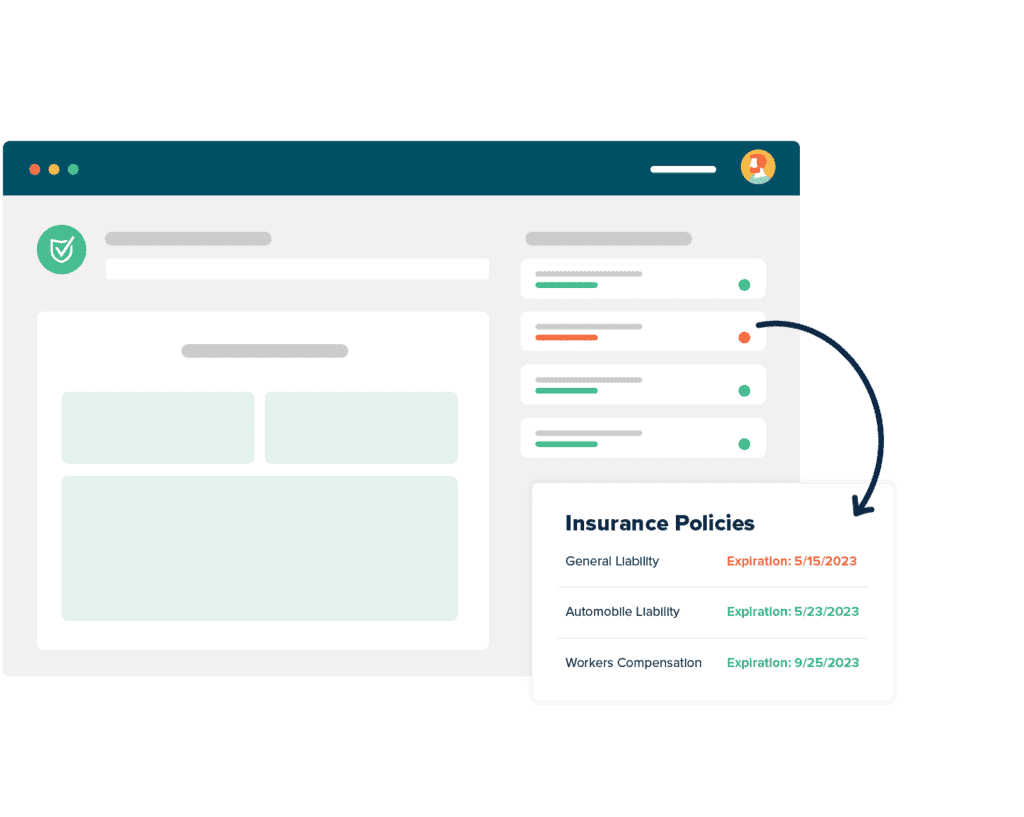

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesSample Letter Requesting Certificate Of Insurance From Vendors

There are few tools as useful as sample letters when it comes to trying to process and verify a certificate of insurance. It’s just such a repetitive process that having some useful templates laying around, ready to be customized and sent, just saves you so much time. In our own myCOI Central software platform, for example, we use a lot of templates in our communications with vendors and insurance brokers. They’ve really just become part of certificates of insurance best practices.

A sample letter to insurance company requesting coverage is a good place to start, but also try and think ahead. How many different scenarios can you imagine? Are all of your COI requirements the same, or do you need different templates for different needs. We see a lot of people start with that letter for the insurance company, then realize they need a different way to speak to vendors, so they generate a request certificate of insurance from vendor letter.

And remember, when we say letter, we don’t always mean a paper copy sent in the mail. Sometimes that’s the choice people make, but these days an email is a lot more common, and a lot faster.

How To Request A Certificate Of Insurance From A Vendor

If you’re a contractor or business asking “when do you need a certificate of insurance from a vendor?,” the answer is pretty simple: before any vendor that enters your business premises or project site to perform work and takes any actions that may generate any risk at all needs to give you a certificate of insurance.

That sounds pretty vague, we know, but it’s a simple reality. Risk exists all around us, whether we generate it or not, and the last thing you want to do is assume the burden of risk your vendor opened you to because you failed to secure a certificate of insurance.

Now you may ask “what is a certificate of insurance for vendors?” and the answer is, the same thing you provide to other entities that you do work on behalf of. It should show the vendor’s coverage, any limitations or exclusions, and all the usual information. You should request certificates of insurance from vendors every time you hire them.

Knowing how to request a certificate of insurance from a vendor likely comes down to how your business works with vendors. In many cases, COIs with the minimum insurance requirements for vendors are required as part of the vendor application process or were specified in the RFP, or in an agreement or contract. If not, it’s often a requirement before the vendor can begin working.

If you deal with a lot of vendors, you can often save a lot of time by having a sample letter requesting certificates of insurance from vendors on hand. Knowing how to request a certificate of insurance from a vendor does little to shield you from the hours of work you have ahead of you verifying all those resultant COIs, though.

Sample Letter Requesting Certificate Of Insurance From Commercial Tenants

The parts of a sample letter requesting certificate of insurance from tenants are different from the templates for contractors usually only in the details. The need for such a letter, and for such insurance verification, is the same: to protect your company from risk incurred by the tenants.

Commercial tenant insurance requirements are unique to every commercial property landlord , and oftentimes unique between states, as well. There could be variations based on location, size of building, or even the intended use. A restaurant, for example, could have different insurance provisions from an aquarium supply store. A commercial property landlord ’s risk team will have requirements around these sorts of issues.

It’s almost never a bad idea to have sample commercial lease agreement insurance requirements on hand whenever you’re working with new or potentially new tenants. You know your properties, and what risk you’re willing to accept from your tenants. Better to have those conversations early, and ensure your potential tenants understand the likely insurance cost of meeting those requirements, before you sign the paperwork.

Certificate Of Insurance Request Template

Receiving, tracking, and verifying certificates of insurance is a repetitive, time-consuming job if you don’t adopt some form of automation or software support (like myCOI). It doesn’t even matter what exact form of insurance you’re verifying with the COI or other proof of coverage. It just takes time. One of the best ways to save time on repetitive tasks is to prepare all the templates you might need beforehand.

A basic request for insurance information can take many forms. Sometimes it’s a letter that you can easily turn into a certificate of insurance request template: when you need a new one, you open the template file, update the details, save a new copy and go on with your day. We’ve seen some companies go a step further and code out a formal certificate of insurance request form template generator, where you enter information and it outputs a unique request letter or email. This is sometimes a stopgap to embracing a full certificate management platform like myCOI.

If your needs are more specific, for example if you’re looking for a proof of renter’s insurance template, you can easily create one. Alternately, there are many good examples of such templates discoverable on the internet. A search for something like “request for evidence of insurance template” will get you what you need.

At myCOI we don’t provide templates because all of our communications are included as part of our software solution.

Certificates Of Insurance For Subcontractors

If you’re a subcontractor, or you hire subcontractors and have to track certificates of insurance you receive from them, you may see a few oddities. Depending on what state you’re working in, certificates of insurance for subcontractors may sometimes lack evidence of workers’ compensation coverage. This is because several states do not require workers’ compensation coverage for what are called sole proprietorships, where the individual worker is the only employee of their one-person company. If you’re unsure whether or not there should be a workers comp policy by statute, consult with your state’s workers compensation board.

Even in states where it is not legally required, however, many companies that hire subcontractors still require the coverage as a necessity for employment. In that case, a workers’ compensation certificate of insurance for subcontractors will show the minimum necessary coverage required by the hiring entity.

What’s fun about these one-person plans is that often they’re what are called ghost policies: they are workers’ compensation plans, but they have exclusions disallowing coverage for the single employee. They allow subcontractors to satisfy the requirement of needing workers’ compensation, but since they are excluded, the coverage only covers a ghost.

One question we get a lot at myCOI is “which vendors need a certificate of insurance?” and the answer to that is “all of them.” Anyone coming on your job site to do work needs to provide you with a COI; otherwise, you’re assuming the risk of any claims they may generate or cause while they’re there.

Request For Proof Of Insurance From Contractor

We’ve mentioned several times about generating prebuilt sample letter requesting certificate of insurance from subcontractor’s offices. Having these kinds of documents handy can really save you time having to write the same letter or email over and over again. But they also have significant usefulness as training aids.

Let’s say you’re on the compliance management team, and you hire a new admin. Having a sample letter requesting certificate of insurance from vendors on hand to show them can save you a lot of time explaining the details of what they’ll need to know when they make a request. It sometimes leads to fun questions like “how do I ask a contractor for proof of insurance?”, and you’ll have to take the time to train on that, but it’s a step in the right direction.

Almost as important as knowing what to put in a letter, though, is knowing how to request a certificate of insurance from a vendor. We get these questions all the time. “What documents should I ask for when hiring a contractor?” or “what paperwork should my contractor provide?” Each business will have its own process: some places make it part of the application process, and some will handle it as a new vendor task after the vendor has been accepted. Your own business will have its own process.

Who Can Sign A Certificate Of Insurance

Knowing who can sign a certificate of insurance seems pretty straightforward: there’s only one signature field on the standard ACORD 25, for example, and it’s labeled “Authorized Representative.” That means the person authorized to sign the certificate. And while that seems like an obvious answer, it’s surprising how often it’s not.

We get a lot of attention here at myCOI for certificates of insurance issues and answers. We sometimes get contractors saying “look, this project is already behind schedule and I know what my insurance is, why can’t I just print it out and sign it myself?” The answer is because you’re not the person issuing the certificate. Your broker is. Yes, you pay your broker for the insurance, but that doesn’t mean you should be signing COIs.

Trust us. Do a search for “contractor lied about insurance” and read the horror stories. You don’t want to be in those stories.

Let your broker sign your certificates of insurance. Please.