Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

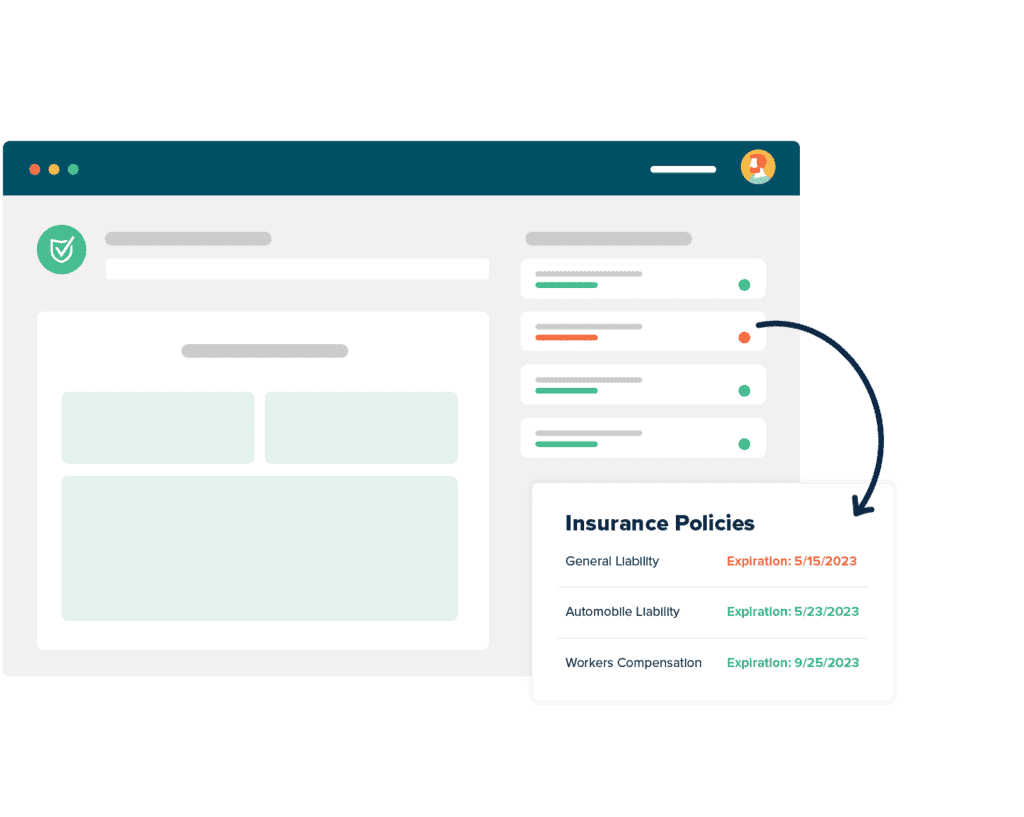

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesCertificate Of Insurance Compliance

At myCOI we’re experts at certificate of insurance compliance. We make it our mission to erase your worry about whether or not the COIs you receive from your third parties are compliant, with either our industry-leading self-service software platform or our managed service Concierge offering. Our cloud-placed lets you track each certificate of insurance online, with automated emails, logged communications, and much more.

Today we’re going to look at how to get a certificate of insurance, or COI. You need a COI from every vendor, subcontractor, or other third parties that you employ. Failing to secure and verify these means you may be assuming insurance risk that you don’t wish to assume, or even be aware that you’re assuming!

All industries, from construction to aviation to commercial real estate, bear the same unspecific levels of risk because of their reliance on third parties. It takes more than a sample letter requesting certificate of insurance from commercial tenants to protect your risk portfolio. It takes a careful plan, an unwillingness to let non-compliant vendors in the door, and a knowledge of insurance.

Let’s look at all that now.

How To Request A Certificate Of Insurance From A Vendor

If you’re a contractor or business asking which vendors need a certificate of insurance, the answer is pretty simple: any vendor that enters your business premises or project site to perform work and takes any actions that may generate any risk at all needs to give you a certificate of insurance.

That sounds pretty vague, we know, but it’s a simple reality. Risk exists all around us, whether we generate it or not, and the last thing you want to do is assume the burden of risk your vendor opened you to because you failed to secure a certificate of insurance.

Now you may ask “what is a certificate of insurance for vendors?” and the answer is, the same thing you provide to other entities that you do work on behalf of. It should show the vendor’s coverage, any limitations or exclusions, and all the usual information. You should request certificate of insurance from vendors every time you hire them.

Knowing how to request a certificate of insurance from a vendor likely comes down to how your business works with vendors. In many cases, COIs with the minimum insurance requirements for vendors are required as part of the vendor application process or were specified in the RFP, or in an agreement or contract. If not, it’s often a requirement before the vendor can begin working.

If you deal with a lot of vendors, you can often save a lot of time by having a sample letter requesting certificate of insurance from vendors on hand. Knowing how to request a certificate of insurance from a vendor does little to shield you from the hours of work you have ahead of you verifying all those resultant COIs, though.

Certificate Of Insurance PDF

It may be helpful to take a look at a certificate of insurance PDF. This might also include a sample certificate of insurance with additional insured information. Certificate of insurance templates are easy to find, the most common being the ACORD 25 general liability insurance certificate form.

There are a lot of boxes out on this form. Whether you’re reviewing a certificate issued by your agent or other insurer, these include:

- You need to make sure your general liability insurance is listed. This typically includes the per occurrence limit and the aggregate limits of the policy.

- You also need to confirm the policy number. This includes the policy effective date and the policy expiration date.

- If you have automobile liability insurance, you need to include this as well. Again, make sure you confirmed the policy number, effective date, and expiration date.

- If you have workers’ compensation and employers liability insurance, you should include all of this information as well. This includes the policy number, effective date, and expiration date.

- You may also have an umbrella or excess insurance policy. An umbrella or excess policy is a policy that kicks in if you exceed the maximum liability on some or all of the underlying insurance policies.

If you have questions about how an ACORD form should be filled out properly, you may want to take a look at a certificate of insurance sample for help.

Certificate Of Insurance (COI)

The concept of a certificate of insurance (COI) is not a new one. In a very basic form, you probably have a certificate of your auto insurance in your car or your wallet. The form is a bit more complex for business general liability insurance, but the concept is the same: a document issued by an insurer saying that the bearer is insured against certain actions to certain levels of protection.

Most agents or brokers will give you a certificate automatically, or offer you a way to request your certificate of insurance online via their website.

Now that we’ve talked about how important certificates of insurance are, let’s look at a certificate of insurance example. By far the most common general liability form is the ACORD 25 general liability insurance form, and you can see an example of this form from almost anywhere that provides certificate of insurance PDFs. Just search for “sample ACORD 25.”

All of the fields are clearly labeled, and your agent or broker should provide it to you already filled out, but let’s look at the high points. The Insured box should have your name or your company’s name in it since it’s certifying your insurance. Depending on your coverage, you may see values in the General Liability box, the Automobile Liability box, or the Umbrella/Excess Liability box, and so on. These details matter, because you can trust then that the certificate of insurance explained your coverage to the certificate holder.

Knowing how to get an insurance certificate online is only useful if you’re carrying the correct kind and amount of coverage for your situation. Knowing what is correct is a conversation you have with your hiring entity and your agent or broker.

Certificate Of Insurance Explained

If you’re a contractor, you need to have a certificate of insurance for business for the insurance policies your business has. There are probably lots of insurance policies you carry at your company. These include:

- General liability insurance, which covers the potential liability you take on with each project, such as construction projects

- Commercial auto insurance, which covers your vehicles and drivers during the job

- Commercial property insurance, which protects any real estate you might have or lease for your business

- Workers compensation and Employers Liability

When it comes to certificates of insurance 101, you need to make sure you have accurate certificates to represent all of your policies. Don’t just trust a certificate of insurance PDF. Know what you’re looking for. A few critical elements include:

- The limits of your protection

- The effective and expiration dates, which define when that policy is active

- Your insurers or carriers, which are your insurance companies

You should not be creating your own COIs. Even though you should review your certificates, it is essential to rely on a specialized third party like your insurance agent to produce them. This is one of the services that your policy premiums pay for. It’s difficult, we know, when you’re trying to figure out when do you need a certificate of insurance, to try and rush at the last minute, but that just leads to mistakes, perhaps costly ones.

Certificate Of Insurance Requirements By State

At myCOI we get asked a lot about certificates of insurance best practices, and one of the most important reminders we can offer is to check and confirm the certificate of insurance requirements by state, for any state your business touches. Insurance requirements vary from state to state, so it’s critical that you check not only the state where you’re headquartered but also the state where the work is taking place if they’re different.

States routinely have statutory insurance compliance requirements that can affect the coverages you’re going to receive on certificates of insurance. Keeping abreast of what’s happening at your state’s online insurance portal is just good practice.

The importance of tracking each certificate of insurance for small business owners is difficult to overstate. When your business is operating on the knife-edge of profitability, one unexpected costly claim can push you off that edge. Falling off that knife-edge because of a simple regulatory oversight would be terrible.

States want you to comply with their standards; they try to make this information as easy to find as possible, and if you’re in doubt you can always check with your broker or agent: they’re normally an expert in the local foibles of insurance statutes.

Certificates Of Insurance Issues And Answers

We know this can be a complicated topic because we get asked about certificate of insurance issues and answers all the time. Insurance is a complicated field with nuances around every corner, and almost every situation has some kind of unique aspect. Understanding coverage, understanding what the certificates of insurance actually say—and what they don’t say—can be, and often is, a full-time job, and it often takes more than glancing at a certificate of insurance template.

There are two parties you want to check within almost any instance of questions around certificates of insurance. First, for questions like which vendors need a certificate of insurance, check with your company’s risk management department, or when that doesn’t exist, your company’s general counsel about what your vendor insurance requirements are. In many cases, these departments or people can give you a certificate of insurance review checklist to help you ensure that the COIs you review have all the necessary coverage.

The other party will be the agent or broker who issued the certificate of insurance. When you have questions about the coverage, exclusions, or limitations shown on a certificate of insurance you receive, the only safe source of information is the agent or broker itself. Don’t ask the third party who provided you with the certificate; not only does this give them the opportunity to be dishonest, it also sets you up to be taken advantage of out of ignorance or a mistaken belief about coverage. Go to the source. Ask the agent or broker. Certificate of insurance compliance is complicated enough without adding more chances for mistakes.