Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesConstruction Insurance Certificate Tracking Tools

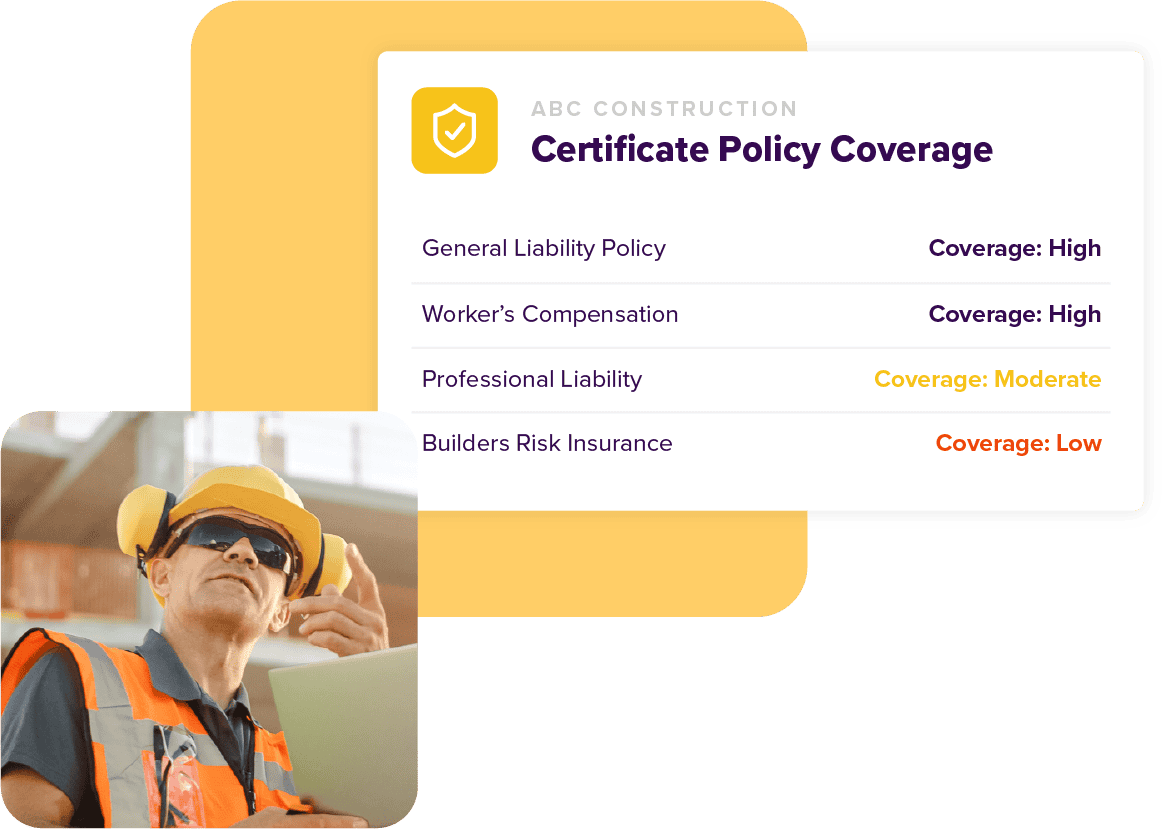

Large construction companies and big general contractor firms: these are the industries with the direst need for construction insurance certificate tracking tools. The sheer number of individual subcontractors, contracting businesses, specialist vendors, and other third parties they must bring to every job site opens them to staggering risk liabilities if they do not properly require, track, verify and confirm certificates of insurance and the coverage reported on them. Each certificate of insurance has the potential to help or hurt the receiving company’s compliance rating.

There are any number of certificates of insurance issues and answers we can explore to make sure your company is able to make the best decision possible. The method you choose to track your certificates, how rigorous your compliance standards are, even knowing the best method to secure the construction insurance certificates you need play a part.

Let’s take a look.

Track Certificates Of Insurance

The competition in the certificate of insurance tracking software space is fierce, and we’d be being dishonest if we didn’t say you need to choose the right solution for your company. Obviously, at myCOI we believe we are the right solution nine times out of ten, but we don’t fit every company, and that’s okay. Knowing how to track certificates of insurance could be a critical part of your business no matter what solution you use, whether that’s a fully managed partner solution, myCOI competitors, or something else.

You’ll need to define what “right” means for your business. Is it the least expensive? That depends on how you measure cost. In pure dollars, a free COI tracking software may work, or even some other basic form of insurance compliance software, but is it reliable? Do its developers offer support? Are there regular product updates coming out? If not, check it carefully to make sure it isn’t out of date.

Is “right” the least of your precious person-hours consumed by tracking certificates of insurance? Then a managed solution like myCOI offers may be best. Our team of insurance professionals know what they’re looking at, and they’re experts in making sure your certificates are promising what they say they do, that they meet your business requirements for coverage, and our quarterly verification makes sure the coverage stays in effect.

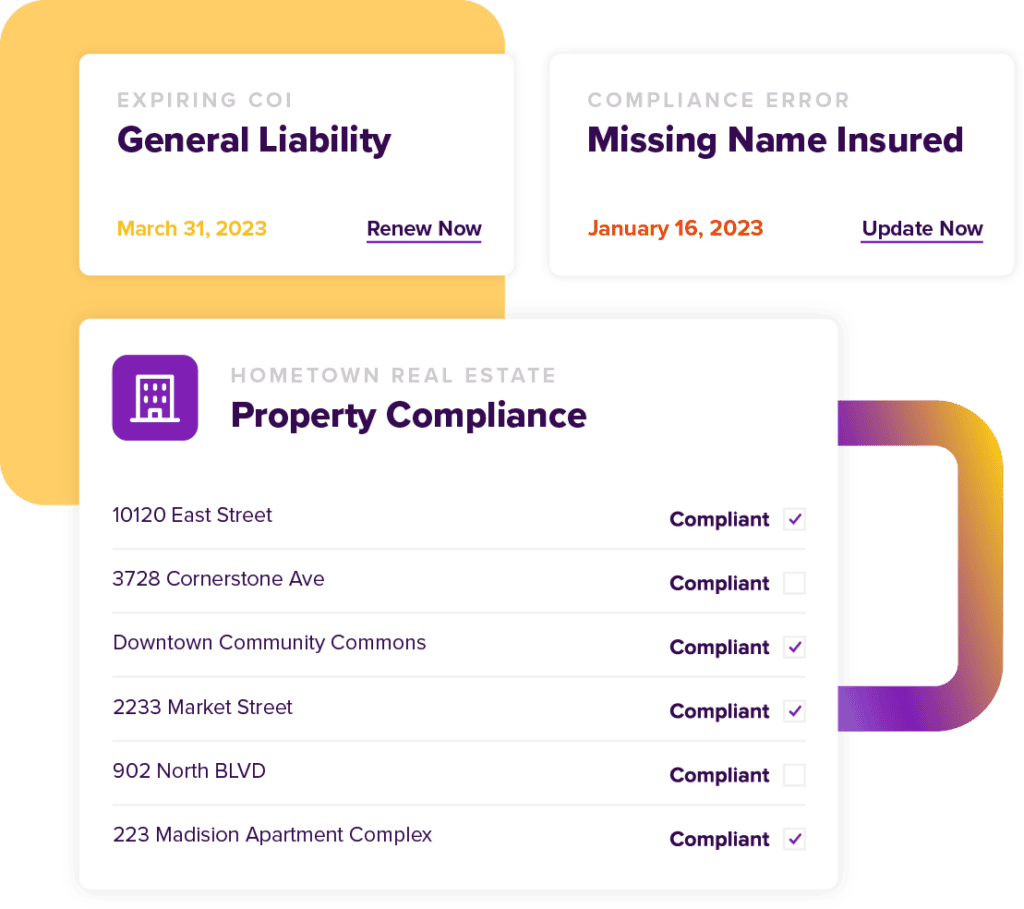

Certificate Of Insurance Compliance

Certificate of insurance compliance is the work a risk manager or compliance admin does to collect, verify and maintain the certificates of insurance provided to that company by its third parties. Almost anyone a business hires to do work on its behalf can be asked to provide some form of proof of insurance. And on the face of it, that sounds like a pretty easy ask.

Collect a piece of paper? A standardized form? And store it? Easy-peasy.

Except each certificate of insurance has to be checked, first and foremost to ensure that it claims all the necessary coverages, amounts, limits, and exclusions that your company requires of its contractors. Sure, there is general liability insurance mentioned, but does it protect to the same amount that you require?

Also, what assurances do you have that the contractor didn’t let the policy lapse the day after they handed you the COI? Are you verifying with insurance agents that these contractors still hold the policies and protections that their COI claims? Are there exclusions to the contractor’s protection that will mean you’re held responsible for risk that should properly rest with the contractor? Are you sure your third party didn’t just download a sample certificate of insurance, fill it out, and give it to you?

Remember that there are varied certificate of insurance requirements by state, and you need to be aware of them. Certificate of insurance best practices in every case remind you to check your state requirements, and we’d be remiss if we didn’t do the same.

COI Tracking Spreadsheet

If you’re looking for a simple and manual way to track the certificates of insurance in your construction business, then using a COI tracking spreadsheet is an option worth considering. Many companies begin by having their staff track insurance policies on Excel spreadsheets. And for smaller companies just starting out, that system works. For basic certificate of insurance tracking spreadsheets are not a bad solution.

Many companies find spreadsheets a good training tool; for a certificate of insurance tracking template Excel has several basic templates that can be customized to what you need, but most companies scale past this very quickly.

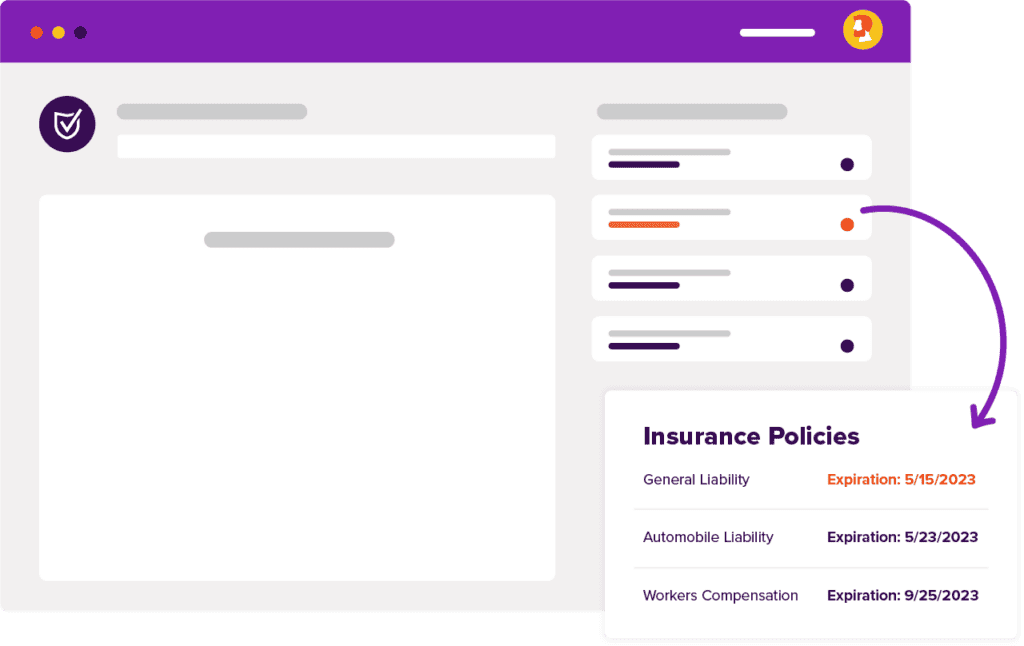

The drawbacks of using an Excel insurance tracker are that they can be time-consuming to maintain and often require constant updating. What began as a simple project one person could track and easily snowball into a time-intensive process that’s impossible to scale as a company grows. Instead, companies might add more people and more spreadsheets, which leads to paperwork being lost or misplaced, which leads to increased chances for errors in the data.

That is exactly the worry that myCOI erases. Our systems are industry-leading. Our insurance professionals are top-notch. If you’re tracking hundreds of certificates of insurance, we’d love the chance to show you just how much time and effort we can save you.

Insurance Certificate Issuance Software

Insurance certificate issuance software is not something non-insurance companies typically have to worry about. The insurance company is responsible for issuing certificates of insurance to the company. If you’re an owner or manager, it’s crucial that you know what your responsibilities are and how those differ from someone in this role at another firm. Whether it comes down to handling employee-related matters or discussing business strategy with clients, a basic understanding of these roles will go a long way when forging relationships within your industry.

Sometimes people mention certificates of issuance, but that’s a different certificate. These testify to the issuance of certificates for things like bar codes or identification numbers. As it sounds, it’s a certificate of issuance meaning it certifies that something was issued.

Instead of wasting time asking “what is certificate of issuance?” focus on tracking your own certificates of insurance. With a COI tracking application, you’ll never need to worry about tedious paperwork again. You can also make sure that your records are always up-to-date thanks to automated updates from vendors.

How To Request A Certificate Of Insurance From A Vendor

If you’re a contractor or business asking “which vendors need a certificate of insurance?” the answer is pretty simple: any vendor that enters your business premises and takes any actions that may generate any risk at all needs to give you a certificate of insurance.

That sounds pretty vague, we know, but it’s a simple reality. Risk exists all around us, whether we generate it or not, and the last thing you want to do is assume the burden of risk your vendor opened you to because you failed to secure a certificate of insurance.

Now you may ask “what is a certificate of insurance for vendors?” and the answer is, the same thing you provide to other entities that you do work on behalf of. It should show the vendor’s coverage, any limitations or exclusions, and all the usual information.

Knowing how to request a certificate of insurance from a vendor likely comes down to how your business works with vendors. In many cases, COIs with the required coverages are required as part of the vendor application process or were specified in the RFP, or in an agreement or contract. If not, it’s often a requirement before the vendor can begin working.

If you deal with a lot of vendors, you can often save a lot of time by having a sample letter requesting certificate of insurance from vendors on hand.

How To Organize Certificates Of Insurance

Knowing how to organize certificates of insurance for tracking is a necessity for any company that hires third parties such as contractors or vendors. A certificate of insurance tracking solution allows businesses to track certificates of insurance. Otherwise, you’re going to find yourself asking “I have all these certificates now what?” Depending on your company’s unique requirements, as well as the varied certificate of insurance requirements by state, will inform your choice of organizing method.

One of the most common mistakes that businesses make is not keeping accurate records of certificates of insurance. This puts them at risk for fines and penalties if they do not have up-to-date documentation on hand when requested by a third party, such as an attorney. In addition to having legal consequences, failing to keep track of your company’s certificates could lead to financial losses. It also increases the likelihood of liability lawsuits filed against your business. Knowing who needs to provide a certificate of insurance is one of the core components of risk management. You request certificates of insurance for subcontractors—all of them—who want to work for you; you should know whether they’re compliant or not!

And if you’re asking “when do you need a certificate of insurance from a vendor?” The answer is before the work starts. Every time. Anything else opens you to incredible risk.