Best Certificate of Insurance Tracking Software

Automate Your COI Tracking

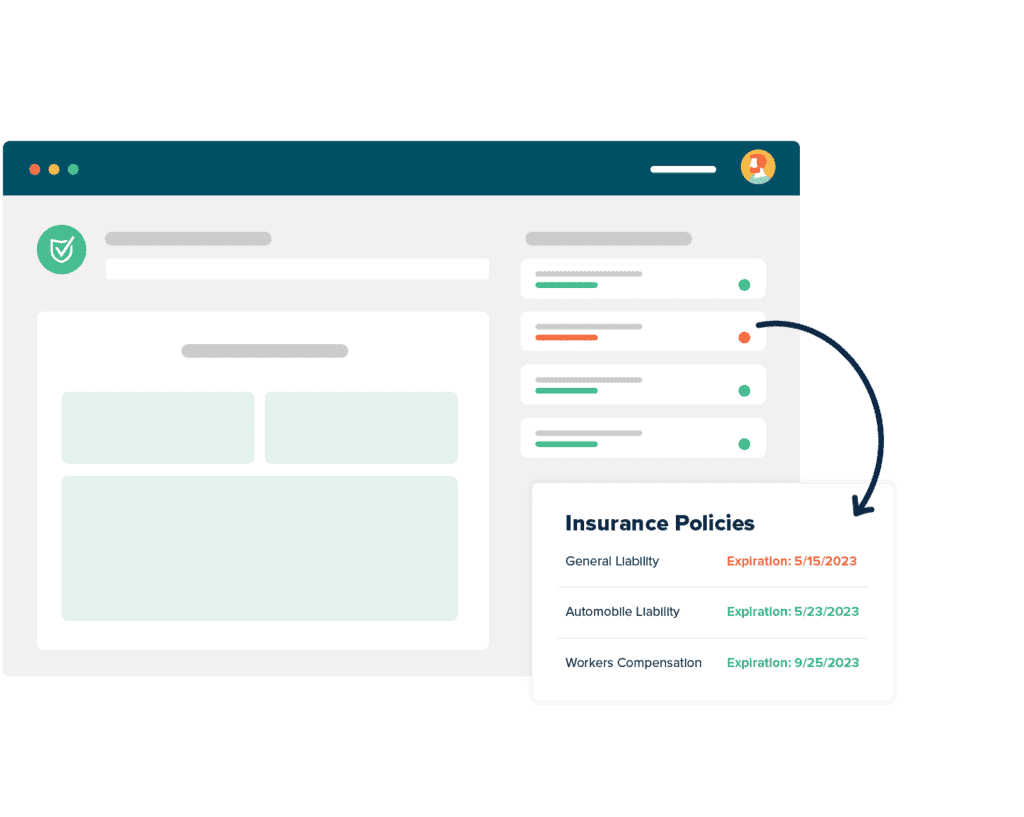

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesWhat Is Risk Transfer

No company is free from risk. Depending on the industry, some companies might only have to contend with a few liabilities. For example, marketing and consulting firms typically have fewer liabilities than construction companies. The construction industry presents more opportunities for injuries and property damage than most fields. It and other high-risk industries face the challenge of protecting themselves from the liabilities that threaten people’s health.

No company can completely eliminate its risk. Accidents happen. People make mistakes. Equipment can fail. However, companies can exert some measure of control over their losses. Companies in all industries can use risk management to help them recognize their risks and how best to handle them.

Risk management should be an essential aspect of any company. Learning about the process not only informs but can create a foundation for creating and carrying out the procedures that can help protect a company from harm.

When should project managers engage in risk management?

They should always practice risk management techniques if they want to see their projects completed on time, under budget, and without incident. Long term, they should practice risk management if they want their companies to remain solvent. The risk management process is a powerful tool to achieve many goals.

Companies can pursue 4 common risk management techniques. Risk acceptance in project management involves acknowledging the loss from risk does not justify spending resources to deal with it. Risk retention accepts a risk and its effects if it is financially feasible to do so. Risk avoidance in project management circumvents any actions that create or increase risk. Risk transfer in project management is the fourth method that many companies employ.

What is risk transfer?

This technique sees a company moving a risk to another entity.

How does risk transfer differ from risk retention? What are some types of risk transfer? Does it have any advantages and drawbacks? This article will answer all of these questions and more.

What Is Risk Transfer In Insurance

Individuals can transfer risk between themselves or, in many cases, to insurance companies.

What is risk transfer in insurance?

Of all the examples of risk transfer in project management, insurance might be the easiest method to implement. Insurance concerns transferring risk from a person to the policy issuer. The person pays a premium while the issuer assumes the risk. The basic idea applies to companies that require their subcontractors to possess sufficient coverage. These companies generally do not want to be held liable for their subcontractor’s actions should they result in bodily or property harm. Most companies can not and do not accept that responsibility. If one must list 4 advantages of transferring risk, then this might be the most significant one: companies are protected against costly claims when they transfer risk to their subcontractors and their insurance issuers.

Although insurance is the common method of risk transfer, it is not the only one. In some instances, it might not be feasible or even possible to require subcontractors to own policies, especially if a company does not hire any. Project managers and companies who assess the major risk transfer advantages and disadvantages can look at a transfer risk example to better understand the concept and decide if this method is right for them.

Risk Transfer Example

Once someone becomes familiar with the risk transfer meaning, they are one step closer to deciding whether or not that method works for them. Looking at examples of risk transfer in project management and comparing them with risk retention examples, for instance, can help companies decide what risk management technique is most suitable. Sometimes, multiple techniques can work together to best protect a company.

Perhaps the easiest to understand risk transfer example is that of insurance. Health, car, and home insurance are seemingly ingrained into the public’s consciousness. Banks usually require homeowners to insure their homes if they have a mortgage. Most states require drivers to have car insurance. Insurance is frequently advertised. Some issuers have even created catchy jingles and memorable mascots to attract consumers to their products. For these companies, insurance is their livelihood. For companies seeking to transfer risk, insurance is the most viable option.

All of this risk transfer examples business is meant to drive the importance of the concept. Risk transfer can help a company survive a potentially catastrophic claim or lawsuit. It is not the only risk management technique that can prove beneficial. Risk retention can work alongside risk transfer in some cases.

Risk Transfer Vs Risk Retention

What is risk retention?

This risk management technique is an individual or company’s decision to take responsibility for a particular risk it encounters. Instead of transferring the risk over to a third party like a subcontractor or their insurance issuer, the entity chooses to accept and pay for any losses that come from claims and litigation. They shoulder the financial burden.

What is risk retention in insurance?

A common example of risk retention in insurance is an individual or company accepting any financial losses after the payment of a deductible.

Companies that comprehend the importance of risk retention can determine which losses are acceptable and how they can minimize them. One of many risk retention examples involves companies weighing the costs of risk management against how much money those techniques can save them. If the costs of avoiding, reducing, or transferring their risks exceed the benefits of those methods, risk retention might work best.

What is risk retention in risk management? How does it differ from risk transfer? Learning the differences between risk transfer vs risk retention can help company leaders make more informed decisions about their risk management policies. Some companies might decide that they can not afford the costs of risk retention. Risk transfer examples promise a brighter future. Seeking risk transfer in insurance can be a cost-effective approach, especially in high-risk industries. However, insurance is not the only type of risk transfer.

Types Of Risk Transfer

The risk transfer insurance approach is just one of several examples of risk transfer. Other common types of risk transfer include making a subcontractor contractually responsible for the risk they create while working, hiring a security company to keep theft to a minimum, and requiring tenants to keep their commercial rental property free of trip hazards. In these cases, the risk is transferred from one entity to another. The risks of a subcontractor’s work, those associated with security work, and those that arise from unattended trip hazards are all transferred from the original entity to someone else.

The company that hired an errant subcontractor can decrease its involvement in claim situations. The same holds true for the store that hired a security outfit and the landlord who rents commercial space. The entities in these examples that accept responsibility for these risks can in turn transfer them to their insurance issuer.

Companies and project managers should also examine risk transfer advantages and disadvantages before deciding on a risk management strategy.

Advantages Of Risk Transfer

Although risk transfer examples illustrate how the technique can function in any situation, they do not often explicitly demonstrate any benefits and drawbacks.

One of the most obvious advantages of risk transfer is that companies that transfer their risk are guarded against any financial losses. Another advantage is that if insured companies or individuals do have to pay out, the amount might be lower due to their coverage.

A major disadvantage of risk transfer is that it creates an added expense for the one who has to manage the risk. In the example of a subcontractor who must possess coverage, they must pay for their policy out of their pocket.

It is important to note that the advantages and disadvantages of risk sharing differ from those of risk transfer because the two similar ideas are not the same. Risk sharing involves multiple entities being responsible for shouldering the burden of a risk. Risk transfer moves the risk from one to another.

Risk Transfer Methods

Risk transfer advantages and disadvantages can point companies to practical ways they can reduce their liabilities. Of all the risk transfer methods, insurance is the most widely accepted. Sometimes, risk transfer in insurance does not end with a subcontractor possessing a policy.

Companies that hire subcontractors and other third parties can transfer their risk to those entities. They can require subcontractors to be insured per their insurance requirements. This transfers risk beyond the subcontractor to the insurance issuer.

However, companies that do this must obtain proof that their subcontractors are insured. Certificates of insurance (COIs) are documents that confirm the subcontractor, the named insured, has sufficient coverage. Companies that collect these forms must verify and monitor them to maintain compliance.

myCOI can help solve their compliance needs. Supported by insurance experts, myCOI automates COI tracking, relieving risk management professionals of all the meticulous work that goes into confirming coverage. Companies can confidently transfer the risk of incorrectly tracking insurance to myCOI.

Proper coverage is a big deal. Partnering with a COI management solution like myCOI could help confirm that subcontractors are getting it right. When they get it wrong, companies can become exposed to the risks they thought were covered.