Best Certificate of Insurance Tracking Software

Automate Your COI Tracking

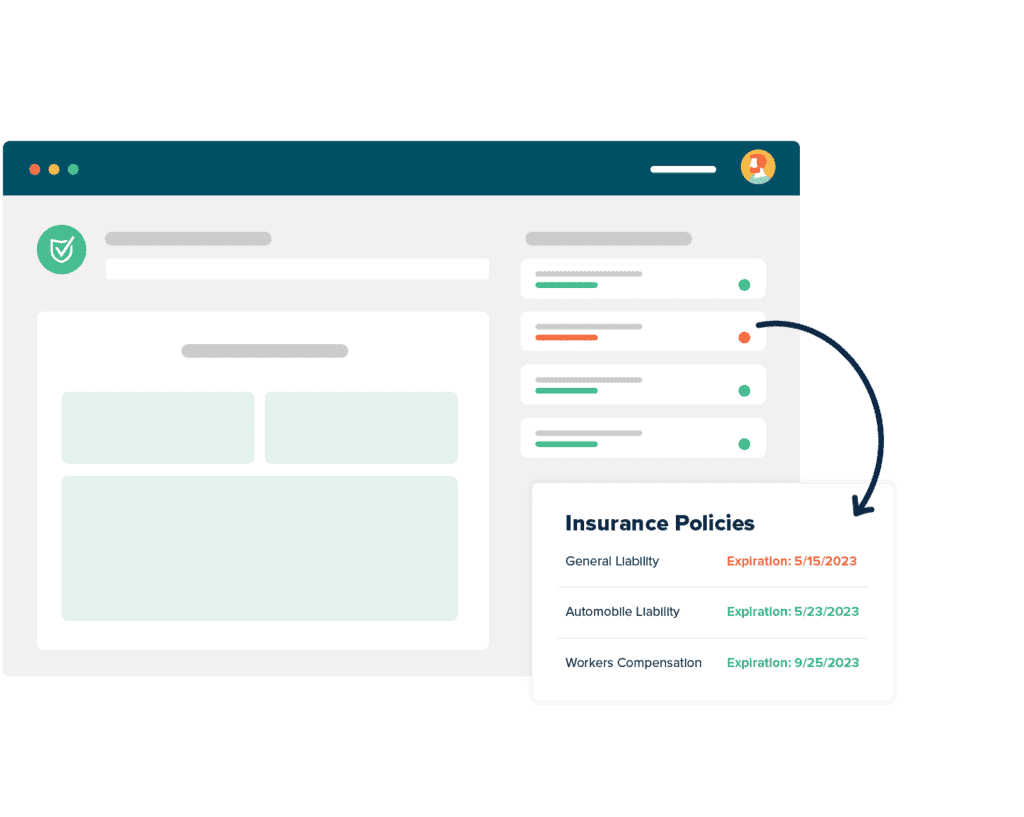

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesWhat Happens If My Subcontractor Does Not Have Insurance

Construction contractors have a lot on their minds, mainly their current job. If you are one of these busy people, then you already know what you have to face daily. You might not think much about lawsuits while you run your business. Why would you? You adhere to strict safety standards. You ensure your subcontractors do, too. You check each subcontractor’s history and only hire the best. However, projects can turn sour dues to circumstances out of your control. A customer or client can suffer an injury due to a subcontractor’s negligence. Even a false claim can lead to costly lawsuits.

Liability insurance can help pay an attorney who can negotiate a settlement or defend you if the case goes to trial. If you lose the lawsuit, liability insurance can also cover all or some of the damages and legal costs, depending on your policy limits.

You can still be sued for your subcontractor’s errors when you are the primary contractor. If the subcontractor does not have liability insurance, then you might have to foot legal expenses and payouts yourself. All it takes is one such instance to wipe out your company’s assets – and your personal ones.

An easy way to protect yourself against subcontractor errors is to require that each subcontractor you hire maintains their own liability insurance. Before you hire them, you should not only investigate their insurance status but also insert language into your contract that requires them to possess sufficient coverage. Additionally, you should request they submit proof of a policy, typically in the form of a certificate of insurance. You will also have to verify and monitor each certificate to track the coverage.

What’s a contractor? What happens if my subcontractor does not have insurance? What if subcontractor does not have workers comp?

This article will touch on these and other related topics. However, if you have questions about a subcontractor workers’ comp waiver form (what is a workers’ compensation waiver for subcontractors), what to do if a contractor lied about insurance, or any subject not addressed in this article, then you should get in touch with an insurance agent or broker. They can help you solve issues that are relevant to your situation.

Does My Subcontractor Need Insurance

Let’s tackle a few common questions regarding subcontractors and insurance.

Do subcontractors need liability insurance?

Liability insurance can offer financial protection for subcontractors and the companies that hire them. In addition, subcontractors who are insured are demonstrating that they take accountability for their work and commitment to safety.

I hired a subcontractor for a job that takes a few hours to complete. Does my subcontractor need insurance?

Regardless of length, every job possesses some element of risk. Every subcontractor possesses an element of risk. Subcontractors should maintain coverage at all times to mitigate losses if the worst-case scenario happens.

What kind of insurance does a subcontractor need?

Although the type of insurance varies based on industry, a subcontractor should have general liability insurance, which can cover property damage or injuries.

How much does subcontractor insurance cost?

Rates depend on many factors including location, claims history, and industry.

What happens if my subcontractor does not have insurance?

If your subcontractor does not have insurance, then you might have to pay for legal costs and damages in the event of a claim.

What happens if a 1099 employee gets hurt on the job?

A 1099 employee can sue the company that hired them if they feel the company did not do enough to prevent the injury.

General Liability Audit Subcontractors

What happens if my subcontractor does not have insurance? This is a common question many companies may encounter. Another common topic involves general liability audits. This evaluation examines a company’s payroll and risk exposure to determine if the company is paying the correct amount for general liability insurance. Plus, it determines if the company has the proper amount of coverage. The audits are often performed by insurance issuers. As such, if you have questions about them, then contact your insurance issuer. They can tell you what each step involves and how to prepare.

Your insurance issuer can also help you answer any general contractor subcontractor workers’ compensation questions. Is the cost of general liability insurance based on payroll? Are there special general liability audit subcontractors stipulations? Is there a general liability payroll limitation guide for owners and officers 2021 edition? Your insurance issuer should either directly answer your questions or point you in the right direction. If they do not seem willing to help you, then you might consider switching issuers. Many issuers will compete with each other for your money. Use this to your advantage and get the most helpful issuer you can find.

Uninsured Contractor Waiver

“Uninsured Contractor Sues Homeowner” is not a headline any homeowner or contractor business owner wants to read. If you choose to not require your subcontractor to have coverage, then you can request they sign an uninsured contractor waiver before they begin work. A contractor waiver and release form frees you from all liability in situations where the subcontractor can sue you in case something goes wrong.

A contractor waiver of liability form is no substitute for insurance. Hiring a contractor without insurance creates many opportunities for disaster to strike. As a responsible person, you should eliminate as many of these instances as you can. You should replace a handyman liability waiver form and an independent contractor release of liability form with the subcontractor’s certificate of insurance.

A certificate of insurance is proof that a subcontractor is meeting their company’s insurance requirements. Companies that request them must check each one for accuracy. This can prove daunting if a company hires hundreds of subcontractors or more. They can automate certificate of insurance tracking with myCOI to further protect their company from bogus and lapsed coverage.

Does Homeowners Insurance Cover Uninsured Workers

Homeowners have a lot to worry about when they hire a handyman to perform work for them. While contractors have to address their own questions (What happens if my subcontractor does not have insurance? What insurance does a contractor need?), homeowners have to know a few things before they hire people to work on their property. For instance, if you are a homeowner, you should know whether to require a liability waiver for workers on your property or insurance for workers on your property. Here are a few common questions and answers:

Does homeowners insurance cover handyman injuries?

Homeowners insurance generally covers any injuries on your property, including those a handyman sustains.

What happens if a handyman gets hurt on your property?

In many cases, homeowners insurance policies should cover legal costs and damages.

Does homeowners insurance cover uninsured workers?

A homeowners insurance policy typically does not cover uninsured contractors. Therefore, requiring any workers you want to hire to be insured should be one of the first things you do before hiring them.

Uninsured Subcontractors

Uninsured subcontractors can place the company or person that hired them at great risk of financial losses. Knowing what contractors and subcontractors do can drive home the need to only hire insured ones. Here are a few questions and answers to help you understand why anyone who performs any type of contract work for you should be insured.

What is a contractor? What does a contractor do?

A contractor is someone who agrees to supply services or goods.

What is a general contractor?

A general contractor oversees construction sites and similar locations.

Do subcontractors get workers comp?

Some contracting companies do not provide workers comp for subcontractors. However, subcontractors can purchase workers’ compensation coverage for themselves.

Are construction and similar fields dangerous?

The very nature of these jobs is dangerous. Heavy machinery and dangerous work conditions can create an unsafe environment.

Shouldn’t contractors follow safety guidelines?

They should but forces out of their hands can cause them to hurt themselves or others. A sudden weather event can turn a relatively safe job site into a minefield of possible injuries or worse.

Are Subcontractors Covered Under Contractors Insurance

Contractor insurance is a package of insurance policies that help protect construction businesses if they must deal with lawsuits, on-the-job injuries, equipment damage, and more. The following questions and answers can help you understand the concept better.

What happens if my subcontractor does not have insurance?

If your subcontractor is not insured, then you or your company might have to pay for legal costs and damages if they file a claim.

Are subcontractors covered under contractors insurance?

Subcontractors may not always be covered under basic contractors insurance policies. Contractors insurance policies typically only cover full-time employees.

Does general liability insurance cover subcontractors?

Although individual plans vary, many general liability insurance policies exclude subcontractors.

Does my business insurance cover independent contractors?

You should refer to your business insurance policy to see if it covers independent contractors. If you need assistance, you should get in touch with your insurance issuer. They should know for sure since they sold you the policy.

Should my company create and enforce subcontractor insurance requirements?

You should protect your company against expensive claims and lawsuits. Requiring COIs from the subcontractors you hire to have coverage can provide a solid level of protection.