Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

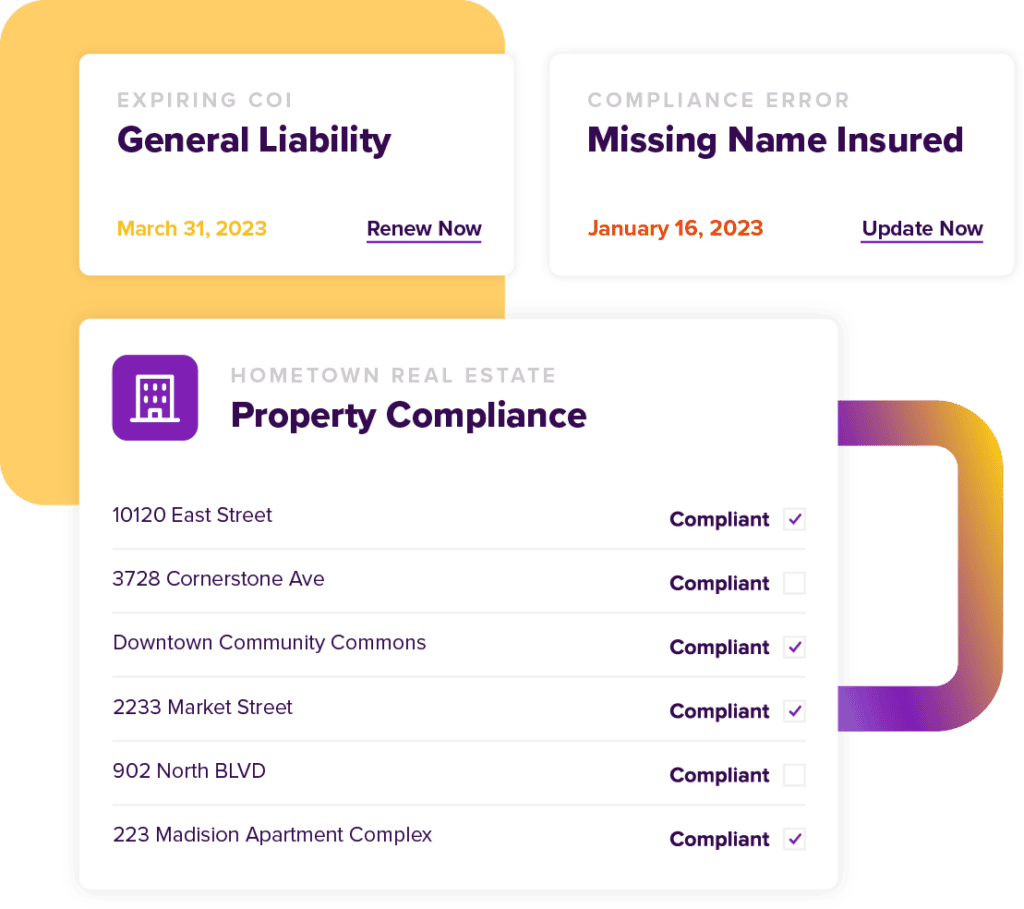

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesCertificate Of Liability Insurance Sample

If you want to run a small business successfully in today’s world, then you need to make sure that your company and everything you invest to build it are all adequately protected. This is where having a certificate of liability insurance is critically important. Even though you may do everything right, your business could still be held liable in certain situations. So, in order to protect your business adequately, you have to have the right insurance plan and you also need to be able to prove that to people who ask about it.

This is where a certificate of liability insurance sample is handy. In particular, this certificate is important because it shows that your business has the appropriate protection in the event of a lawsuit, disaster, or other catastrophes.

As you get started working on this important aspect of your small business, though, you may also be wondering how to get ACORD insurance certificate. You get them from your insurer. ACORD certificate of insurance verification is one of the first tasks any company that hires you or your company will undertake. You may also need to learn more about the difference between an insurance certificate holder vs additional insured. For example, if you have blanket additional insured wording on certificate of insurance, then this is significantly different from a traditional insurance policy. Therefore, you should do everything you can to find the right insurance protection for your business.

You need to make sure that you have the certificate to prove that your company does have the right insurance. This can instill faith in your customers, your investors, and even employees. Most critically, it tells the companies that hire you that you’re carrying the protection they require.

So what do you need to know about your certificate of liability insurance? Likewise, what are a few situations in which this type of insurance certificate could be helpful? There are several important points to keep in mind here.

ACORD Certificate Of Liability Insurance (2021)

The past year has been difficult for just about every business, and everyone has seen firsthand that there will always be circumstances that just cannot be predicted or planned for. Now more than ever you need to make sure that your business is adequately protected, especially when you’re hoping to work with another company. Thanks to the simplicity of an ACORD form insurance COI has never been easier to prove.

For those who may not know, ACORD stands for Association for Cooperative Operations Research and Development. This body develops the forms that you as a small business owner or leader have likely dealt with. An ACORD form is a document designed to prove that you have the right insurance coverage when it comes to business liability.

Of course, there are numerous types of insurance forms out there, and the ACORD 25 is only one of them. Because of this, you need to take a look at this form and make sure that the coverage outlined on it is right for your company. That way, you can prove to everyone that your business has the right level of protection for its size, industry, location, and more. However, if you are not sure about this or if you need help requesting this kind of form, do not hesitate to reach out to trained insurance professionals. By getting an expert helping hand, you will know that you have the right coverage for your business.

ACORD Certificate Of Insurance Sample

In order for you to make sure you have the right form, though, you should also take a closer look at an ACORD certificate of insurance sample. When you are looking at an ACORD form sample, including the sample ACORD 25 Liability Form, you need to make sure the ACORD liability insurance sample is an accurate reflection of the insurance your company needs and is purchasing.

For example, when you are looking at an ACORD certificate of liability insurance PDF, you should be able to tell whether you are looking at an ACORD certificate of liability insurance. It’s also worth keeping in mind that the ACORD certificate of liability insurance PDF may change from year to year.

There are also a few important pieces of information that you need to make sure are included in the ACORD certificate of liability insurance PDF. For example, your ACORD certificate of liability insurance should include the name of the insurance companies providing coverage as well as the name of your own company. It should also specify the effective date and expiration date during which this insurance policy is active as well as what type of coverages you have.

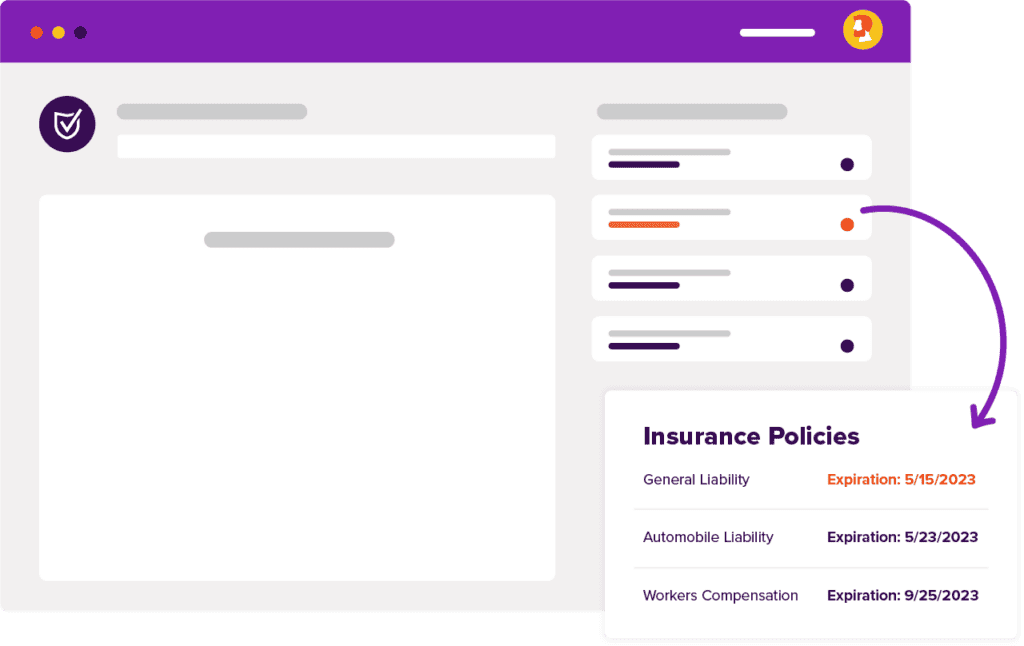

Finally, it’s worth mentioning again that you also have to make sure the expiration date of the policy has been printed clearly on the document. There will always come a time when your policy is about to expire, leaving your company vulnerable and exposed to risks. In this case, it may be helpful to have an advanced program that can let you know when the policy is about to expire. That way, you can request a new ACORD certificate of liability insurance before the policy itself actually lapses.

This is important because you do not want to have any lapses in the protection of your business. Otherwise, you risk leaving your business vulnerable.

Sample Certificate of Insurance with Additional Insured

There is another type of certificate of insurance that your company could have, which is called a sample COI with additional insured. A certificate with additional insured could be appropriate for your company in certain situations, and this is why you need to take a closer look at ar insurance sample.

As you are taking a closer look at your certificate of insurance with additional insured, though, you also need to think about the type—or types—of coverage that your business might require. For example, if you are a general contracting business that works with a variety of subcontractors and vendors, then there are probably situations where you probably want to receive protection from your subcontractors as well. In this case, you need to take a closer look at a certificate of insurance with your company as an additional insured, as this could provide you with the type of coverage you need from these specific companies you hire so that you’re not assuming risk you don’t have to assume.

If you have questions at any point in this process, such as whether you require a certificate of insurance with additional insured status, then do not hesitate to reach out to trained professionals who can help you answer them correctly. This way, you can make sure that you are not overlooking anything that would leave your company at risk. Your company needs to have the right level of protection in order to ensure that your business is placed in the best possible position for success.

Acord 25 Example

As you go through the various documents you need to have at hand, you may come across something called an ACORD 25. An ACORD 25 example could be included in a certificate of insurance example PDF. So if you are looking at an additional insured endorsement example, then you may also come across this form.

If you are taking a closer look at your ACORD 25 example too, then you need to make sure that all the necessary information is included. For example, your insurance agent should be identified in this form and their contact information should also be included. In addition, your own name and contact information should also be included on the form.

Your policy number should also be printed clearly, and there might be a certificate number included as well. The effective date of the insurance policy also has to be included, showing anyone who looks that these are the dates during which the coverage is active. You may also get your liability insurance limits included as well. What is the limit of the liability of your company is insured for? If exhaust r this limit, then you may be held responsible for any remaining claims or losses. Finally, if there is any additional insured information, this may need to be included as well.

Acord 25 Fillable 2021

Your agent or broker should be filling out your certificates of insurance. There is often a lot of policy coverage specifics on each of these forms, you should consider reaching out to trained professionals who can help you sort through it all. Though it is complicated, this information is still important because it specifies the type of insurance protection that your business has. Furthermore, if anyone has any questions or concerns about the document, then they can reach out to the agent or broker themselves because the information necessary—including the policy number—will be clearly printed on the form. That way, you can save a significant amount of time, money, and stress while still meeting all necessary rules, regulations, and requirements.

Finally, if you have questions or concerns about this form, keep in mind again that you should not fill it out on your own. You can work with your insurance agent or broker y themselves or you can reach out to experienced business insurance professionals who can lend a helping hand.