Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

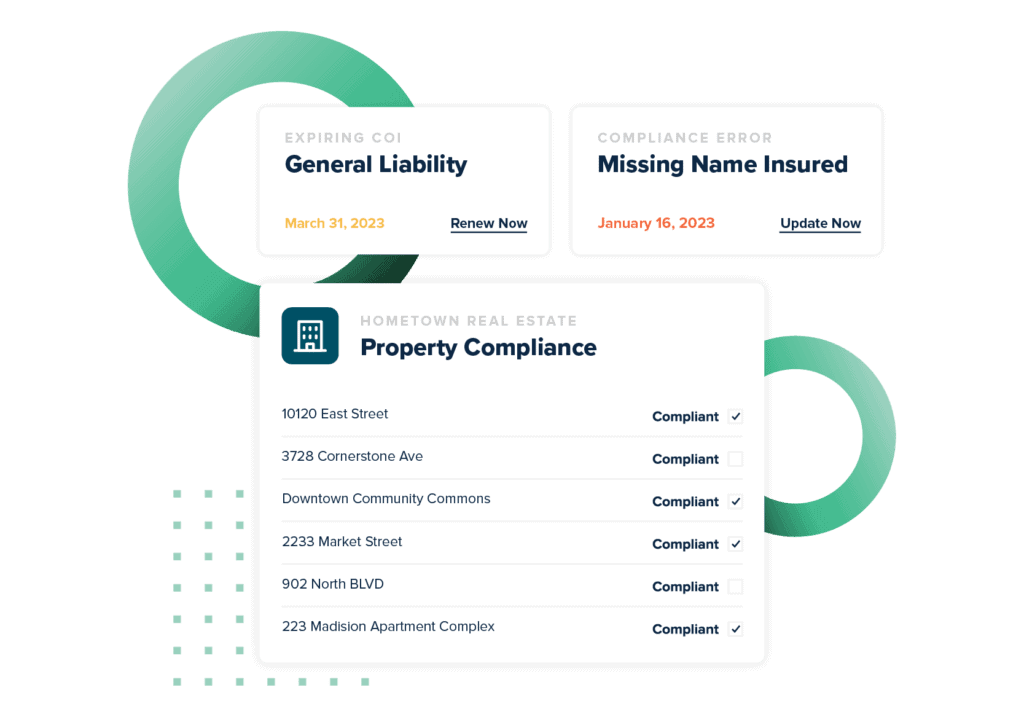

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesGeneral Contractor Insurance Requirements

General contractor insurance requirements are as diverse as the companies themselves. Residential contractor insurance requirements can be quite different, for example, from the necessary business automobile insurance required of delivery companies. Even asking a basic question like “what is general contractor insurance” means you’re going to get an answer that starts with “it depends.”

Because there isn’t just one answer.

And it only gets more complicated when you add in subcontractors. What if subcontractor does not have insurance? Is your coverage up to being extended to cover them, as well? Should it?

These are all the kinds of questions you need to lock down with your risk team or counsel. Let’s look at some more examples.

Sample Insurance Requirements In Contracts

Depending on your industry and your company’s specific insurance needs, the sample insurance requirements in contracts can be critical. Sample insurance clauses in commercial contracts, for example, might be drastically different from the sample insurance requirements for vendors in another state or even on another job site. Let’s take a look at just one example.

There is a great deal of importance in the specific insurance requirements in contracts, perhaps none as important as the certificate of insurance additional insured wording. It can often be the deciding factor between whether a company is held liable for a specific claim or not.

Let’s look at this example IRMI provides:

A project owner may enter into a contract with a general contractor that obligates the general contractor and all subcontractors to name the owner as an additional insured on their general liability policies. Even if the general contractor, in turn, requires the subcontractors to name the owner as an additional insured and the subcontractors procure policies containing blanket additional insured endorsements, it is not always clear that the subcontractor’s insurer will be obligated to provide additional insured coverage to the owner due to the absence of a direct contract between those parties.

There is a growing distance between being listed as additional insured and being endorsed as an additional insured, and states and courts have been ruling on this difference in different ways. You need to make sure your counsel or your risk management team clearly understands the precedents in your state, if you receive additional insured wording on certificate of insurance.

And if you’re a company that often receives requests for additional insured endorsement wording, make sure your requestors are making what they require very clear, because again: there is a difference between being listed as an additional insured and being endorsed as one. You’ll want to work with your insurer to make sure you understand the costs and impacts of each of those scenarios, so you know what your business can accept during the negotiation process.

Are Subcontractors Covered Under Contractors Insurance

If you’re a subcontractor, or you hire subcontractors and have to track the certificates of insurance you receive from them, you may see a few oddities. Depending on what state you’re working in, minimum subcontractor insurance requirements may sometimes lack evidence of workers’ compensation coverage. This is because several states do not require workers’ compensation coverage for what are called sole proprietorships, where the individual worker is the only employee of their one-person company. If you’re unsure whether or not there should be a workers comp policy by statute, consult with your state’s workers compensation board.

Even in states where it is not legally required, however, many companies that hire subcontractors still require the coverage as a necessity for employment. In that case, the subcontractor insurance requirements will show the minimum necessary coverage required by the hiring entity.

What’s fun about these one-person plans is that often they’re what are called ghost policies: they are workers’ compensation plans, but they have exclusions disallowing coverage for the single employee. They allow subcontractors to satisfy the requirement of needing workers’ compensation, but since they are excluded, the coverage only covers a ghost.

Or in reality, no one.

These policies are one of the prime ways in which small subcontractor insurance costs are managed, but you can and should see if your company has subcontractor agreement insurance requirements above and beyond the state requirements.

General Contractor Insurance Coverage

Answering the question “who sells the best general contractor insurance?” is as easy as naming off all the top insurance providers. Almost every insurer will offer this kind of protection, though some vary whether they offer it nationally or locally. General contractors insurance coverage is one of the most common forms of insurance.

You should check locally first, however, when you’re figuring out what kind of insurance do general contractors need. Or local to the area that you’ll be working, if you live near a state border and often work across the border. States require different types and levels of general contractor insurance requirements from businesses and contractors. It’s just good practice to check with the states you’ll be operating in; it’s not that uncommon, for example, for one state to require coverage that another state waives.

Putting in phrases like “general liability insurance for contractors near me” or “general liability insurance for contractors in texas” (if you live or work in Texas) is going to get you a list of the who’s-who of insurance providers. You’ll likely see names like GEICO, the Hartford, Next Insurance, or Hiscox Insurance in the top results.

Take the time to look at your local results, though. Dealing face to face with a local agent may provide you with a better experience than you’ll get filling out a faceless form on the internet. In the end, the best insurance companies for general contractors are the ones that can serve your unique requirements.

What Kind Of Insurance Do General Contractors Need

General contractor insurance requirements vary, like most insurance standards, very much from state to state, and depend very much on the structure of your business. Are you the sole proprietor of a one-person business? You’ll likely need less coverage than a contracting company that employs hundreds of contractors. It’s likely that your counsel or risk team already has a list of insurance requirements for construction projects, which will help you get started.

Remember also that regulatory requirements can sometimes vary greatly from state to state; don’t be afraid to go to Google and look for things like “general contractor insurance Washington state,” for example, if you’re based in Oregon but have a job coming up across state lines.

Think—and talk to your insurer—about the details of your business, too. Does your business own vehicles? You’re probably going to need to have some form of commercial auto insurance, which is going to add its own rules and premiums.

Do you have an office? Your landlord will almost certainly have requirements about the kind of coverage you need to protect that office or industrial space. Again: talk to your insurer, and check the laws and regulations in your state.

If you have employees, you’re almost certainly going to need to carry workers compensation insurance. The best general contractor insurance agencies can probably help you gain coverage for all of these kinds of insurance, but ultimately the responsibility lies with you.

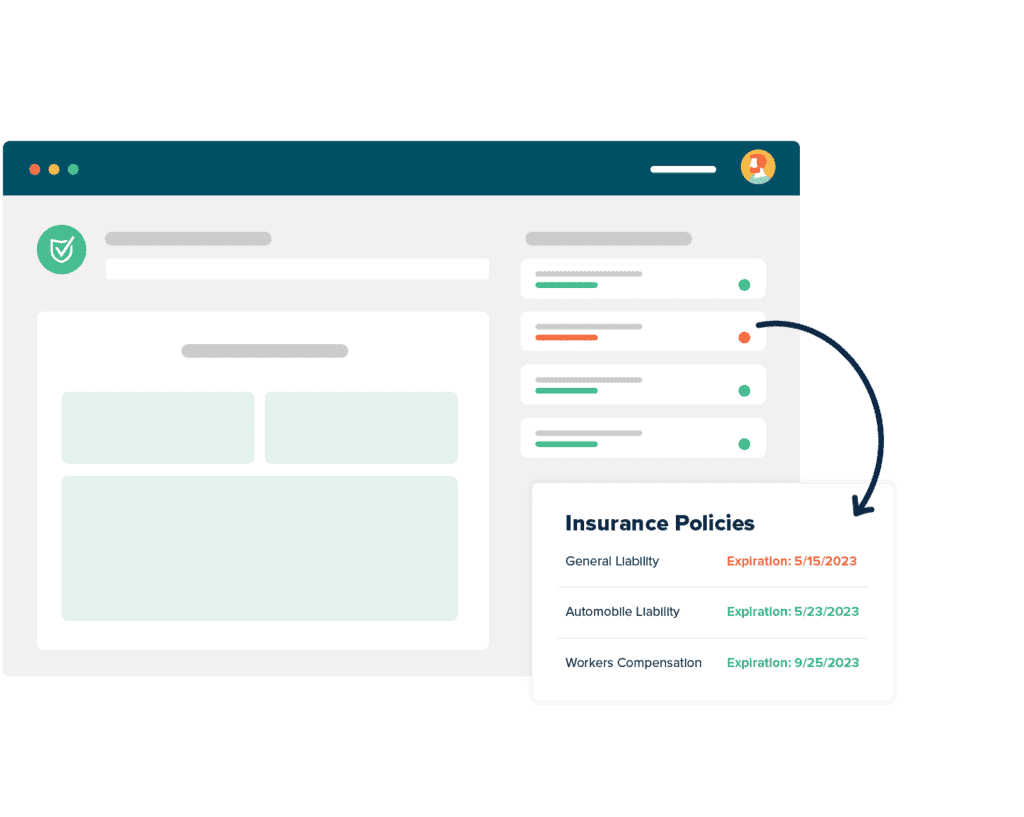

And if you’re contracting third parties, you need to take extra care with your certificates of insurance. It’s not enough to just collect them. You need to make sure they’re valid, that they carry the coverages you require, and that you have a way to track and verify them.

myCOI can help with that.

Insurance Requirements For Construction Projects

Insurance requirements for construction projects are a broad category, and it’s important that you figure out exactly where your company, project and required insurance fit into it. Construction project insurance is absolutely necessary, and not to be ignored or underestimated.

Remember, the details of the project and the people involved will dictate the kinds of coverage required. Building construction insurance requirements can cover a lot, but it doesn’t cover everything. There are hundreds of guides to insurance for construction managers, don’t worry. It’s just a matter of selecting the correct one.

Your insurer is the best source of information about what kinds of coverage you might need. If you’re a contractor, you’ll also want to check with the business hiring you, to see what their standards are. And if you do different kinds of work for that company, make certain you check to see if the standards of coverage are different between projects!

Construction insurance coverage could be builder’s risk insurance or simple general liability insurance. Remember that it may include commercial auto insurance or even inland marine insurance for larger equipment. Don’t let the name fool you; inland marine covers more than just things that float! Finding insurance for construction company projects can be time-consuming, but absolutely necessary.

Knowing what protections you need, and which are required of you by a contracting entity, is just part of the job. You can usually find construction insurance requirements in contracts.

General Contractor Insurance Cost

What your construction liability insurance costs depends entirely on the size of your company, the kind of work you do, what your contracting company requires in the way of coverage, and who your insurer is. There isn’t a handy independent contractor insurance cost for contractors table, or a wall-mounted poster of subcontractor insurance costs.

Because insurance is the coverage of risk, your insurer will set their rates based on the variables of your company. A company with more employees has a greater potential risk than a company with one employee, just as a company that works indoors in a controlled environment carries less risk (usually) than a company whose employees work outside on highrise buildings

One item to consider when insuring equipment or materials is the replacement cost of tools or materials. But if you’re using highly specialized equipment to work with rare or expensive materials, the cost of your risk is going to be higher.

Companies that hire you to work don’t want to assume that risk. That’s why they insist on certificates of insurance from contractors, so that you can shoulder the risk that you and your employees are generating. That can be a lot of risk, so be sure of your coverage before you just sign for the cheapest general contractor insurance.

One unique angle is the sole proprietorship; because they don’t have any other employees, figuring the independent contractor insurance cost becomes difficult.