Best Certificate of Insurance Tracking Software

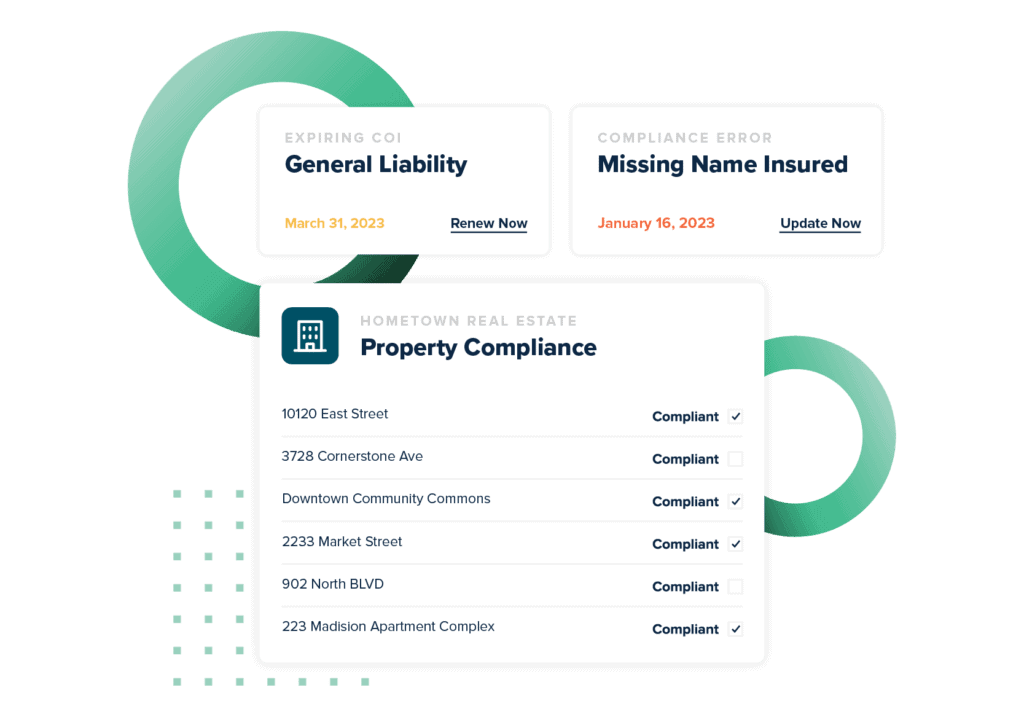

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

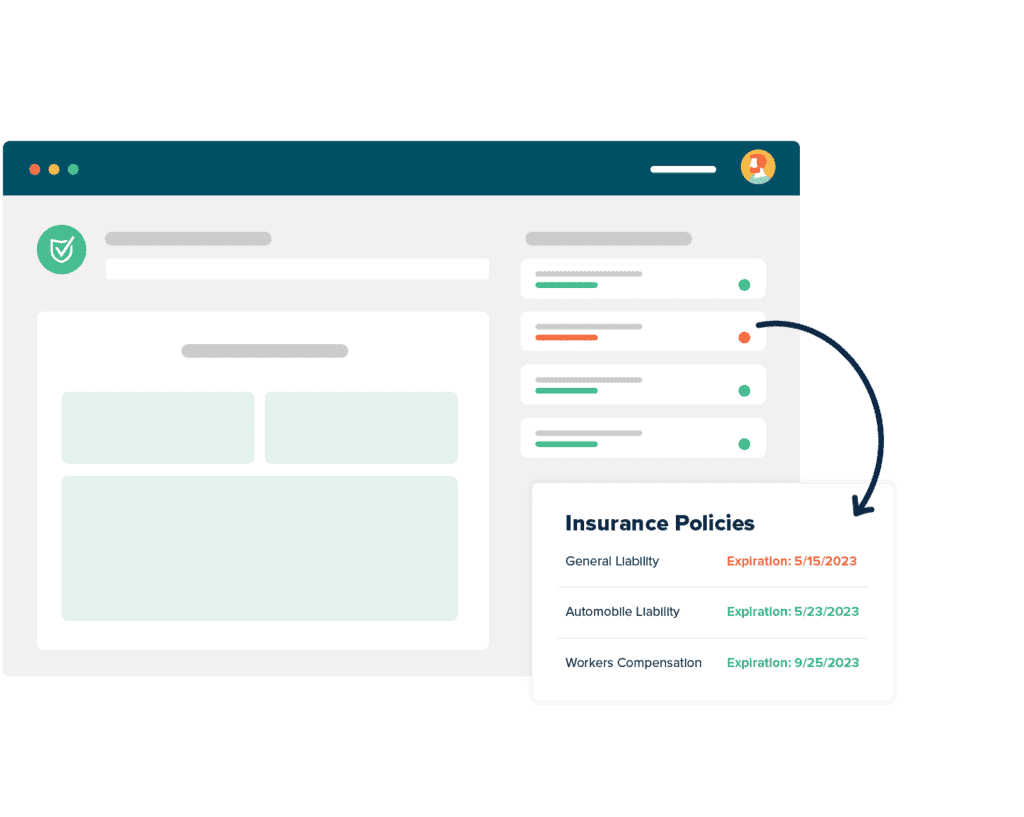

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesWhat Is A Certificate Of Insurance For Vendors

In its simplest form, a certificate of insurance for a vendor is representation from that vendor’s insurance agent(s) that the vendor carries the coverage stated on the certificate at the time the certificate was issued.

That didn’t sound very simple, did it? We know.

Your business uses these to ensure that the insurance requirements in a contract are met; that the vendors are carrying protections that move any risk they generate off of your risk blotter and onto theirs. The process of ensuring these COIs, as they’re called, say what they’re supposed to, and that they remain in effect, is called certificate of insurance tracking.

That’s what we do, here at myCOI. We help you stop worrying about that, with purpose-built software and a team of insurance experts.

Let’s dig in.

How To Request A Certificate Of Insurance From A Vendor

If you’re a contractor or business asking “when do you need a certificate of insurance from a vendor?,” the answer is pretty simple: before any vendor that enters your business premises or project site to perform work and takes any actions that may generate any risk at all needs to give you a certificate of insurance.

That sounds pretty vague, we know, but it’s a simple reality. Risk exists all around us, whether we generate it or not, and the last thing you want to do is assume the burden of risk your vendor opened you to because you failed to secure a certificate of insurance.

Now you may ask “what is a certificate of insurance for vendors?” and the answer is, the same thing you provide to other entities that you do work on behalf of. It should show the vendor’s coverage, any limitations or exclusions, and all the usual information. You should request certificates of insurance from vendors every time you hire them. Certificate of insurance request templates are very helpful here.

Knowing how to request a certificate of insurance from a vendor likely comes down to how your business works with vendors. In many cases, COIs with the minimum insurance requirements for vendors are required as part of the vendor application process or were specified in the RFP, or in an agreement or contract. If not, it’s often a requirement before the vendor can begin working.

If you deal with a lot of vendors, you can often save a lot of time by having a sample letter requesting certificate of insurance from vendors on hand, or some other kind of certificate of insurance request form template. Knowing how to request a certificate of insurance from a vendor does little to shield you from the hours of work you have ahead of you verifying all those resultant COIs, though.

Certificate Of Insurance Requirements By State

Each state in the United States maintains its own laws and statutes around insurance, and there’s no promise that two states with contiguous borders will have congruent insurance standards. Not only are there differing insurance requirements for businesses by state in general, this difference extends down as far as the specific types of insurance.

For example, in Indiana, the Indiana Department of Revenue issues a Worker’s Compensation Exemption Certificate Clearance to individual taxpayers who are independent contractors or otherwise not required to carry worker’s compensation insurance on themselves under the Worker’s Compensation Act of Indiana. Persons and/or businesses that qualify for such exemption are issued forms that act as a workers comp exemption letter.

There are no rules that say Illinois, Ohio, Michigan, or Kentucky must have similar laws, which can make life interesting for people who live and work along state borders.

It is always safest to lean on your insurance broker first when questions arise; by necessity, they are usually well-informed about the various state requirements.

Certificate Of Insurance For Business

When it comes to needing a certificate of insurance for business purposes, much depends on which business you are in that relationship. Let’s first look at when you’re the requesting business: you’re hiring contractors or vendors and you need to ensure they’re carrying the requisite coverage to shield your company from risk they create, without exclusions or limitations that your business won’t accept.

It almost goes without saying that you’re also on the lookout for fake business insurance certificates or other attempts at fraud.

In this instance, you probably have either a tool like myCOI to help you with this, or you have a risk management checklist of some sort to check the certificates of insurance against. One common check is to decide whether your company needs to be just the insurance certificate holder vs additional insured; being endorsed as additional insured can extend coverage to your organization in the event of a loss or litigation caused by the third party you hire.

And if you’re on the other side, the contractor or vendor providing the certificate of insurance, all you really need to do is consult with your broker or other insurer, ensure you meet and can accept all the coverage requirements requested, and get an acceptable certificate of insurance issued by your broker.

Certificate Of Insurance For Small Business

myCOI is not an insurer, so we’re not going to offer you a small business insurance calculator that will, for example, allow you to enter X amount of coverage over Y amount of assets and get back Z, an estimated premium. That’s not our business. There are plenty of businesses that do that.

What we will talk about, instead, is the advisability of maintaining stable insurance coverage. We hear stories, sometimes, about businesses that look for very short-term policies. They want to know how to get a certificate of liability insurance for an event, right before the event. Many people sell short-term insurance, and if the work is far outside your normal zone of coverage, that may be a good solution. But don’t discount the first, the cost savings associated with a longer-term policy, and second, the benefits of a more stable relationship with your agent or broker.

The next time you feel the urge to Google “how to get a certificate of insurance for an event,” stop and think first. Consider changing your search to “how much does general liability insurance cost for a sole proprietor?” (if you are a sole proprietor, otherwise change it to ‘small business.’ Balance the short-term cost against the long-term cost. What if you need this coverage six times this year? Is the short-time cost still worth it?

Every dollar is precious when you’re a small or young business. Be a good steward of your money and do your due diligence.

Certificate of Insurance Sample PDF

Let’s look at an example of what a certificate of insurance looks like. By far the most common certificate of insurance sample form is the ACORD 25 general liability insurance form.

All of the fields are clearly labeled, and your agent or agency should provide it to you already filled out, but let’s look at the high points. The Insured box should have your name or your company’s name in it, since it’s certifying your insurance. Depending on your coverage, you may see values in the General Liability box, the Automobile Liability box, or the Umbrella/Excess Liability box, and so on.

If you’re a company that receives certificates of insurance, and you’re not using an automated solution like myCOI, you may find it helpful to generate and store a library of likely templates. A certificate of insurance is only as good as it’s verified to be, and sometimes that means reaching out to agents/agencies to make sure the coverage stated is still valid.

Many businesses maintain a sample letter requesting certificate of insurance from commercial tenants, which is slightly different, due to requirements, from a sample letter requesting certificate of insurance from tenants. In fact, some companies just try to make do with a basic sample letter requesting copy of insurance policy, which can sometimes generate the necessary certificates regardless.

Certificates Of Insurance Issues And Answers

We know this can be a complicated topic because we get asked about certificate of insurance issues and answers all the time. Insurance is a complicated field with nuances around every corner, and almost every situation has some kind of unique aspect. Understanding coverage, understanding what certificates of insurance explained—what they actually say and what they don’t say—can be, and often is, a full-time job.

There are two parties you want to check within almost any instance of questions around certificates of insurance. First, for questions like which vendors need a certificate of insurance, check with your company’s risk management department, or when that doesn’t exist, your company’s general counsel. In many cases, these departments or people can give you a certificate of insurance review checklist to help you ensure that the COIs you review have all the necessary coverage.

The other party will be the insurer who issued the certificate of insurance. When you have questions about the coverage, exclusions, or limitations shown on a certificate of insurance you receive, the only safe source of information is the insurer itself. Don’t ask the third party who provided you with the certificate; not only does this give them the opportunity to be dishonest, it also sets you up to be taken advantage of out of ignorance or a mistaken belief about coverage. Go to the source. Ask the insurer.

Minimum Insurance Requirements For Vendors

At myCOI we erase the worry businesses have about noncompliant certificates of insurance (COIs) because we know our industry-leading technology and unmatched professional insurance staff make us the best choice for any company dealing with hundreds or thousands of certificates. We know, from experience helping hundreds of companies succeed, what certificates of insurance best practices are.

There’s a wide breadth of familiarity with certificates of insurance and vendor insurance requirements. New subcontractors, for instance, might be asking us about sample insurance requirements for vendors, moments before we hear questions about the need for an insurance clause in vendor agreements from brand-new risk managers or compliance admins.

The answers, by the way, ask your risk team or your general counsel. Only your business can answer those questions.

There’s a lot of complexity in certificates of insurance tracking and management. Knowing where to find certificates online, knowing how to request a certificate of insurance from a vendor, these are just the starting points. You also need to know your company’s requirements around insurance coverage, so you can confirm that the COIs you receive actually claim the coverage you need to see to let the vendor begin work. You need to know what each box of the certificate of insurance form is for, and what the numbers mean. You need to know the difference between a certificate holder and an additional insured, and perhaps dozens more differences depending on your company’s requirements as well as the state and local insurance requirements.

It’s a complicated job, and every COI you accept that is noncompliant can open your business to the potential for significant risk. You don’t want to have to explain why your company is liable for a claim that should rightfully lay with the vendor. Trust us. We hear these horror stories all too often.