Best Certificate of Insurance Tracking Software

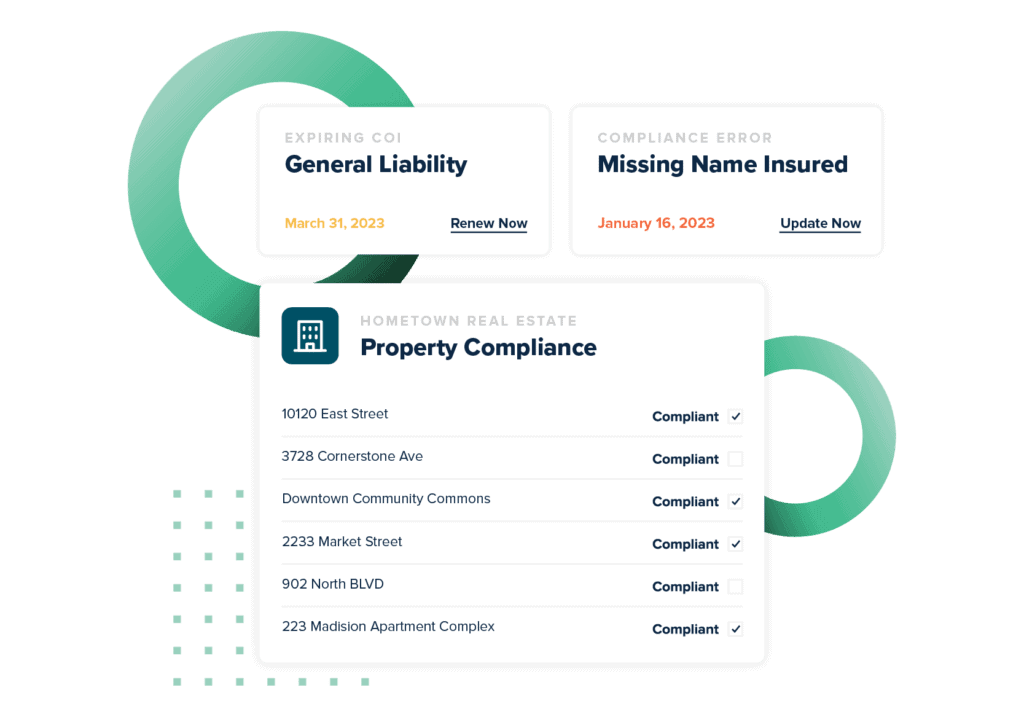

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

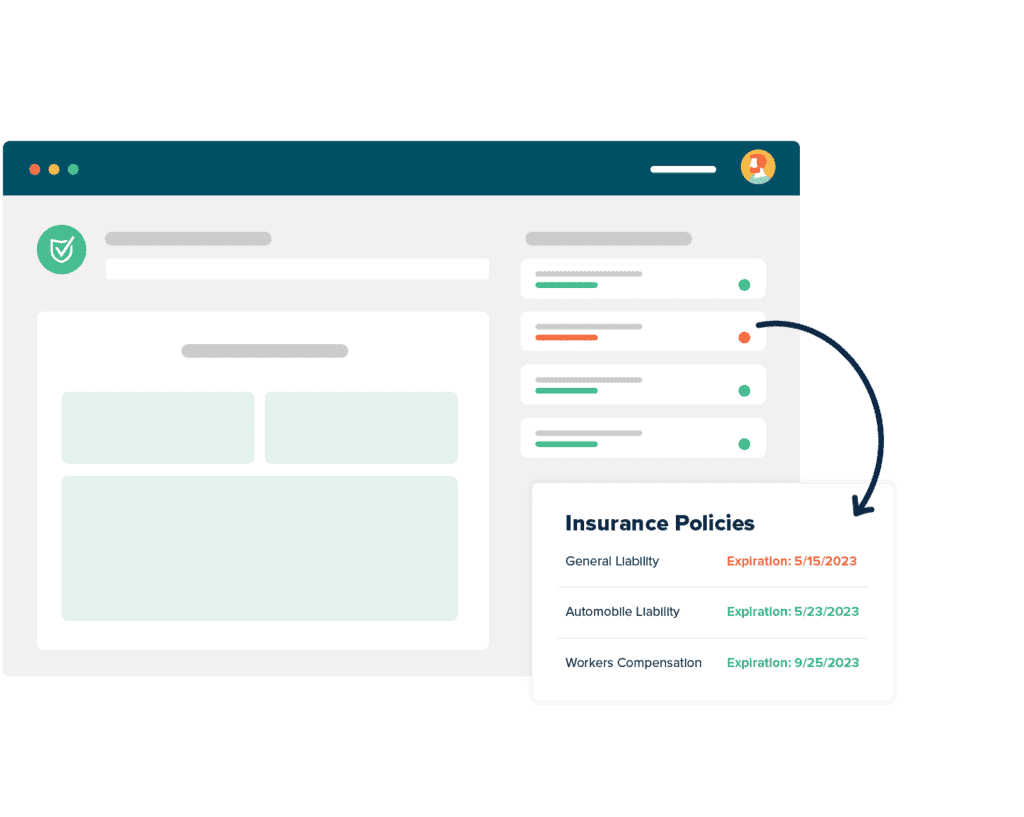

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesCertificate Of Coverage Insurance

“What is a policy certificate for health insurance?”

That’s a question we hear sometimes. And even though that’s not usually part of our core business, we can tell you a little about them. A health insurance certificate is called a certificate of coverage form. We’ll define it a little more in a moment, but that’s the short version. It’s proof that you have medical insurance.

There are plenty of reasons you’d need this, but we’re told it comes up often related to Social Security in the United States. With a certificate of coverage Social Security benefits are easily defined to any inquiring party.

Let’s take a look at some of the related items, starting with first fully defining what a certificate of coverage is.

Certificate Of Coverage Meaning

Because we’re the industry leader in certificates of insurance tracking, at myCOI we sometimes get asked “what is a certificate of coverage?” A certificate of coverage is a term that is usually applied to certificates of medical insurance. The actual certificate of coverage definition, according to Insuranceopedia, “is an official contract that outlines what an insured is entitled to, and what they aren’t insured for, under a health insurance policy.”

You’ve seen a version of these: the medical insurance cards most of us carry are like a certificate of coverage meaning it explains our coverage. Insuranceopedia continues:

This document details all the benefits that a health insurance policyholder can avail themselves of. It also discloses all the exemptions and exclusions from the policy.

The certificate of coverage also tells the insured how they can access those benefits. It will specify, for instance, what treatment or procedure entails a deductible or copayment.

Once hiccup here is the difference between a certificate of coverage and a certificate of creditable coverage. Certificates of creditable coverage come from your previous health insurance providers, not your current one.

Both certificates have standard forms, and you can compare them easily by searching for a certificate of creditable coverage templates and then comparing what you find to a certificate of coverage health insurance sample. The differences between the two forms will become readily apparent.

Certificate Of Insurance

The concept of a certificate of insurance (COI) is not a new one. In a very basic form, you probably have a certificate of your auto insurance in your car or your wallet. The form is a bit more complex for business general liability insurance, but the concept is the same: a document issued by an agent or broker saying that the bearer is insured against certain actions to certain levels of protection.

Most agents or brokers will give you a certificate automatically, or offer you a way to request your certificate of insurance online via their website.

Now that we’ve talked about how important certificates of insurance are, let’s look at an example of what one looks like. By far the most common liability form is the ACORD 25 Certificate of iability insurance form, but you should check a certificate of insurance PDF from whatever source your company uses.

All of the fields are clearly labeled, and your agent or broker should provide it to you already filled out, but let’s look at the high points. The Insured box should have your name or your company’s name in it since it’s certifying your insurance. Depending on your coverage, you may see values in the General Liability box, the Automobile Liability box, or the Umbrella/Excess Liability box, and so on.

You don’t really need to know how to get insurance certificate online; most agents and brokers want to make this as easy for them as it is for you, and build processes that make it simple.

Certificate Of Insurance For Small Business

One of the most common issues we hear about around business insurance for small business is either evidence of, or worry about, fake business insurance certificates. Erasing this fear is one of our core missions at myCOI and one we fight every day on behalf of our clients with our certificate verification programs.

Like any document, a certificate of insurance can be forged. In most cases, the forgery is obvious: handwritten rather than printed, sometimes in inks of different colors, different font types, or an obvious cut-and-paste photocopy. Any of these should be triggers for your compliance team to reach out to the producer or agent and confirm the coverage presented on the suspect certificate.

Any certificate, even certificates of insurance for subcontractors who have previously done work for you, should be reviewed first for accuracy in coverage, but also verified with the producer or agent to ensure the coverage presented is still accurate.

Everyone in small business insurance recognizes the critical need for good insurance risk management. Every business is unique, though, and that’s where the very many ways of tracking certificates of insurance come in.

When Do You Need A Certificate Of Insurance From A Vendor

If you’re a contractor or business asking “when do you need a certificate of insurance from a vendor?,” the answer is pretty simple: before any vendor that enters your business premises or project site to perform work and takes any actions that may generate any risk at all needs to give you a certificate of insurance.

That sounds pretty vague, we know, but it’s a simple reality. Risk exists all around us, whether we generate it or not, and the last thing you want to do is assume the burden of risk your vendor opened you to because you failed to secure a certificate of insurance.

Now you may ask “what is a certificate of insurance for vendors?” and the answer is, the same thing you provide to other entities that you do work on behalf of. It should show the vendor’s coverage, any limitations or exclusions, and all the usual information. You should request certificates of insurance from vendors every time you hire them.

Knowing how to request a certificate of insurance from a vendor likely comes down to how your business works with vendors. In many cases, COIs with the minimum insurance requirements for vendors are required as part of the vendor application process or were specified in the RFP, or in an agreement or contract. If not, it’s often a requirement before the vendor can begin working.

If you deal with a lot of vendors, you can often save a lot of time by having a sample letter requesting certificates of insurance from vendors on hand. Knowing how to request a certificate of insurance from a vendor does little to shield you from the hours of work you have ahead of you verifying all those resultant COIs, though.

How To Request A Certificate Of Insurance From A Vendor

We’ve mentioned several times about generating prebuilt request certificate of insurance from vendor letters, for example. Having these kinds of documents handy can really save you time having to write the same letter or email over and over again. But they also have significant usefulness as training aids.

Let’s say you’re on the compliance management team, and you hire a new admin. Having a sample letter requesting certificate of insurance from vendors on hand to show them can save you a lot of time explaining the details of what they’ll need to know when they make a request. It sometimes leads to fun questions like “what is a certificate of insurance for vendors?”, and you’ll have to take the time to train on that, but it’s a step in the right direction.

Almost as important as knowing what to put in a letter, though, is knowing how to request a certificate of insurance from a vendor. Each business will have its own process: some places make it part of the application process, and some will handle it as a new vendor task after the vendor has been accepted. Your own business will have its own process.

Insurance Compliance

Insurance compliance is a phrase that can mean a lot of things to different people. Here at myCOI, we think of tracking the compliance of third-party insurance on certificates of insurance (COI), because that’s our business: we erase the worry of certificate tracking for companies that use our software or hire our team of insurance professionals.

Other teams may take insurance compliance to mean insurance regulatory compliance, which is the business function that ensures a business is aligned with any and all federal, state, or local regulatory insurance requirements. In the United States, there are many varied requirements around business insurance regulations, for example.

These meanings generally apply to larger businesses that hire other businesses, but insurance compliance is a necessity for companies that get hired, as well. Subcontractors, specialists, independent vendors: all of these kinds of companies regularly have to check to see if they’re compliant with the standards the hiring company insists on as a condition of employment.

Regardless of which specific track of insurance compliance you’re currently pursuing, know that it is important, even critical work for your company. There are few more unanticipated and sometimes destructive unexpected expenses than insurance claims your company should never have been liable for. We’ve seen such claims put companies behind by years or more, or even shove them out of business altogether.

No one wants that to be their company. That’s just one of the reasons so many companies trust myCOI to help them avoid that risk. We can help you, too.