Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

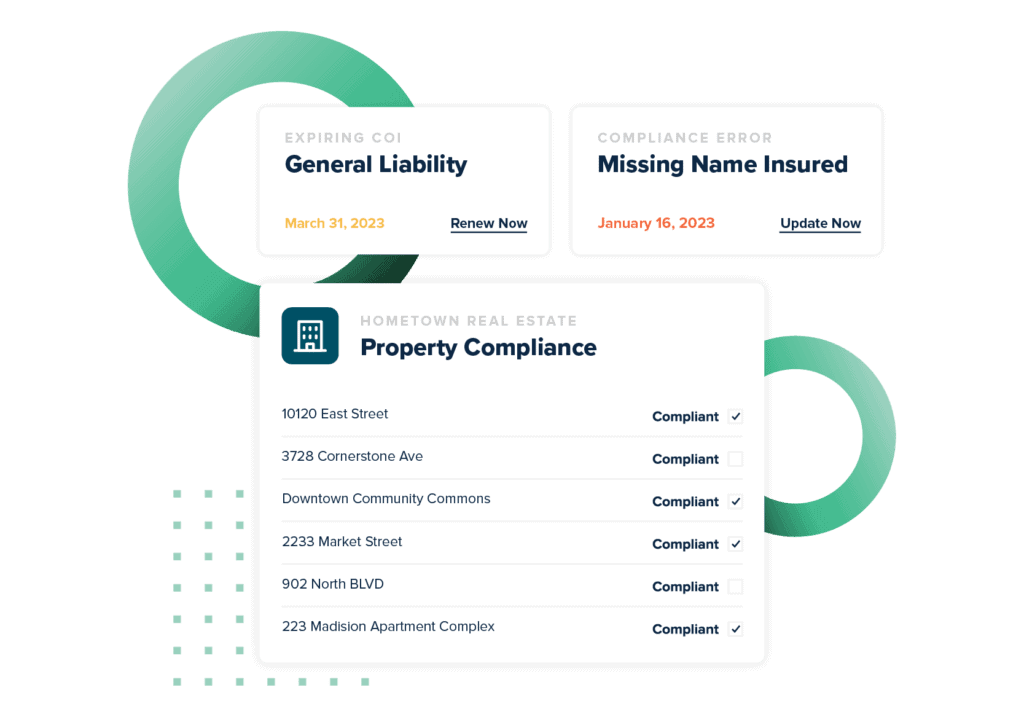

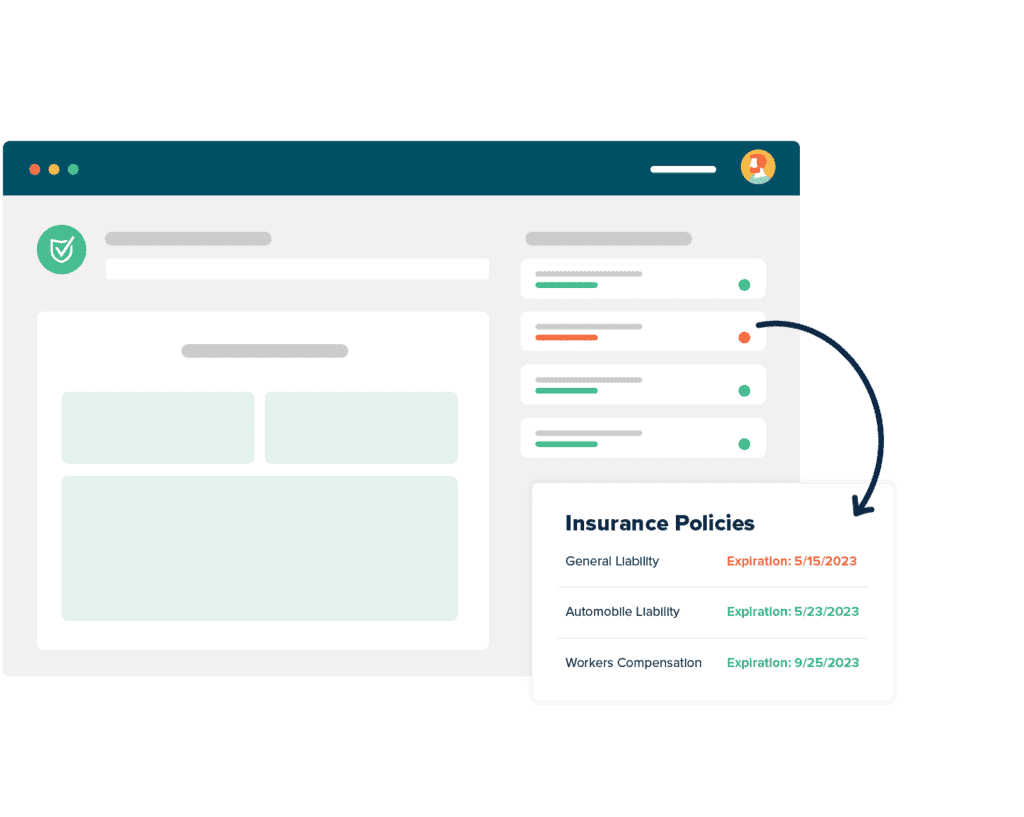

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, manage certificates and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesCertificate Of Insurance Management Software

Certificate of insurance management is one of the most important tasks your risk management team undertakes, and that importance only scales up as the number of COIs you need to track goes up. At myCOI, we’re devoted to erasing the worry of certificate of insurance tracking, by using our industry-leading insurance tracking software and services to make sure your COIs are compliant when you accept them and across the lifetime of your contract with your third-party.

There are other solutions, of course. More companies enter the online certificate tracking space every year. And many of them may be the right choice for your business, but myCOI has spent more than a decade ensuring that we’re the right choice for almost any company. We offer the best technology backed up by the very best team of insurance professionals.

And no one—no one—cares more than we do.

If you’re comparing a couple of COI management solutions against each other, pay attention to things like this:

- Can the solution help you with certificate of insurance issues and answer insurance compliance management questions?

- Can it read both typed and handwritten COIs?

- Is it backed by a team of insurance professionals, or are you putting all of your faith (and your risk) in a machine?

- Does it meet all the individual needs you have for your business and your compliance team?

Take demos from all of them. Go in with a list of questions. And don’t leave that demo until you have your questions answered.

Certificate Of Insurance (COI)

A certificate of insurance (COI) is a document you or your subcontractor provide to others that confirms and specifies the liability insurance coverage you carry for your business, or that your business carries on your behalf. In many cases it is a document required by a business that seeks to hire you to perform services, or if you lease space for your business.

At myCOI we sometimes hear people ask “what is a certificate of insurance,” too, so if you have to ask, don’t feel bad. It’s not a common document unless you need it. But when it is needed, it’s critical.

In construction or commercial real estate, time is precious. Projects have timelines, leases have end dates, and whether it’s a crew sitting idle, a building with no roof, or an empty commercial rental space, neither you nor your other stakeholders can afford to wait too long on paperwork. That’s one of the reasons certificates of insurance best practices often include keeping a copy of certificate of insurance documents within easy reach.

myCOI offers the industry-leading certificate of insurance tracking solution, in a self-service SaaS solution as well as a concierge, managed service solution. We pioneered the COI tracking industry, you might say. And our team of insurance specialists, coupled with our commitment to customer service, makes us unmatched. Companies who have us tracking their certificates now know they have a trusted partner looking out for their interests.

Tracking certificates of insurance can quickly get out of hand. We hear it over and over again from our clients. “We just weren’t successful in collecting and maintaining tenant insurance certificates,” one senior property manager told us. “Things were slipping through the cracks, and expensive claims they should have been protected against were coming in.”

It’s not just the number of certificates of insurance that gets away from business, though that is sometimes a factor. Each of those certificates needs to be verified, tracked and monitored to ensure that the third party stays in compliance.

Certificate Tracking

Certificate tracking is a necessity for any company that hires third parties such as contractors or vendors, and knowing how to track certificates of insurance for your company is a critical skill for any risk management team member, whether you use an app or not. A certificate of insurance tracking app is a type of software program that allows businesses to track certificates of insurance for their company.

One of the most common mistakes that businesses make is not keeping accurate records of certificates of insurance. This puts them at risk for fines and penalties if they do not have up-to-date documentation on hand when requested by a third party, such as an attorney or law enforcement officer. In addition to having legal consequences, failing to keep track of your company’s certificates could lead to financial losses. It also increases the likelihood of liability lawsuits filed against your business. Choosing a solid COI tracking solution that moves you past using a certificate of insurance tracking template or some other insurance policy tracking software is just smart business.

There are many benefits associated with using certificate tracking software that can help you avoid all these pitfalls: saving time, decreasing errors due to paperwork being misplaced or lost, saving money from avoiding fees tied into other solutions. Many of these solutions often allow you to request a certificate of insurance online.

If you’re just getting started and looking for a certificate of insurance tracking template Excel can be a decent stopgap solution, but you don’t want to stay there very long.

Certificates Of Insurance Best Practices

Let’s look at certificate of insurance best practices from two points of view: a company that handles receiving COIs, who we’ll call the certificate holder, and the company (or person, in sole proprietorships) who is being hired, who we’ll call the insured.

Both of these groups have reasons to look for a certificate of insurance online, or to review a certificate of insurance PDF, but for different reasons. And both groups should be careful that they only look at reputable sources, like ACORD, for example.

If you are (or are going to be) a certificate holder, it’s important before you receive your first COI that you know what your company’s minimum requirements are with regard to coverages. Whether a blanket corporate policy or custom per-job requirements, know what you need to check the incoming certificates for. Once you have that, your job becomes first ensuring that minimum requirements are met, and then looking deeper to track and, where necessary, verify coverage.

If you’re an insured, and you’re going to be providing COIs to a hiring company, you need to know your COI accurately represents the coverage you carry. The absolute first and best place to get an accurate COI is your insurance agent or broker. They can issue the certifcation that you carry that coverage as of that date, and sometimes even provide it directly to the requesting company.

The very last thing you should ever be doing as an insured, however, is filling out your own COI. That’s your agent’s job, full stop. Creating or editing your own COI just makes you look dishonest.

Free COI Tracking Software

Running a business is expensive, and sometimes the last thing you want to add is another expense, even when you have a need. We can’t tell you how many times we’ve heard companies tell us that they were doing their best: they knew about COI tracking software, but the budget was just too tight, so they did it with a certificate of insurance tracking spreadsheet or a free COI tracking software. For a while, they did okay.

But their compliance percentage slipped down a little every month, as their business grew and more and more certificates were received. Each of those certificates had to be tracked and verified. Each month, more certificates than the last.

At a certain point, the amount of unnecessary risk they were assuming got to be too much, and they had to look for a more professional solution. Sometimes it’s because their risk management team or general counsel audits and realizes the exposure. Sometimes a new hire discovers a distressing reality that had gone unnoticed.

Unfortunately, sometimes it’s because the company just had to pay a damaging claim that they should have been covered for.

Free COI tracking software is not inherently bad, and almost no one sets out to make bad software. And as an insurance tracker Excel isn’t completely useless. But it takes a dedication to customer service, a mission to erase worry, and a team of insurance professionals like the one we’ve assembled at myCOI to make sure your company is doing all it needs to with its certificates of insurance.

How To Track Certificates Of Insurance

Knowing how to track certificates of insurance, and the skills, practices, and tricks that make it less consuming, are what make great risk managers. Of course, at myCOI we believe the absolute best way to track COIs is to partner with us, but we also acknowledge that there are companies that are a bad fit for our service.

Here are a couple of qualifying questions you can ask yourself or your team to find out the lay of the land with regard to compliance:

- What is our current compliance rating, and are we satisfied with that?

Compliance rating is the percentage of hired contractors, vendors, or other third-parties who are compliant with your insurance requirements. If only half of them are compliant, then your compliance rating is 50 percent. If your company isn’t satisfied with its current rating, there’s work to be done. - What is our current method for ensuring good compliance?

Do you require your bid process to include COI compliance? Do you only check compliance on the bid winner? Do you ask for and verify compliance before you allow an insured to begin work? Do you hold payment for insureds who fall out of compliance during the job time? All of these questions affect not only your compliance rating, but also how much time it will take to rectify the issues. Knowing how to get insurance certificate online, for example, can save you a lot of back-and-forth with your insureds. - Is your current tracking method a spreadsheet, basic insurance software, or a dedicated COI tracking solution?

Each of those solutions have good points and bad, but I think by now you probably realize that your exposure to insurance risk, and the potential hours of work saved, probably make a dedicated COI tracking solution like myCOI a smart choice.

Answering these questions, or even just making sure you routinely challenge the assumptions under which your compliance and risk management decisions are made, can often pay dividends down the road.

Certificate Of Insurance For Small Business

The needs for a certificate of insurance for small business operators are the same as any other business. If your small business is hiring subcontractors, you will want to collect certificates of insurance for subcontractors you hire. Any contractor who will be working in or around your business premises should be providing you with proof that they carry the coverage you demand of them to ensure you’re not assuming liability for risk that they cause.

Sometimes small business owners consider not securing certificates of insurance because they’re concerned about costs, but this isn’t a valid concern. Any certificate of insurance cost is borne by the insured, but that cost should be zero. There have been some cases of insurers requiring fees to replace certificates of insurance, but almost every agent or broker will provide these at no cost.

We’ve also seen small business owners who aren’t sure which vendors need a certificate of insurance; the answer to that is, all of them need to provide you with one, if they’re doing work for you. Failing to gather these COIs puts your liability risk in jeopardy. If you’re unsure of how to request a certificate of insurance from a vendor, there are plenty of templates online.

On the other end of the spectrum, if you’re a small business owner wondering how you gain certificates of insurance for your own small business insurance, the process is the same. Speak to your agent or broker or see if you can request the necessary certificates online from their website.