Best Certificate of Insurance Tracking Software

Automate Your COI Tracking

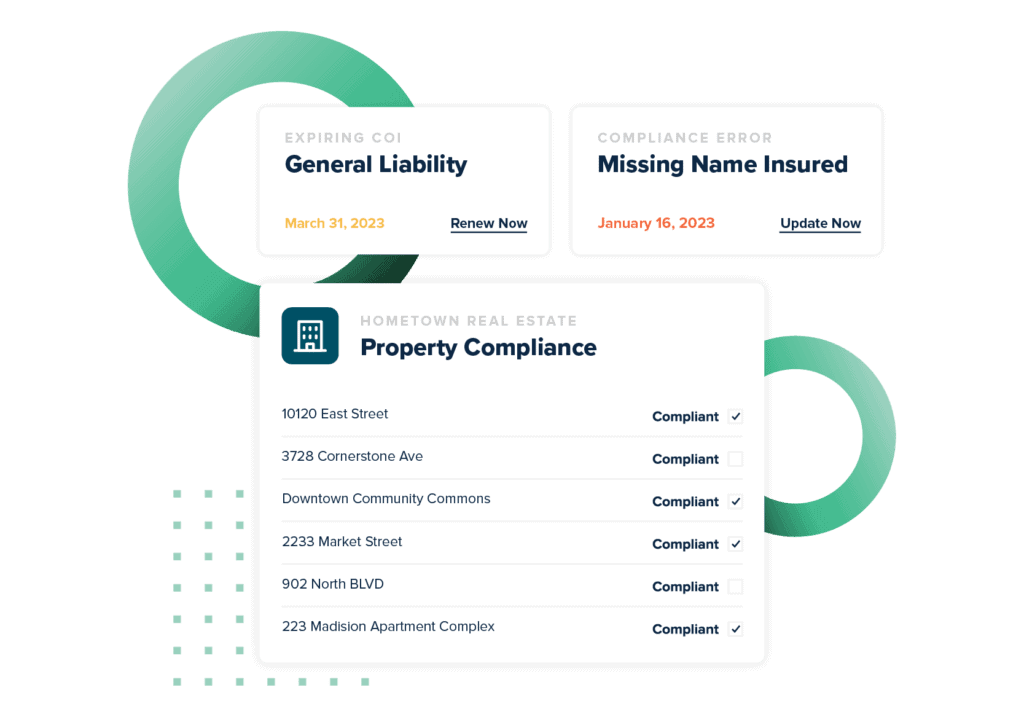

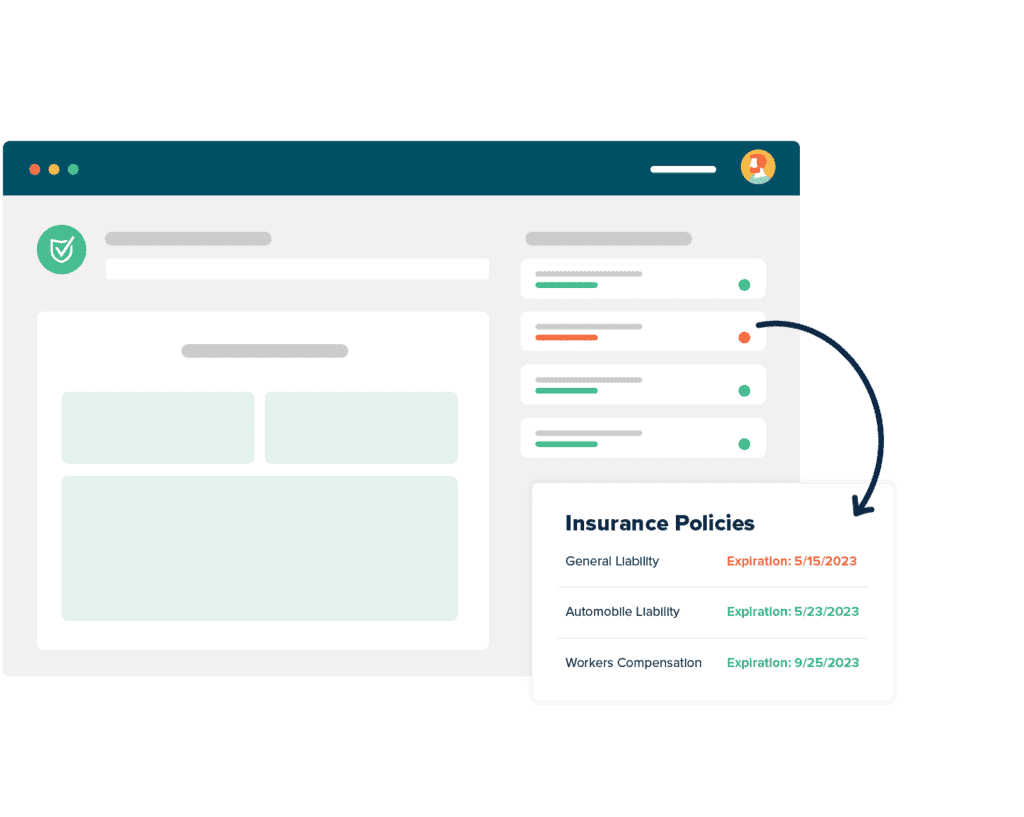

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesWhat Is A COI

Running a business involves more than selling a product or service. Owners sometimes overlook their duty of handling risk. Whatever happens to their employees, vendors, and contractors during normal operations is their responsibility. Workers can harm themselves, others, and property.

Business owners should protect their companies in any way they can. After all, some companies require time and financial investments to get started. Building something from nothing costs money and energy. Entrepreneurs should not let their hard work go to waste.

Liability insurance can protect companies and the third parties they hire from claims and lawsuits stemming from job-related incidents. It can guard a company’s finances and provide owners peace of mind. Owners can also work more confidently knowing they do not have to worry about losing all they have created because of an unfortunate situation.

It does not matter if a company hires a few vendors or hundreds. The people they hire carry risk into a job. Everyone makes mistakes. Accidents can happen despite the strictest safety protocols. Liability insurance defends companies against claims of negligence and injuries. It typically offsets medical care and repair costs as well as legal fees.

Lawsuits can devastate a company, forcing it into bankruptcy and tarnishing its reputation. Liability insurance can be the difference between a company’s survival and death.

Companies that are insured have taken a solid first step towards a bright future. One more step awaits. They should require that their vendors and contractors possess their own coverage and be able to prove it. Third parties who have sufficient coverage are protecting themselves and the companies they work for.

Unfortunately, companies can not rely on their third parties to simply confirm they are insured. People can lie, especially if they think they will lose their job if they are not covered. This is where COIs come in handy.

What is a COI?

A COI insurance form is an important document that proves insurance coverage. A COI (certificate of insurance) is also known as a certificate of liability insurance.

A certificate of liability insurance sample can be beneficial for training and everyday use. People who have never seen one can grasp the basics by looking at an example. Anyone can learn how to get a certificate of liability insurance example. A quick search can yield how to get insurance certificate online instructions.

Understanding the complexities of insurance can be intimidating especially if companies do not have the resources. Knowing everything about COIs can overwhelm the people who have to collect, verify, and manage them – even with samples to guide them.

Teaming with a certificate of insurance online solution like myCOI can help companies confirm their third parties are adequately covered. The burden of COI management can be lifted from a company so they can continue with business as usual while saving time and money.

What Is A COI In Business

COIs can be found in the private and public sectors. Anyone who has car insurance will usually have a COI as proof of coverage, usually in the form of a card. The general idea remains the same.

What is a COI in business?

A COI certificate of insurance confirms the insurance coverage of the named insured.

Certificate of insurance compliance is the function companies perform to ensure the contractors, vendors, and other third parties they have hired have proper insurance coverage. Insurance compliance professionals collect, verify, and track the COIs provided to their companies. It is an ongoing process that can grow unwieldy depending on how many third parties are hired. A COI has to be collected from each third party. For instance, 100 contractors must each submit a COI. That means 100 COIs must be checked for authenticity and then stored. It also means compliance professionals must frequently keep current with insurance regulations to adjust their company’s requirements as needed. Confirming constant compliance with every COI can take a lot of time.

Additionally, insurance compliance professionals must know how to request a certificate of insurance from a vendor. This can be done verbally or in an email or letter. A paper trail can help in cases where third parties argue that they did not receive a request. Compliance professionals who need assistance can download a sample letter requesting certificate of insurance from vendors to help them craft the perfect template.

Proof of insurance is a vital item for companies to require. Knowing how to read a COI and remembering every detail of managing them can help eliminate any misunderstandings that cause coverage gaps. Some companies struggle to effectively track and oversee their insurance compliance. Training can go a long way to increase their knowledge.

A blank certificate of insurance for contractors and vendors can be a good starting point to learn about COIs. They can be downloaded from several resources. Companies that do not have the time or inclination to study a certificate of insurance PDF, can solve their compliance needs by using myCOI. Backed by insurance experts, myCOI can help companies sustain compliance and inform third parties when their coverage is about to expire. Automated insurance tracking can relieve compliance professionals and their companies of tedious tasks that can increase liability risk when done poorly.

What Is A Certificate Of Insurance

What is a certificate of insurance? What is a certificate of insurance for vendors? What is a certificate of insurance quizlet?

These are only three questions some people ask when faced with having to manage COIs for their employers. Many more exist. Insurance is occasionally complicated. COIs can also seem complex to the untrained. A COI meaning simply defines a simple idea that incorporates intricate components.

A sample COI, like an ACORD 25 form, can demonstrate what regularly needs to be validated:

- the insured’s name

- the name of the insurance company

- the policy number

- the type of insurance protection

- the date coverage begins

COIs can appear legitimate even under scrutiny. It is essential for compliance professionals to double-check every detail for authenticity. Fake COIs only protect the people who submit them. They place companies in danger because coverage does not exist in those instances.

The obligation to prove coverage does not solely rest on companies. Their vendors and contractors have to keep up their end of the responsibility. Third parties who are suitably covered and submit their COIs do themselves and their companies a great service. However, sometimes minor complications occur. For instance, a third party is covered but can not prove it. If a vendor or contractor does not have a COI, then they can contact their insurance agent or broker to find out how to get a certificate of insurance. Some insurance issuers allow their customers to download a certificate of insurance PDF online.

A certificate of insurance for business can help mitigate any financial damages if a claim occurs by showing the third party is satisfactorily covered. This simple document can influence a company’s fortunes. It should not be taken lightly. Companies that are unsure how to effectively request and manage COIs can use myCOI to help simplify insurance tracking. The cloud-based solution gives companies a single place to view their COIs, compliance, and risk reporting. This administrative simplicity can facilitate the processing of every collected COI.

What Is The Purpose Of A Certificate Of Insurance

What is a certificate of insurance (COI)? What is the purpose of a certificate of insurance? What is a certificate of insurance for vendors?

By now, these questions should be answered. More questions will spring up the further one delves into COI insurance tracking. For instance, what is the difference between insurance policy and insurance certificate holders?

A policyholder is an insured party. A certificate holder is a company or person who requests and holds a COI.

What is an additional insured?

The questions continue. Fortunately, there are many resources available to educate anyone who needs to comprehend certificate of insurance for business practices.

Some companies know how to get a certificate of insurance from vendors and contractors. Some can effortlessly handle any issues regarding them. However, a large volume of COIs can become overwhelming, even for a team of numerous experts.

A typical insurance compliance professional who has to work with COIs must:

- collect and review COIs to make sure they align with their company’s requirements and current regulations.

- file all documentation.

- continuously monitor COIs for mistakes or noncompliance.

- contact third parties for information regarding their COIs (renewals, discrepancies, etc.).

A compliance professional or team that has to do all of these tasks for a hundred COIs or more can open themselves up to mistakes. They might hurry with each COI. They might not know the latest laws. They might not care because they are overworked.

myCOI automates COI tracking to save companies time and money. Built for the end-user, myCOI is supported by insurance experts who can provide some of the industry’s finest compliance management. The platform’s straightforward usability and functionality make it a practical option for companies that wish to mitigate their risk and claims.

Automated COI tracking can also protect companies against the risk of costly litigation and failed audits. Companies can simplify their workflows when they take advantage of COI tracking software. myCOI has industry expertise built into it. The platform can be more reliable than someone with no training or an expert with no time. The highly-functional platform can improve staff productivity. They can do more in less time when they do not have to worry about researching new laws or tackling a stack of paperwork. myCOI’s reliability and efficiency can make people’s jobs and lives easier.