Best Certificate of Insurance Tracking Software

Automate Your COI Tracking

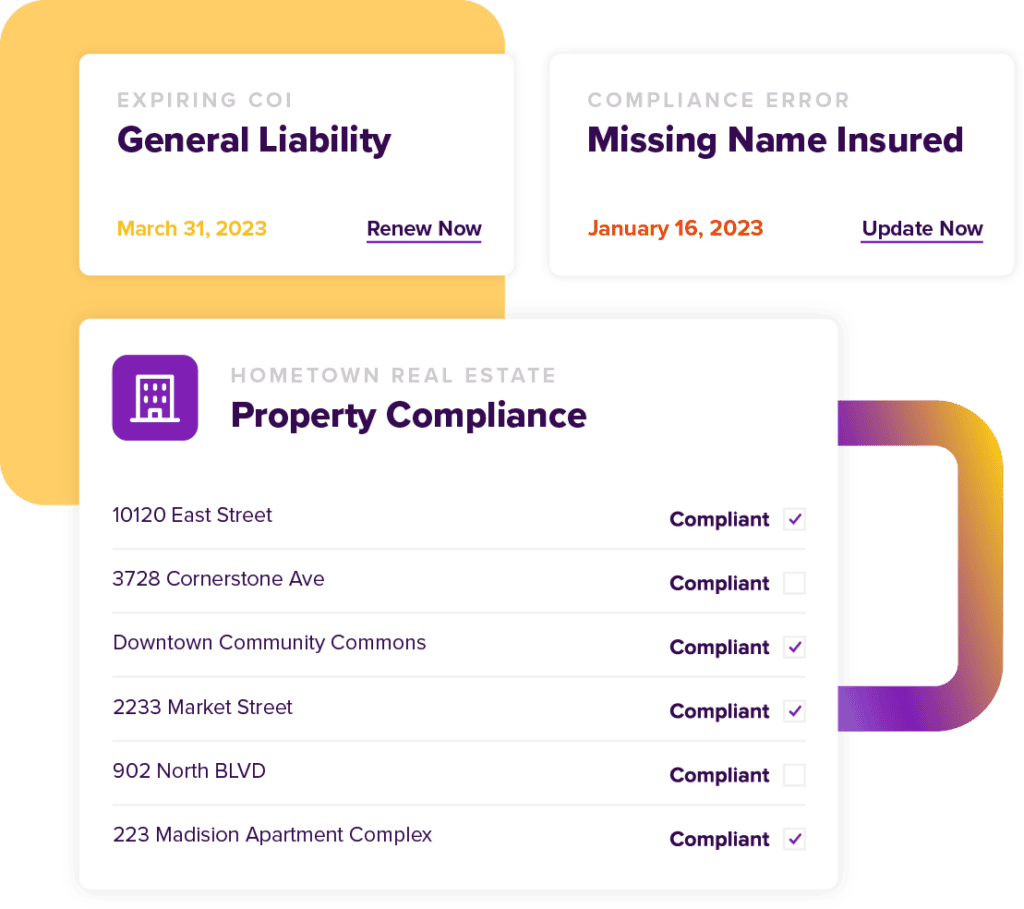

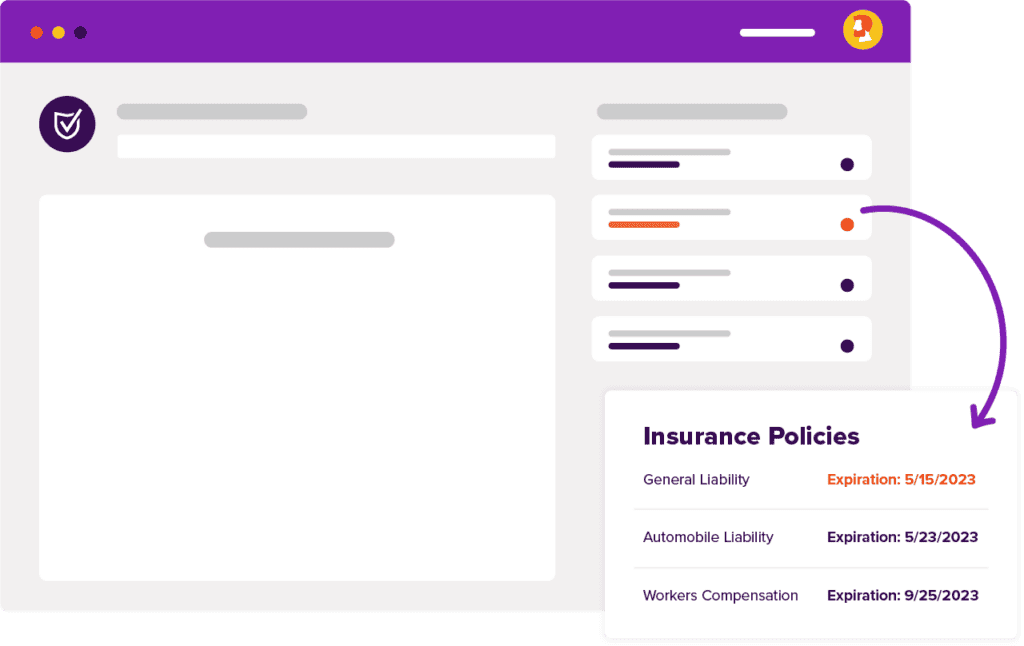

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesGeneral Liability Insurance Coverage

Owning a business is not free from risk. One significant concern is that the company will not succeed despite its best efforts. Owners take a chance when they invest their time and money into seeing their entrepreneurial dreams come true. Not every company can do well.

Another risk exists. It is just as major as the chance of failure. However, it can be easily mitigated with the right knowledge.

Liability risk affects every company, regardless of industry. Some companies’ liabilities can include a staff of thousands. Some liabilities can involve a fleet of vehicles. Smaller companies only have to worry about a handful of people.

Although a company’s size determines how much risk is involved, it should not cause smaller outfits to skip any type of general liability insurance coverage. Even small business general liability insurance is crucial. Accidents can happen on a job, that cause bodily injuries and property damage. Companies can be held responsible if proper coverage is not present.

Having appropriate insurance can save businesses from directly paying damages. Lawsuits can drain a company’s reserves and leave it bankrupt and broken. Companies that hire contractors and other third parties should ensure those workers own insurance. Anyone working under a company’s banner brings risk onto the job. Insurance helps mitigate that risk.

Tracking contractors’ insurance policies can be daunting. How does one begin?

Requiring proof of coverage in the form of a certificate of insurance is the best policy. Validating the information they contain establishes compliance. However, this is a detail-oriented duty that some companies are not equipped to handle alone. They may lack the expertise or time to manage each certificate they receive.

myCOI is the industry’s leading certificate of insurance tracking software. The easy-to-use, cloud-based solution simplifies the entire process, mitigating liability risk and expediting full compliance.

General Liability Insurance Coverage For Small Business

General liability insurance coverage for small business owners might be more than enough for low-risk companies. However, disaster can still strike. Every contingency should be considered when buying small business insurance. Sometimes the ones you do not think will ever become an issue are the most serious.

Business liability insurance can save companies from reimbursing injured people for damages. This can include property loss due to a worker’s actions. Business liability insurance can neutralize the costs of medical treatment, property repair, and litigation.

Small businesses incur expenses. If they are just starting, then they might try to cut corners where they can. Forgoing insurance is not only dangerous but possibly illegal. Small business owners must come to terms with the fact that having insurance is a necessary expense much like electricity. How much money is saved when an uninsured company ends up sued?

Insurance is vital for companies of any size in any industry. Equally essential is the need to confirm and trace coverage. This task can grow out of hand if a company hires many contractors and vendors. Operating in a constant state of compliance can tax staff to the point that they can not keep up with workloads.

Fortunately, solutions exist. myCOI can help risk management professionals and teams quit worrying about towers of paperwork and time-consuming phone calls. Automating insurance tracking streamlines workflows and ensures tighter control over compliance practices.

General Liability Insurance Coverage For Contractors

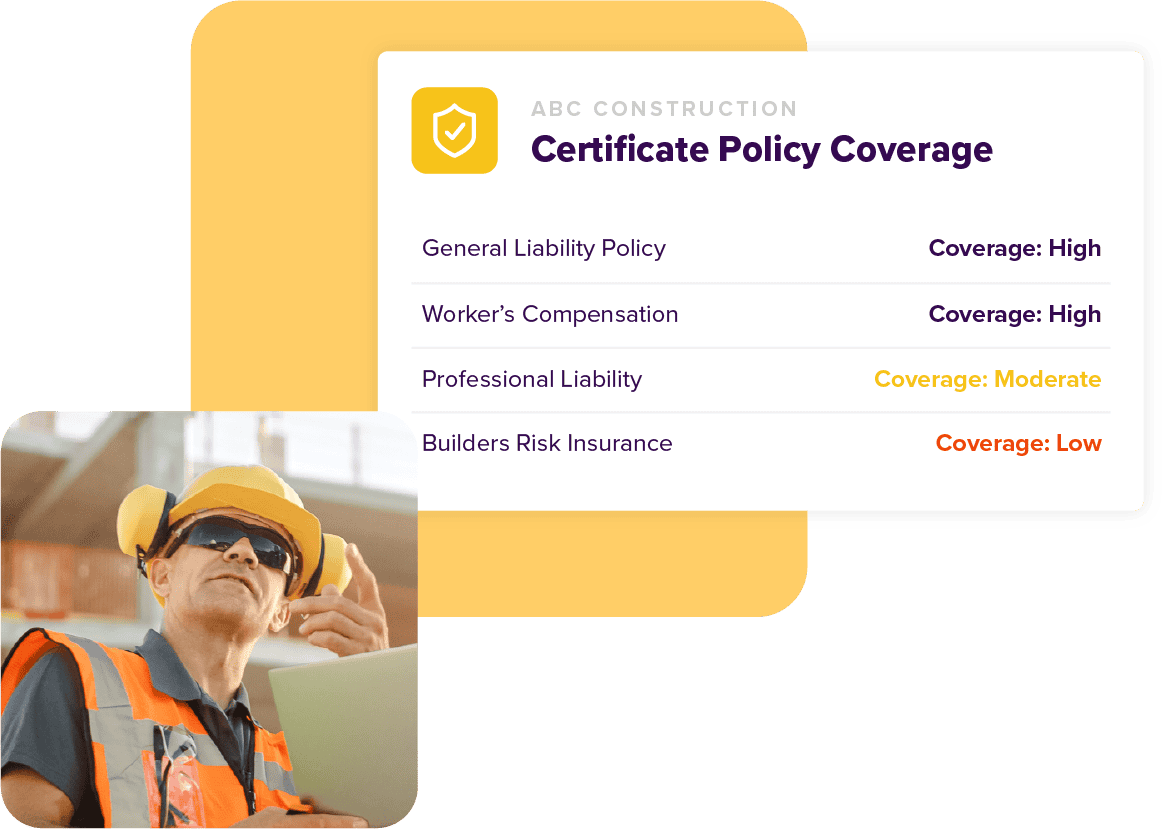

Construction and contracting companies should require general liability insurance coverage for contractors they hire. It does not matter if a company has a spotless injury record. All it takes is one uninsured contractor to destroy a company’s goodwill and fortunes. Contractor general liability insurance cost considerations are perfectly valid, but general liability insurance for independent contractors keeps companies clear of liability.

People shopping for the best general liability insurance for contractors have a lot to keep in mind besides prices. Each state has its own general liability insurance requirements for contractors. Companies should mandate that their contractors follow applicable regulations. Being aware can keep every involved party amply covered. Contractors can confer with their companies to find out what is required. Then they can contact an insurance agent or broker to find suitable policies.

Contractors who already know what they need and are comfortable shopping alone can search for insurance online. Talking to an agent or broker can help contractors better understand the policy they are interested in owning. Informed purchases can result in more effective coverage and lower expenses. Contractors should take the time to weigh all of their options before settling on one policy.

Commercial General Liability Insurance

What is general liability insurance for contractors?

It is an invaluable tool that protects companies from financial losses originating from personal and property damage claims. Although the concept seems simple to grasp, insurance can intimidate many people. Although some people have no trouble learning every nuance, others will never be able to wrap their heads around the most basic policies. Even small business insurance terms can confuse people who have a basic understanding of the subject. Not having insurance knowledge is no excuse for not owning coverage.

Commercial general liability insurance is a wide category of policies that provide coverage of liability risks. There are several general liability insurance examples that can help people better understand each one’s purpose. Comprehending commercial general liability insurance policy wording can empower policyholders to know exactly what they are paying for.

Commercial general insurance is only one-half of the equation when it comes to reducing liability risk. While contractors are responsible for learning all they can to obtain insurance, the companies that hire them must do more than collect proof of coverage. Certificates of insurance are documents that companies obtain, verify, monitor, and store all in the name of insurance compliance.

A certificate of insurance (COI) typically lists the insured’s name, commercial general liability insurance limits, and other data about the policy. Companies need to check every detail for accuracy and legitimacy. Fraudulent COIs can place a company at risk since typically they try to hide the fact that coverage does not exist in that case.

myCOI is the solution to validating COIs. Developed and supported by insurance experts, companies can automate verifying and tracking COIs. The platform’s Policy Reader can scan documents, eliminating data entry. myCOI alerts companies when their insurance requirements are not being met. Companies can remain protected with increased liability awareness at all times.

General Liability Insurance For LLC

Business owners have several duties they must fulfill. One of them is to protect their companies’ finances from claims that stem from normal operations. While it is true that some claims have no merit, some do. People make mistakes. People get tired or bitter so they do not put much effort into their jobs. Sometimes, people just have bad days. Negligence can spring from these vulnerable moments. How can companies mitigate all of this risk?

Like insurance, a limited liability company (LLC) is another layer of protection for business owners. An LLC owner’s assets can not typically be at stake in a lawsuit. These owners can also possess general liability insurance for LLC to further shield themselves from liability risk.

Insurance is not free. General liability insurance for LLC cost estimates depend on the business, industry, and other factors. An insurance agent or broker can best address these concerns.

It should be remembered that even the best general liability insurance for LLC should not be a substitute for proper safety practices. Diligence can go a long way in keeping people out of harm’s way. There is yet another way companies can reduce their liability risk: general liability insurance for contractors.

Cheap General Liability Insurance For Contractors

Any job carries an inherent risk. Some jobs carry more than others. Construction is an industry that is often rife with opportunities for things to go wrong. Equipment mishaps, severe weather conditions, negligent workers, and more place the companies that hire them at risk of costly claims.

In most, if not all, circumstances, contractors should own their insurance and be able to prove it. Purchasing general contractor insurance should be taken seriously. Researching the best general liability insurance for contractors can take time. Cost-conscious people can shop around for cheap general liability insurance for contractors. Cheap general liability insurance small business research can result in an informed purchase that provides sufficient coverage at a reasonable price. Those who do not care about money can spend more if they feel they are receiving the best general contractor insurance.

How can someone prove their cheap general liability insurance for handyman and contractor services is valid?

A certificate of insurance affirms that a contractor is adequately covered. Submitting COIs is easy. Managing them can prove exacting.

Among the many challenges companies face when handling COIs, maintaining compliance with applicable laws is one of the most demanding. General contractor insurance requirements vary by state. Keeping up with all of the regulations can be a full-time job in itself. myCOI can monitor the coverage provided by general liability insurance for independent contractors so companies have one less burden to shoulder. myCOI also automates expiration notifications so contractors know when it is time to submit another. General liability insurance coverage never has to lapse when your company uses myCOI.