Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

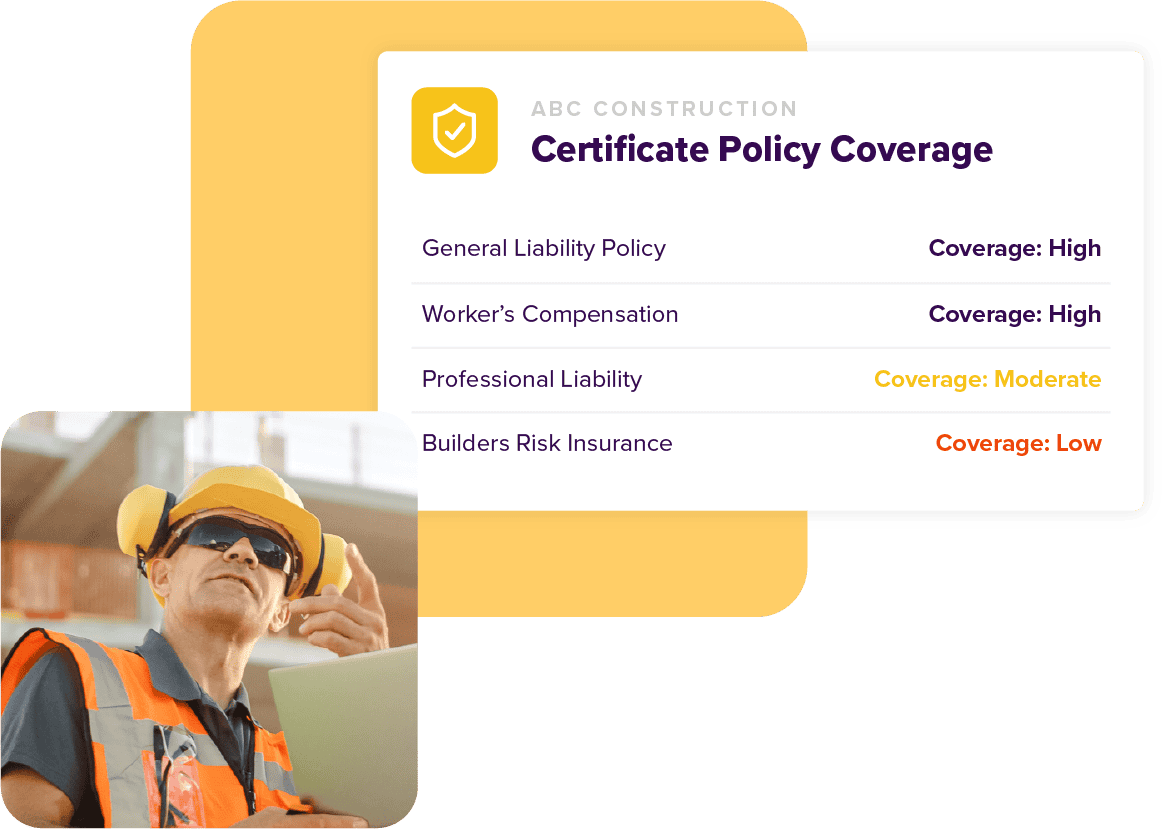

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

Automate Your COI Tracking

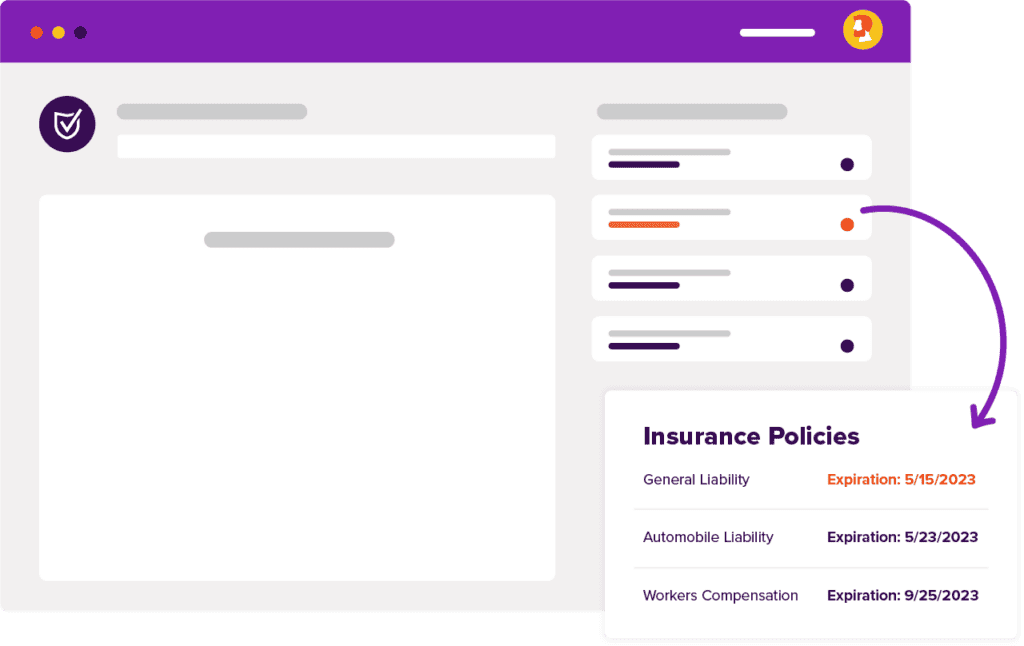

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesGeneral Contractor Certificate Of Insurance Tracking App

If you are a general contractor certificate of insurance tracking apps are something you’re going to deal with at some point. It may be because you’re hiring a lot of subcontractors, and you need a method to track the certificate of insurance you require from them. Or it could be because you work with businesses that use certificates of insurance tracking software to manage the certificates of insurance that you provide to them.

It’s almost a certainty, and the probability of it being a certainty that you will deal with such technology climbs every day. For years anyone who tracks certificates of insurance best practices has been noting the importance of an automated certificate of insurance tracking app solution.

At myCOI we offer the industry-leading certificate of insurance tracking solution, in a self-service SaaS solution as well as a concierge, managed service solution. We pioneered the COI tracking industry, you might say. And our team of insurance specialists, coupled with our commitment to customer service, makes us unmatched.

The risks of not tracking your certificates of insurance, or tracking them poorly, are almost too numerous to count, but most of them boil down to risk. Insurance risk not handled properly can open you to enormous potential responsibilities. If you’re not navigating the web of overlapping coverage, exclusions, limitations, additional insureds, and sometimes just basic human error that can easily exist in business relationships, you’re risking being held responsible for claims or damages that you should not be.

Anyone can download a certificate of insurance template and fill it in, make it look presentable, and deliver to a requestor. Yes, that’s dishonest and oftentimes illegal but it happens. Can your contracting business absorb the risk of not tracking for things like that? Or hiring full-time staff to hand-verify each one?

If you can’t, then a tracking solution may be a smart move.

Certificates Of Insurance 101

Let’s take a moment and run through certificates of insurance 101. In its most simple form, a certificate of insurance is the evidence from your agent or agency that you carry the insurance you claim to carry. The normal forms include all the necessary information a requestor would need to verify that you or your business carry the insurance they require of their contracted entities. Just like your driver’s license says your state believes you know how to drive safely, so a certificate of insurance says your agent or agency believes you are covered.

There are nuances, of course. The certificate of insurance for businesses may be different, and will almost certainly carry different information, then the certificate of insurance for contractors, because the work done, the number of employees involved, and therefore the risk involved, can be different.

A certificate of insurance also removes the need for unnecessary conversations. If you’re being considered for a job, competing on the bid is enough work. Not having to explain your insurance coverage, because your certificate of insurance explained it for you, can be a real time saver.

And as we said above, if you’re a business that receives them, organizing certificates of insurance is a critical task that can sometimes mean life or death to your company.

Certificate Of Insurance Sample

Now that we’ve talked about how important certificates of insurance are, let’s look at an example of what one looks like. By far the most common certificate of insurance sample form is the ACORD 25 general liability insurance form.

All of the fields are clearly labeled, and your agent or agency should provide it to you already filled out, but let’s look at the high points. The Insured box should have your name or your company’s name in it, since it’s certifying your insurance. Depending on your coverage, you may see values in the General Liability box, the Automobile Liability box, or the Umbrella/Excess Liability box, and so on.

If you’re a company that receives certificates of insurance, and you’re not using an automated solution like myCOI, you may find it helpful to generate and store a library of likely templates. A certificate of insurance is only as good as it’s verified to be, and sometimes that means reaching out to agents/agencies to make sure the coverage stated is still valid.

Many businesses maintain a sample letter requesting certificate of insurance from commercial tenants, which is slightly different, due to requirements, from a sample letter requesting certificate of insurance from tenants. In fact, some companies just try to make do with a basic sample letter requesting copy of insurance policy, which can sometimes generate the necessary certificates regardless.

Certificates Of Insurance For Subcontractors

If you’re a subcontractor, or you hire subcontractors and have to track the certificates of insurance you receive from them, you may see a few oddities. Depending on what state you’re working in, certificates of insurance for subcontractors may sometimes lack evidence of workers’ compensation coverage. This is because several states do not require workers’ compensation coverage for what are called sole proprietorships, where the individual worker is the only employee of their one-person company. If you’re unsure whether or not there should be a workers comp policy by statute, consult with your state’s workers compensation board.

Even in states where it is not legally required, however, many companies that hire subcontractors still require the coverage as a necessity for employment. In that case, a workers’ compensation certificates of insurance for subcontractors will show the minimum necessary coverage required by the hiring entity.

What’s fun about these one-person plans is that often they’re what are called ghost policies: they are workers’ compensation plans, but they have exclusions disallowing coverage for the single employee. They allow subcontractors to satisfy the requirement of needing workers’ compensation, but since they are excluded, the coverage only covers a ghost.

Or in reality, no one.

COI Tracking Spreadsheet

If you’re just starting out managing certificates of insurance (COIs) and you’re using a spreadsheet, don’t worry. You’re not alone. A lot of people begin this journey by using a COI tracking spreadsheet. It’s one of the easiest ways to get started: with a simple certificate of insurance tracking template Excel lets you keep a decent record of a few COIs.

But please, remember this danger when you track insurance policies on Excel spreadsheets: it’s a manual process. And when the number of COIs you have to track explodes because your business is growing, it may not be a process you can scale easily. All too many of the people we speak to about COI tracking software started with something like a certificate of insurance tracking Access template and got busy, and lost track, and suddenly their business was on the hook for an incredible amount of liability risk it could have avoided.

You can avoid this situation with one of two methods: continue to be diligent, every time, in using your COI request forms and tracking the results in your spreadsheet, because every moment you spend on this is a moment you’re spending protecting your business from risk.

Or you can invest in an automated COI tracking solution like myCOI, and quite often save significant time, money, and opportunity cost that you can use to grow your business and build the success you’re looking for.

Certificate Of Insurance Retention Period

What certificate of insurance retention period you should follow is a complicated question with a lot of answers. The most often given general answer is five years. But you should absolutely confirm your insurance record retention requirements by state. Each state in the United States has different rules, regulations, and laws around insurance, so especially if you’re working in an unfamiliar state, or if you live in one state or work in another, or even if the company you’re working with is headquartered in another state, you will want to confirm the controlling requirements.

Also, remember that sometimes record retention requirements for insurance companies can differ from the state rules, so double-check with your insurer. The last thing you want to happen is to be held liable for a claim or damages when you shouldn’t be, for no other reason than the paperwork was lost.

We all hate having those boxes of files sitting around, taking up space, but in this case, it’s better to have the records and not need them, than to need the records and not have them.

Certificates Of Insurance Issues And Answers

We know this can be a complicated topic because we get asked about certificate of insurance issues and answers all the time. Insurance is a complicated field with nuances around every corner, and almost every situation has some kind of unique aspect. Understanding coverage, understanding what the certificates of insurance actually say—and what they don’t say—can be, and often is, a full-time job.

There are two parties you want to check within almost any instance of questions around certificates of insurance. First, for questions like which vendors need a certificate of insurance, check with your company’s risk management department, or when that doesn’t exist, your company’s general counsel. In many cases, these departments or people can give you a certificate of insurance review checklist to help you ensure that the COIs you review have all the necessary coverage.

The other party will be the insurer who issued the certificate of insurance. When you have questions about the coverage, exclusions, or limitations shown on a certificate of insurance you receive, the only safe source of information is the insurer itself. Don’t ask the third party who provided you with the certificate; not only does this give them the opportunity to be dishonest, it also sets you up to be taken advantage of out of ignorance or a mistaken belief about coverage. Go to the source. Ask the insurer.

Request Certificate Of Insurance From Vendor Letter

We’ve mentioned several times about generating prebuilt request certificate of insurance from vendor letters, for example. Having these kinds of documents handy can really save you time having to write the same letter or email over and over again. But they also have significant usefulness as training aids.

Let’s say you’re on the compliance management team, and you hire a new admin. Having a sample letter requesting certificate of insurance from vendors on hand to show them can save you a lot of time explaining the details of what they’ll need to know when they make a request. It sometimes leads to fun questions like “what is a certificate of insurance for vendors?”, and you’ll have to take the time to train on that, but it’s a step in the right direction.

Almost as important as knowing what to put in a letter, though, is knowing how to request a certificate of insurance from a vendor. Each business will have its own process: some places make it part of the application process, and some will handle it as a new vendor task after the vendor has been accepted. Your own business will have its own process.

Certificate Of Insurance Compliance

Knowing how to organize certificates of insurance for tracking is a necessity for any company that hires third parties such as contractors or vendors. A certificate of insurance tracking solution allows businesses to track certificate of insurance compliance

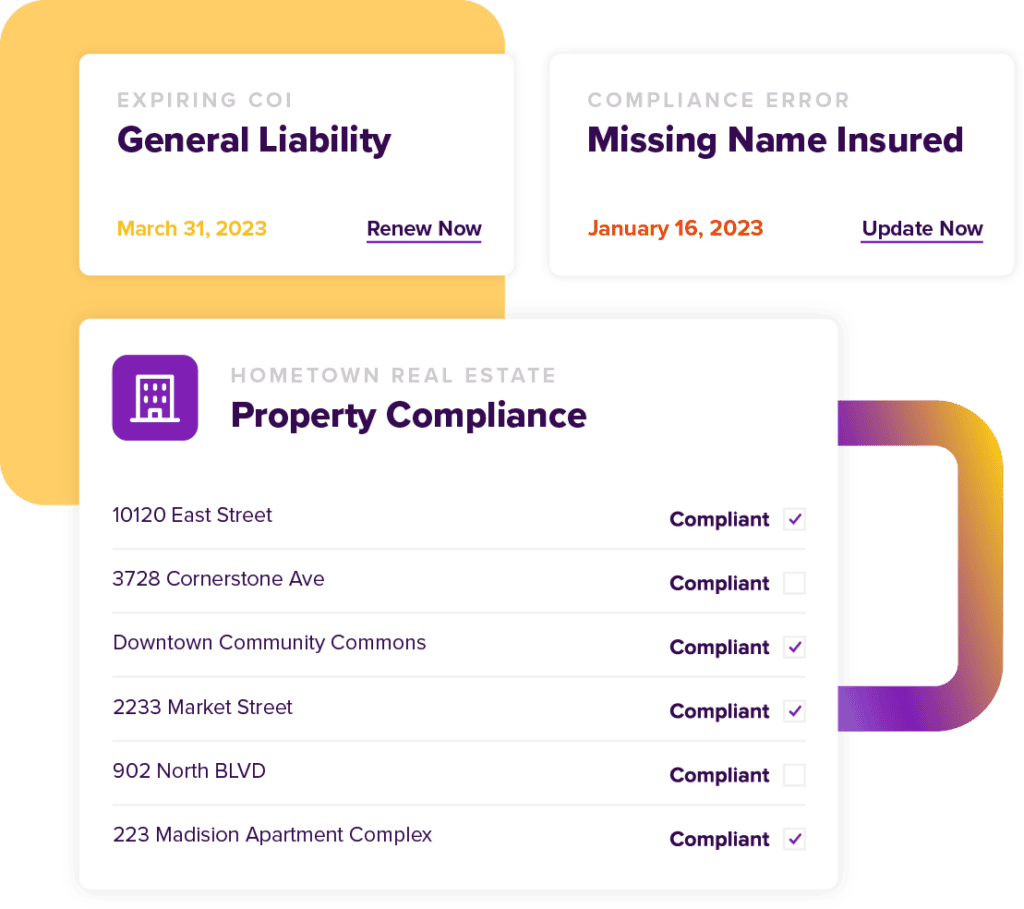

One of the most common mistakes that businesses make is not keeping accurate records of certificates of insurance. This puts them at risk for fines and penalties if they do not have up-to-date documentation on hand when requested by a third party, such as an attorney or law enforcement officer, sometimes even when they think they’re in compliance because they don’t check certificate of insurance requirements by state, which vary. In addition to having legal consequences, failing to keep track of your company’s certificates could lead to financial losses. It also increases the likelihood of liability lawsuits filed against your business. Knowing who needs to provide a certificate of insurance is one of the core components of risk management.

It’s not just those who hire contractors and vendors that need to track certificates of insurance. Property managers who host commercial tenants also need to ensure those tenants are carrying the proper insurance. We often see the duty of securing and verifying these COIs fall on property managers, instead of dedicated risk teams, so we strongly suggest having on hand a sample letter requesting certificate of insurance from commercial tenants, so you can quickly request the COIs you need to manage your property’s risk.

Remember. If you find yourself asking which vendors need a certificate of insurance, the answer is usually “all of them.” The next step, knowing how to request a certificate of insurance from a vendor, is something your risk management team probably already has a process for.

Free COI Tracking Software

Running a business is expensive, and sometimes the last thing you want to add is another expense, even when you have a need. We can’t tell you how many times we’ve heard companies tell us that they were doing their best: they knew about insurance certificate tracking services, but the budget was just too tight, so they did it with Excel or a free COI tracking software. For a while, they did okay. Sometimes they tried to make do with free renewal tracking software or apps.

But their compliance percentage slipped down a little every month, as their business grew and more and more certificates were received. Each of those certificates had to be tracked and verified. Each month, more certificates than the last.

At a certain point, the amount of unnecessary risk they were assuming got to be too much, and they had to look for a more professional solution. Sometimes it’s because their risk management team or general counsel audits and realizes the exposure. Sometimes a new hire discovers a distressing reality that had gone unnoticed.

Unfortunately, sometimes it’s because the company just had to pay a damaging claim that they should have been covered for.

Free COI tracking software is not inherently bad, and almost no one sets out to make bad software. But it takes a dedication to customer service, a mission to erase worry, and a team of insurance professionals like the one we’ve assembled at myCOI to make sure your company is doing all it needs to with its certificates of insurance. At myCOI integrations we’ve built with other software make us a powerful option, and a key component people ask about in myCOI demos.

Certificate Of Insurance Tracking

The competition for the best certificate of insurance tracking software is fierce, and we’d be being dishonest if we didn’t say you need to choose the right solution for your company. Obviously, at myCOI we believe we are the right solution nine times out of ten, but we don’t fit every company, and that’s okay. Certificate tracking online could be a critical part of your business no matter what solution you use, whether that’s a fully managed partner solution, myCOI competitors, or something else.

You’ll need to define what “best” means for your business. Is it the least expensive? That depends on how you measure cost. In pure dollars, a free COI tracking software may work, but is it reliable? Do its developers offer support? Are there regular product updates coming out? If not, check it carefully to make sure it isn’t out of date.

Is “best” the least of your precious person-hours consumed by tracking certificates of insurance? Then a managed solution like myCOI offers may be best. Our team of insurance professionals know what they’re looking at, and they’re experts in making sure your certificates are promising what they say they do, that they meet your business requirements for coverage, and our quarterly verification makes sure the coverage stays in effect.

Certificate Of Insurance (COI)

The concept of a certificate of insurance (COI) is not a new one. In a very basic form, you probably have a certificate of your auto insurance in your car or your wallet. The form is a bit more complex for business general liability insurance, but the concept is the same: a document issued by an agent or broker saying that the bearer is insured against certain actions to certain levels of protection.

Most agents or brokers will give you a certificate automatically, or offer you a way to request your certificate of insurance online via their website.

Now that we’ve talked about how important certificates of insurance are, let’s look at an example of what one looks like. By far the most common general liability form is the ACORD 25 general liability insurance form, but you should check a certificate of insurance PDF from whatever source your company uses.

All of the fields are clearly labeled, and your agent or broker should provide it to you already filled out, but let’s look at the high points. The Insured box should have your name or your company’s name in it since it’s certifying your insurance. Depending on your coverage, you may see values in the General Liability box, the Automobile Liability box, or the Umbrella/Excess Liability box, and so on.

Insurance Certificate Issuance Software

Insurance certificate issuance software is not something non-insurance companies typically have to worry about. The insurance company is responsible for issuing certificates of insurance to the company. If you’re an owner or manager, it’s crucial that you know what your responsibilities are and how those differ from someone in this role at another firm. Whether it comes down to handling employee-related matters or discussing business strategy with clients, a basic understanding of these roles will go a long way when forging relationships within your industry.

Sometimes people mention certificates of issuance, but that’s a different certificate. These testify to the issuance of certificates for things like bar codes or identification numbers. As it sounds, it’s a certificate of issuance meaning it certifies that something was issued.

Instead of wasting time asking what is certificate of issuance, focus on tracking your own certificates of insurance. With a COI tracking application, you’ll never need to worry about tedious paperwork again. You can also make sure that your records are always up-to-date thanks to automated updates from vendors.