Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

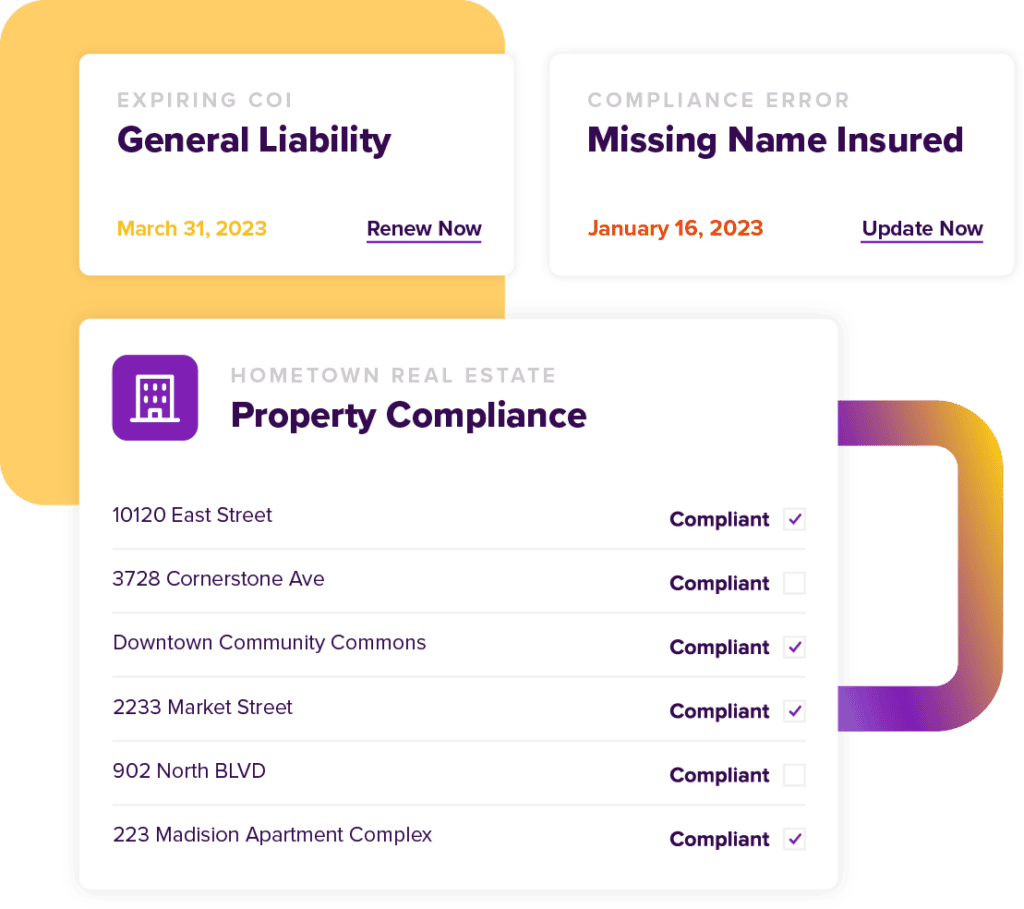

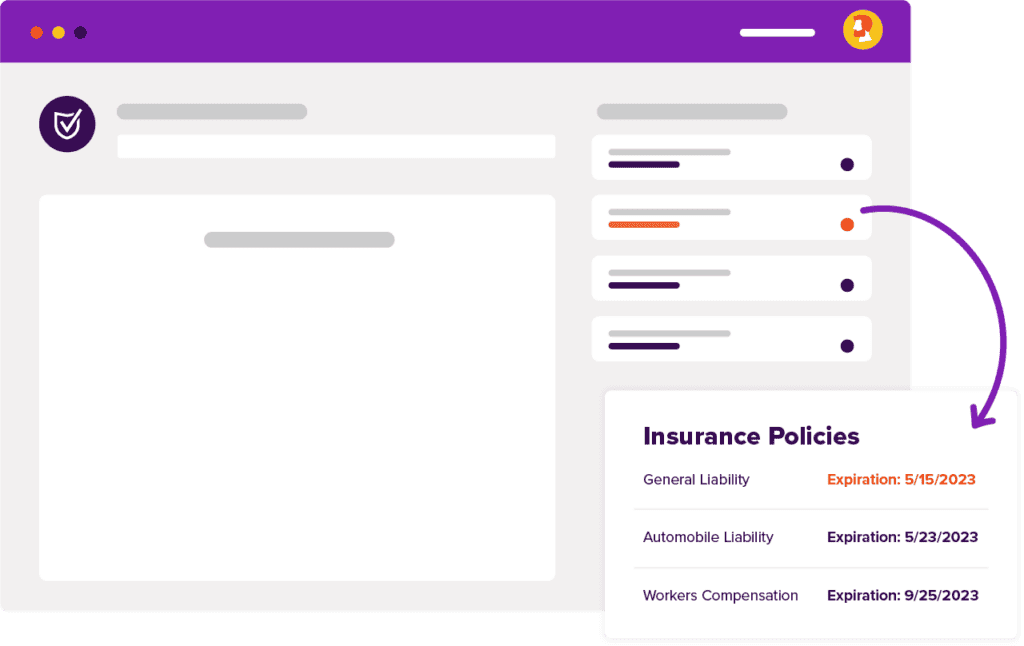

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesCertificates Of Insurance Best Practices

At myCOI we erase the worry businesses have about noncompliant certificates of insurance (COIs) because we know our industry-leading technology and unmatched professional insurance staff make us the best choice for any company dealing with hundreds or thousands of certificates. We know, from experience helping hundreds of companies succeed, what certificates of insurance best practices are.

There’s a wide breadth of familiarity with certificates of insurance. New subcontractors, for instance, might be asking us “where do I get a certificate of insurance”, moments before we heard “when do you need a certificate of insurance from a vendor?” from brand-new risk managers or compliance admins.

The answers, by the way, are from your agent or broker, and before the vendor starts any work.

There’s a lot of complexity in certificate of insurance tracking and management. Knowing where to find certificates online, knowing how to request a certificate of insurance from a vendor, these are just the starting points. You also need to know your company’s requirements around insurance coverage, so you can confirm that the COIs you receive actually claim the coverage you need to see to let the vendor begin work. You need to know what each box of the certificate of insurance form is for, and what the numbers mean. You need to know the difference between a certificate holder and an additional insured, and perhaps dozens more differences depending on your company’s requirements as well as the state and local insurance requirements.

It’s a complicated job, and every COI you accept that is noncompliant can open your business to the potential for significant risk. You don’t want to have to explain why your company is liable for a claim that should rightfully lay with the vendor. Trust us. We hear these horror stories all too often.

Let’s take a look at some additional best practices. With any luck, you’ll find the insights you need to better protect your business from insurance risk.

How To Organize Certificates Of Insurance

Knowing how to organize certificates of insurance for tracking is a necessity for any company that hires third parties such as contractors or vendors. A certificate of insurance tracking solution allows businesses to track certificates of insurance. Otherwise, you’re going to find yourself asking “I have all these certificates now what?” Depending on your company’s unique requirements, as well as the varied certificate of insurance requirements by state, will inform your choice of organizing method.

One of the most common mistakes that businesses make is not keeping accurate records of certificates of insurance. This puts them at risk for fines and penalties if they do not have up-to-date documentation on hand when requested by a third party, such as an attorney. In addition to having legal consequences, failing to keep track of your company’s certificates could lead to financial losses. It also increases the likelihood of liability lawsuits filed against your business. Knowing who needs to provide a certificate of insurance is one of the core components of risk management. You request certificates of insurance for subcontractors—all of them—who want to work for you; you should know whether they’re compliant or not!

And if you’re asking “when do you need a certificate of insurance from a vendor?” The answer is before the work starts. Every time. Anything else opens you to incredible risk. Certificates of insurance issues and answers are easily one of top priorities your risk team should tackle, because so much rides on managing the coverage provided by your third party’s insurance policies.

Certificate Of Insurance Tracking Template Excel

If you’re looking for a simple and manual way to track the certificates of insurance in your business, then using a COI tracking spreadsheet is an option worth considering. Many companies begin by having their staff track insurance policies on Excel spreadsheets. For basic certificate of insurance tracking spreadsheets are not a bad solution, but as a full-function insurance tracker Excel has limitations.

Many companies find spreadsheets a good training tool; for a certificate of insurance tracking template Excel has several basic templates that can be customized to what you need, but most companies scale past this very quickly. Other companies attempt to use simple software to track expiration dates, but the lack of additional functionality can cripple them.

The drawbacks of using an Excel insurance tracker are that it can be time-consuming to maintain and often require constant updating. What began as a simple project one person could track and easily snowball into a time-intensive process that’s impossible to scale as a company grows. Instead, companies might add more people and more spreadsheets, which leads to paperwork being lost or misplaced, which leads to increased chances for errors in the data.

That is exactly the worry that myCOI erases. Our systems are industry-leading. Our insurance professionals are top-notch. If you’re tracking hundreds of certificates of insurance, we’d love the chance to show you just how much time and effort we can save you.

Blanket Additional Insured Wording On Certificate Of Insurance

Investopedia defines blanket additional insured wording on certificate of insurance as “an insurance policy endorsement that automatically provides coverage to any party to which the named insured is contractually required to provide coverage. A blanket additional insured endorsement is most commonly found in liability insurance policies, though it is typically not a feature of the policy language.” Quite often, people choose blanket endorsements because they work with so many companies that securing individual endorsements is too time and effort-consuming to be practical. The types of additional insured endorsements have specific values to both insureds and certificate holders.

Like a named additional insured endorsement, a blanket additional insured endorsement extends the insured’s policy protection to another party. However, many insurers stipulate additional requirements for entities to qualify for blanket endorsement, the most common of which is that the two parties have a business contract in place.

If you want to see what these endorsements look like, search online for blanket additional insured endorsement example or blanket additional insured endorsement form sample. You should be able to find quite a few PDFs for your state or industry to give you a good general direction of what to look for.

Deciding whether your business can accept a blanket endorsement vs specific endorsements is a question for your counsel or your risk management group. There are pros and cons to each, and in many cases certificate holders often stipulate that a specific endorsement is required, so that there’s no danger of claim denial.

Also, remember that additional insured endorsements are different from things like a blanket waiver of subrogation; subrogation refers to the practice of recovering losses incurred from claims from other related parties.

Business Insurance

Business insurance is one of the most important parts of any business. That’s a bold statement, but we believe it. According to Investopedia, business insurance “protects businesses from losses due to events that may occur during the normal course of business.” They go on to mention several types of business insurance “including coverage for property damage, legal liability and employee-related risks.”

Now, obviously, anyone can look up a business insurance definition and recite it for you, but take another look at those sentences. Losses due to events during the normal course of business is a pretty broad phrase, sure, but look at the details: property damage. Legal liability. Employee-related risks.

What doesn’t fall into employee-related risks? Not a whole lot.

Broadly, there are two classes that we hear about most often. The first is commercial business insurance, which is kind of a catchall phrase that includes most specialty forms of business insurance such as general liability insurance, commercial vehicle insurance, or even professional business insurance. These policies protect businesses against specific types or risks, carry unique premiums and limitations, and are often the most-negotiated items on certificates of insurance when one company is being hired by the other.

Business Insurance For Small Business

One of the most common issues we hear about around business insurance for small business is either evidence of, or worry about, fake business insurance certificates. Erasing this fear is one of our core missions at myCOI and one we fight every day on behalf of our clients with our certificate verification programs.

Like any document, a certificate of insurance can be forged. In most cases, the forgery is obvious: handwritten rather than printed, sometimes in inks of different colors, different font types, or an obvious cut-and-paste photocopy. Any of these should be triggers for your compliance team to reach out to the producer or agent and confirm the coverage presented on the suspect certificate.

Any certificate, even certificates of insurance for subcontractors who have previously done work for you, should be reviewed first for accuracy in coverage, but also verified with the producer or agent to ensure the coverage presented is still accurate.

Everyone in small business insurance recognizes the critical need for good insurance risk management. Every business is unique, though, and that’s where the very many ways of tracking certificates of insurance come in.